Jack Mitnick, a previously obscure, 80-year-old lawyer and tax accountant from New York, suddenly became famous Saturday when he was named as a crucial source in the bombshell New York Times story published in the paper’s online edition Saturday evening, detailing how Republican presidential candidate and real estate mogul Donald Trump may have avoided paying any income taxes for up to 18 years.

After Trump responded to the Times story by saying that he “brilliantly” used the tax laws, in order to keep his taxes low, Mitnick appeared on the program Inside Edition to rebut his former client. See the video of his appearance, above.

Here’s what else you need to know about Jack Mitnick.

1. He Spoke to the Times On the Record — and Nailed Trump

The New York Times story, which can be accessed at this link, was based on several key pages of state tax return documents from Trump’s 1995 personal filing, which he made jointly with his then-wife Marla Maples.

The documents, viewable at this link, appeared to show that Trump declared a staggering income loss that year of $915,729,293. Under a loophole provision known as “net operating loss,” Trump — like all wealthy Americans — was allowed to fold his business losses into his personal income tax returns, meaning that he was able to use the claimed losses from his bankrupt casinos and other businesses to cancel out his personal income tax obligations.

But the Times needed proof that the Trump tax return pages, which were mailed to the paper anonymously, were the real deal. For that, the paper’s reporters turned to Mitnick, “a lawyer and certified public accountant who handled Mr. Trump’s tax matters for more than 30 years, until 1996,” the paper reported. “Mr. Mitnick was listed as the preparer on the New Jersey tax form.”

Mitnick recognized the tax returns immediately, saying that his signature appearing on one of the tax pages, from Trump’s 1995 New Jersey state return, was indeed his. Mitnick also pointed out that the amount of Trump’s net loss was so enormous — nine figures — that the tax preparing software the accountant used at the time couldn’t handle it. Mitnick had to type in the first two digits by hand, which is how the figure appears on the returns.

“This is legit,” Mitnick told the Times, referring to the tax documents. “Here the guy was building incredible net worth and not paying tax on it.”

2. Trump May Have Faked Mitnick’s Signature on an Earlier Tax Document

Some earlier information about Trump’s tax returns was made public as the result of a tax appeal case Trump brought in 1992, according to an article published in June of this year by The Daily Beast.

The information in the case showed that on Trump’s federal 1984 income tax return, the mogul showed no income at all, but claimed $626,264 in expenses. On his New York State return that year, he claimed a similar though slightly smaller amount.

“The record does not explain how (Trump) had significant expenses without any concomitant income from his consulting business,” the judge in the 1992 case wrote.

Mitnick testified on Trump’s behalf in the 1992 case — in fact, he was Trump’s only witness. But when shown a photocopy of Trump’s tax return, he flatly denied having prepared it, even though he acknowledged that the signature at the bottom was his own. The original tax return from which the photocopy was made was never found.

“Among the issues raised by Mitnick’s 1992 testimony is whether Trump or someone acting on his behalf substituted a return that he or someone else prepared and then transferred Mitnick’s signature using a photocopier,” Daily Beast reporter David Cay Johnstone wrote.

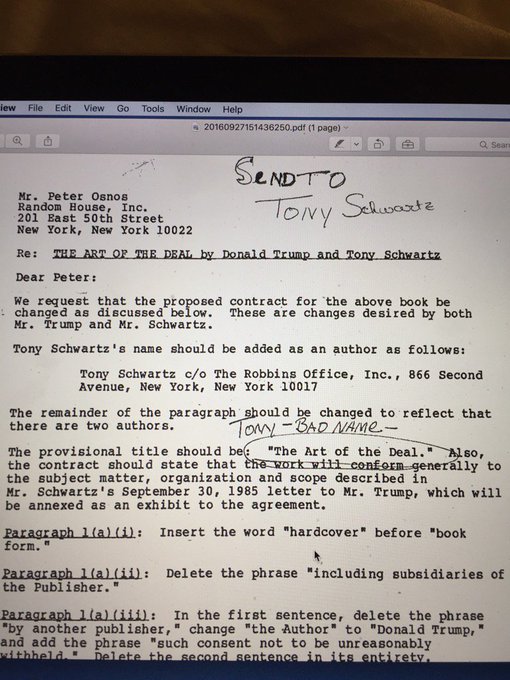

3. Trump Quoted Mitnick’s Advice In His Book

In Trump’s 1987 bestselling book, co-written with Tony Schwartz, The Art of the Deal, Trump quotes Mitnick advising him on how the 1986 Tax Reform Act would legally reduce his taxes. The act, sometimes referred to as “the second Reagan tax cut” slashed top tax rates — but also removed a number of tax shelters for real estate investors like Trump.

Mitnick still thought the law would be good for Trump, according to Trump and Schwartz’s account.

“Jack Mitnick, my accountant, calls to discuss the tax implications of a deal we’re doing. I ask him how bad he thinks the new federal tax law is going to be for real estate, since it eliminates a lot of current real-estate write-offs,” Trump and Schwartz wrote.

“Mitnick tells me he thinks the law is an overall plus for me, since much of my cash flow comes from casinos and condominiums and the top tax rate on earned income is being dropped from 50 percent to 32 percent. However — I still think the law will be a disaster for the country, since it eliminated the incentives to invest and build.”

4. Mitnick Became an Overnight Social Media Star

Mitnick, a 1956 graduate of New York City College and a 1960 New York University Law School grad who has held his New York law license for 55 years, suddenly found himself a hero to Twitter users when the New York Times story appeared online.

5. He Appears to be a Registered Democrat

The Times story identifies Mitnick as 80 years old, semi-retired and “living in Florida.” According to information located in online databases, Mitnick lives at least part of the year in Lake Worth, Florida.

The Florida state voter registration database lists Jack Mitnick, born October 4, 1935, with an active voter registration in the Florida Democratic Party.