Getty

A big chemicals initial public offering couldn’t quite live up to the performance the smaller biotech IPOs have enjoyed recently.

Venator Materials (VNTR), a division of chemical giant Huntsman, priced at the low end of its range, but saw some gains on the NYSE in midday trading.

Here’s what you need to know.

1. The IPO Raised $454 Million

Venator priced 22.7 million shares at $20 per share last night, raising $454 million.

The price was at the low end of the expected range of $20 to $22 per share.

The deal was run by a host of big-name firms, but that didn’t get the IPO to its midpoint pricing.

The lead underwriters were Citigroup, Goldman Sachs, BofA Merrill Lynch and J.P. Morgan.

And if that’s not enough, Deutsche Bank Securities, UBS, RBC Capital Markets, Barclays, HSBC, Nomura, SunTrust Robinson Humphreys, Moelis & Co., Academy Securities and Commerzbank all also had a hand in the IPO.

The underwriters have the option for 30 days to buy another 3,405,000 shares at $20 per share, not including the underwriting discount.

2. Shares Moved Above Offer Price

The stock opened at $20.89 this morning and had been in a fairly tight range since then.

It had an early trough of $20.51 before starting a choppy climb higher.

It was trading around $21 in early afternoon trading.

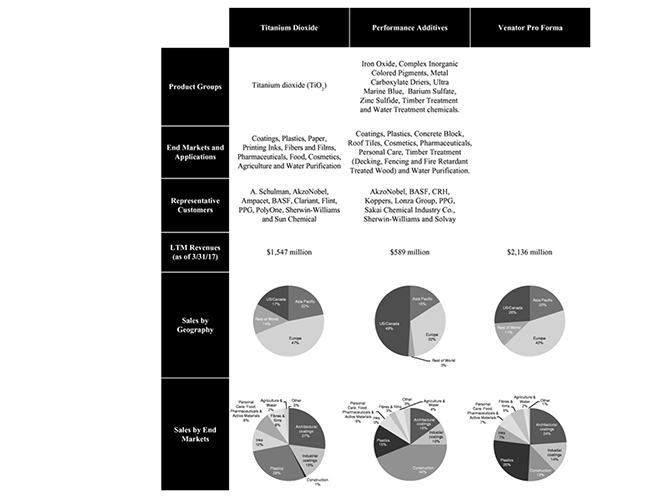

3. Its Products Are in Your Printing Inks and Your Food

The company produces chemicals in its two major divisions.

The first is the Titanium Oxide, or TiO2

“TiO2 is derived from titanium bearing ores and is a white inert pigment that provides whiteness, opacity and brightness to thousands of everyday items, including coatings, plastics, paper, printing inks, fibers, food and personal care products,” the company said in its SEC filing.

Then there’s the performance additives division.

That comprises functional additives, which “are barium and zinc based inorganic chemicals used to make colors more brilliant, coatings shine, plastic more stable and protect products from fading,” color pigments and timber treat and water treatment.

Venator has about 6,900 customers, it said.

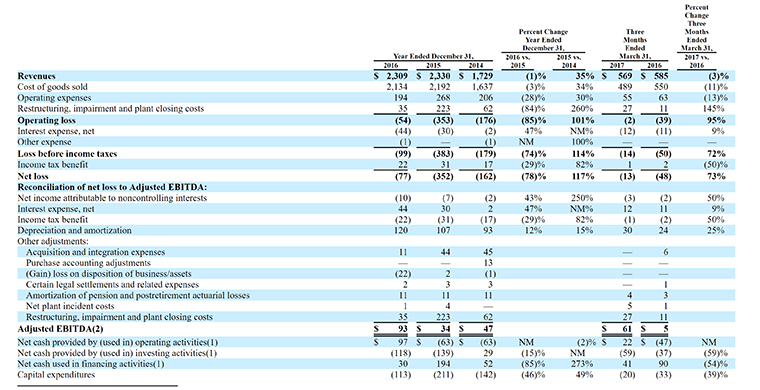

4. Revenue Rising Annually, but Down Q/Q

This is a bit of a doozy in the filing because of all the caveats created by Venator being part of Huntsman. Comparables will be tough, too.

“The results of operations from other businesses that will be retained by Huntsman that are included in our historical financial statements will not be included in our future results from continuing operations for periods that include the date of separation, affecting the comparability of our historical results to our future results of operations,” Venator said.

But if you look at the numbers provided by the company, keeping in mind that some of that includes other areas of Huntsman, you see annual rising revenue and a narrowing loss.

But it’s still not profitable and the revenue of the first quarter of 2017 fell from the year-ago period.

5. Huntsman Keeps All the Money

The company is now public, but it won’t get a cent of the IPO.

“Huntsman has informed us that it currently expects to use substantially all of the net proceeds of this offering and the amounts we will transfer to Huntsman from the net proceeds of the senior notes offering, the term loan facility, and the dividend, if paid, to repay borrowings under certain Huntsman credit facilities,” Venator said in its filing. “Certain of the underwriters or their affiliates are lenders, or agents or managers for the lenders, under certain Huntsman credit facilities and may receive proceeds as a result of repayment by Huntsman of these credit facilities.”

As of the end of the first quarter, the company’s book value was $782 million and its capitalization was $1.18 billion.

Are you a thoughtful investor looking for uncommon investment ideas?

Stirling Strategic Investor is a new source of high-quality investment ideas from seasoned investment professionals Tim Collins and Kim Khan, formerly senior members of TheStreet.com. Tim and Kim share 50 insightful equity trade’s per year for $100. That’s just $2 per trade.

Tim and Kim’s first recommendation, Mobileye, was recently acquired at a 34% premium by Intel. We provide the first two ideas at Stirling Strategic Investor for free. We look forward to providing you uncommon ideas of true value.

Learn more at Stirling.