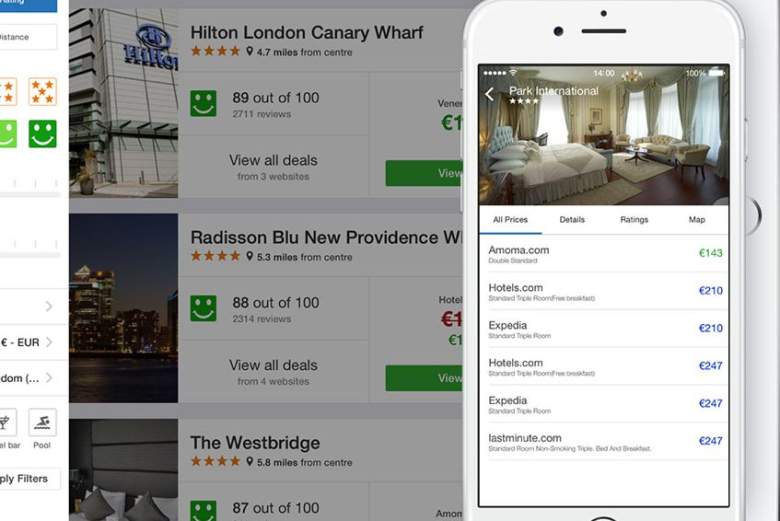

(Trivago)

What in the market can put a smile on the face of a sloppy, sexy as hell pitchman? A big one-day jump in the stock price of Trivago (TRVG).

The company is enjoying a double-digit percentage jump due to increased guidance. And that is continuing what is a compelling rally in the tech/travel sector since Trivago debuted on the Nasdaq late last year.

Here’s what you need to know.

1. It’s a Standout for Majority Holder Expedia

(Getty)

Expedia (EXPE) holds a majority equity stake in Trivago and reported its first-quarter results after the bell Thursday. Expedia issued mixed numbers.

For the three months ended March, it earned 5 cents per share, excluding items, well shy of the 10 cents per share that analysts, on average, expected. But revenue of $2.19 billion topped expectations of $2.15 billion.

A big help to the top line, was Trivago, which Expedia said had revenue of $286 million, up more than 60% from the year-ago period.

Trivago in turn boosted guidance.

“Given our strong start to the year, we have increased our full-year guidance and now expect annual revenue growth to be around 50% in 2017 [current consensus is for sales +45.2%], with our adjusted EBITDA margin likely to be up slightly from 2016,” Trivago CFO Axel Hefer said in statement, according to Briefing.com.

Shares of Trivago jumped 12% in late trading, while Expedia slid 1.7%.

2. Its Cautious IPO Was a Good Move

(Getty)

Alarm bells rang when Trivago moved to debut the shares not owned by Expedia on the Nasdaq. The underwriters, among which were JPMorgan, Morgan Stanley and Goldman Sachs, priced fewer shares than anticipated and priced them below the expected range.

That tends to give investors pause as an indicator of weak institutional demand.

Trivago priced 26.1 million shares at $11 per share, raising $287 million. It was expected to price 28.5 million shares between $13 and $15. That’s a big cut.

But by being realistic about the initial pricing the underwriters managed to help shares have a debut gain of 7.5% on Dec. 16, 2016. Even worse than raising less than anticipated is a broken IPO, where shares close below the initial pricing.

3. The Trivago Rally Is Going Full Steam

Trivago (TRVG) chart since IPO. (FreeStockCharts.com)

From the first-day gain it’s been mostly strength to strength in terms of stock price.

Shares of Trivago are up more than 43% from its IPO day, compared with a 6.53% rise in the S&P 500.

Sell-side analysts sentiment started strong shortly after it went public with mainly Buy or Neutral (or equivalent) ratings on the stock.

When it reports quarterly earnings on May 15, analysts predict a profit of a penny per share and revenue of about $243 million.

4. Financial Reporting Worries Were a Speed Bump

(Trivago)

Shares of Trivago slipped close back down to its opening day price on March 9 when a paragraph in its 20-F filing caused concern.

“We have identified a material weakness in our internal control over financial reporting and may identify additional material weaknesses in the future that may cause us to fail to meet our reporting obligations or result in material misstatements of our financial statements,” the company wrote.

“If we fail to remediate our material weakness or if we fail to establish and maintain an effective system of internal control over financial reporting, we may not be able to report our financial results accurately or to prevent fraud. Any inability to report and file our financial results accurately and timely could harm our business and adversely impact the trading price of our securities.”

That weakness was specifically “lack of sufficient accounting and supervisory personnel with the appropriate level of technical accounting experience and training.”

There was the usual host of shareholder rights law firms launching investigations, but overall the share price indicates the market is past the problem. It could be worth looking at the fine print of the earnings, though.

5. It Went for TV Instead of Digital Ads

Germany-based Trivago was founded in 2005 as a destination hotel search site and decided in 2008 that to differentiate itself from the competition it would focus on TV brand awareness rather than digital marketing, Skift reported.

After working on expanding through Europe, it moved to the U.S, which led to the creation of the very familiar Trivago Guy ads.

That certainly caught the eye of Expedia, which paid about $630 million for a 62% stake in the company.