(Getty)

Artificial Intelligence company Veritone (VERI) had a bad debut on Wall Street. Its initial public offering broke (closed below its offer price), with shares finishing sharply in the red.

Veritone opened above its IPO price of $15 on the Nasdaq Friday, but quickly sank below that level. The company raised $37.5 million with its IPO.

Veritone is moving from its ad-placement media business to a subscription-based cloud platform it touts as major artificial intelligence technology.

Here’s what you need to know.

1. The Deal Details

Veritone (VERI) intraday chart and volume. (FreeStockCharts.com)

Shares of Veritone opened at $15.64, but drifted lower and sank sharply in the last hour of trading.

The stock finished at $13.07, 12.9% lower.

Last night the company’s underwriters priced 2.5 million shares at $15 per share. Veritone increased the number of shares offered this week. It originally planned to price 1.3 million shares.

Wunderlich and Craig Hallum are the lead underwriters for the deal. Northland Capital is a co-manager. There is an overallotment option for the underwriters to buy 375,000 more shares for a period of 30 days.

2. The Company Is Moving More to AI

A trader works at the Nasdaq MarketSite in New York. (Getty)

The first thing any investor will ask is “what does the company do?” This should be a once sentence section, but like many tech startups it takes a little more explanation.

Here’s what the company says it does:

Veritone, Inc. is a leading artificial intelligence company that has developed the Veritone Platform, which unlocks the power of AI-based cognitive computing to transform and analyze unstructured public and private audio and video data for clients in the media, politics, legal and law enforcement industries.

Let’s distill that to say that the company has technology that lets it scour audio and video data for results that are useful to its clients. It uses more than 45 cognitive engines from third parties like Google (GOOGL), IBM (IBM) and Microsoft (MSFT) and “several Veritone developed cognitive engines” to create the platform, it said in its filing.

The company is very big on promoting “cognitive” and AI.

For an example on how that helps customers, take Veritone Legal, which “can render every second and frame of audio and video content searchable for things like faces, phrases, sentiment, and voice identification.”

Veritone also has a more traditional media buying and placement business, but is looking to move more into its AI business.

3. Revenue Decline Is a Red Flag

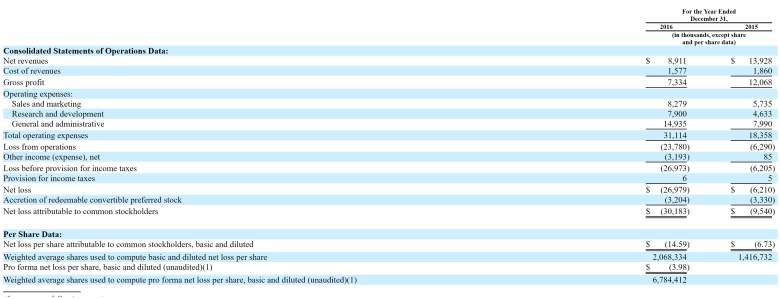

(Veritone)

Veritone isn’t profitable, and that’s expected for a small tech IPO. But revenue fell substantially in 2016 compared with 2015 and that sounds alarms.

Right now this is a company in transition and its transition away from where the money is coming from (the aforementioned media buying and placement segment) to where sales are hard to come by (its subscription, software-as-a-service AI platform).

The company has revenue of $13.9 million in 2015, with just $100,000 of that coming from the AI platform. In 2016 revenue fell to $8.9 million and only $500,000 was revenue from the AI platform.

The large drop came because, as the company was moving to focus on its AI platform, two clients – LifeLock and DraftKings – that accounted for 43% of revenue, decided to spend less in 2016, Nanalyze reported.

“We intend to continue to invest significant resources and capital in developing our AI Platform Business, and therefore, we do not expect to achieve profitability for the foreseeable future,” the company said in its filing.

Why would the company push forward with an IPO with daunting recent financials? One reason is just how hot the sector is. It’s certainly hot enough for Veritone management and its backers to sign off on switching from its proven revenue source of ad placement and into the SaaS platform.

Veritone would be one of the few pure-play AI companies to trade and that, in turn, could be make it an attractive takeover target. Once a company trades, it makes valuation for potential suitors that much easier. The sector is dominated by big names that could want to add cognitive expertise in advertising, law, and other areas in which Veritone specializes.

IBM is undergoing its own transformation as it moves resources to its Watson AI segment and it’s making deals.

In March, it announced cooperation of Watson with Salesforce (CRM) Einstein to develop AI in customer relationship management.

“This year we expect Watson will touch one billion people—through everything from oncology and retail to tax preparation and cars,” IBM CEO Ginnni Rometty said in a statement.

Smarter advertising is a large potential market for IBM. Veritone’s expertise could certainly help with first of the six ways Martech reported that IBM is changing digital marketing: ads that think.

“‘Personalized’ ads have been ones assembled on the fly from a fixed set of elements for the segment of many users where you find yourself,” Martech reported. “But Watson and similar services can now power ads that generate original content tailored just for you. For instance, Watson now can immediately return custom recipes based on food ingredients you enter into an ad, because he understands how human taste works.”

4. Acacia Is Veritone’s Largest Investor

(Veritone)

Newport Beach, Calif.-based Veritone was founded in 2014 by brothers Chad and Ryan Steelberg. Chad Steelberg is chairman and CEO and Ryan Steelberg is president.

As the company stated, it has yet to make a profit. During its tenure as a private start-up it has received two rounds of funding, totaling $65 million. In July 2014, it received $15 million from Mirimar Ventures and Checketts Partners Investment Fund. In August 2016, Acacia Research (ACTG) agreed to invest up to $50 million.

As the senior lender, Acacia has warrants that will be exercised on the IPO. It can first purchase up to 809,400 shares of common stock at $13.6088 or the IPO price if it’s lower, and then it can purchase up to 154,311.

Acacia Research is interesting more than simply because it is the biggest backer. The company is not involved in the AI space or even tech space directly. Instead, it’s a patent assertion entity (PAE). Pejoratively, these are called patent trolls. The company buys up patents and litigates to enforce those patents.

Here is one of the latest stories of its ongoing patent disputes with Apple (AAPL).

Here’s Acacia’s definition of itself:

Acacia Research Corporation … is the industry leader in patent licensing. By partnering with patent owners, Acacia applies its deep legal and technology expertise to patent assets to unlock financial value. An intermediary in the patent market, Acacia facilitates efficiency and delivers monetary rewards to the patent owner. With this strategy, Acacia has generated over $1,300,000,000 revenue to date, and has returned more than $723,000,000 to our patent partners.

A couple of things stand out in that description when looking at why Acacia is putting its cash into an AI startup.

First, there are patents. No stranger to battling with tech behemoths like Apple, Acacia could be looking to take on IBM and Microsoft and others in the AI arena by securing some patents.

Veritone and some of its subsidiaries currently have 87 patents in the space, according to the S-1 filing.

There there is the word “legal.”

If a PAE wanted to expand its ability to enforce patents, it could do worse than getting a company that touts its platform’s ability to search thousands of hours of audio and video depositions.

5. Where Is the Money Going?

Veritone has given itself lots of latitude on how its uses the cash from the IPO, saying it may be used for general corporate purposes, working capital and possible acquisitions.

For its growth strategies Veritone is looking to:

— Increase penetration in existing markets.

— Expand into other markets and create awareness of its platform.

— Continue to spend on technology to boost software capabilities.

— Look for select acquisitions and investments that can strengthen its platform.