Getty

Denmark-based Zealand Pharma (ZEAL) kept the biotech IPO momentum going a little bit as its American Depositary Shares (ADS) rose above where they priced.

The company already has two treatments approved for type 2 diabetes, but like most biotechs is still searching for profitability.

Zealand opened at $18.30 on the Nasdaq. The stock hit a high of $18.69 before setting around $18 in midday trading.

Here’s what you need to know.

1. Zealand Raises $78 Million

Since Zealand already trades on the Nasdaq Copenhagen, its pricing was based on the price of shares there.

Zealand priced 4.4 million shares at $17.87, raising $78.2 million Tuesday night.

Originally, Zealand expected to sell 3.9 million shares around $19.30, where shares were trading on Aug. 1. That would have raised $75.27 million.

The lead underwriters of the deal are Morgan Stanley and Goldman Sachs, with Guggenheim and Needham also co-managing the deal.

The underwriters have the option of buying 585,000 ADSs at the offer price for 30 days from the offering.

2. Zeal Has Two Drugs Approved and in Production

The company focuses on drugs based on peptides, chemical bonds that consists of two or more amino acids.

As noted, it has two type 2 diabetes drugs approved. There is lixisenatide, which is sold in the U.S. as Adlyxin and elsewhere as Lyxumia. And there is a combination of lixisenatide and Sanofi’s Lantus, an insulin glargine (long-lasting insulin) which now sells in the Netherlands as Suliqua.

Suliqua is expected to be sold in other European countries this year.

The company also had a pipeline, with the graphic above showing the 2017 progress levels.

3. The Company Has Cash, but No Profit

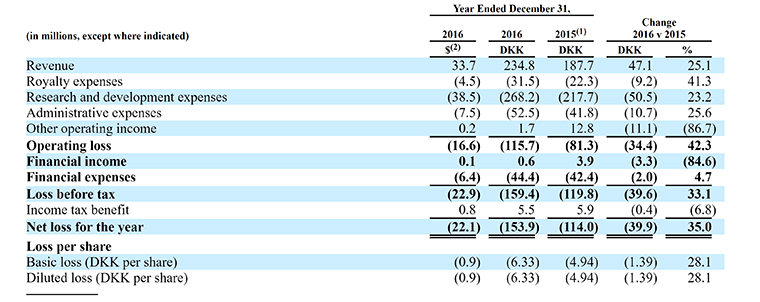

The financial situation is a familiar one for biotechs. Revenue is rising, but losses are widening because the company needs more drugs on the market. The risk is always in the regulatory approval.

“Lyxumia had global sales of €32.7 million ($37.3 million) in 2016,” the company said in its SEC filing. “For the six months ended June 30, 2017, Adlyxin/Lyxumia had combined global sales of €13.9 million ($15.8 million) and Soliqua-100/33/Suliqua had combined global sales of €9.1 million for ($10.4 million).”

The major research and development expenses come from the clinical trials of drugs.

“We expect to incur increasing costs for clinical trials as our internal product candidates, dasiglucagon and glepaglutide, advance in clinical development,” Zealand said.

The company had $59 million in cash and cash equivalents of $59 million.

4. Proceeds Will Go to Clinical Trials

If Zealand sells the full 3.9 million shares at $19.30 it expects to have $65.2 million in proceeds after underwriting commission and offering expenses. If the underwriters exercise their overallotment option, then the company should take in about $75.7 million.

According to the filing, proceeds will be allocated to the following things:

- About $45 million to fund clinical trials and registration of the drug glepaglutide to treat short bowel syndrome.

- About $25 million to fund clinical trials and registration of dasiglucagon as single-dose rescue treatment for acute, severe hypoglycemia.

- About $20 million to fund clinical trials of dasiglucagon as an artificial pancreas system for improved hypoglycemia control.

- About $10 million to fund clinical trials of dasiglucagon as a multiple-dose version for use in a single-hormone pump for the treatment of congenital hyperinsulinism.

The rest will be used for research projects and working capital.

5. There’s a Large Western Market

About 415 million people between the ages of 20 and 79 in the world and 91% of people with the disease in high-income countries had type 2 diabetes in 2017, the company said, citing the International Diabetes Federation.

In the United States, 29.3 million people, more than 9% of the populations, had diabetes in that year.

Spending on diabetes treatments totaled $521 billion in North America, the Caribbean and Europe in 2015.

The market is big, but so is the competition.

“Our competitors in the type 2 diabetes field are primarily large pharmaceutical companies, including Merck, AstraZeneca, GlaxoSmithKline, Eli Lilly, Sanofi, Novo Nordisk, Johnson & Johnson and BI.”

At the time of publication, neither the author nor the company held positions in the stocks mentioned, but positions may change at any time.

Are you a thoughtful investor looking for uncommon investment ideas?

Stirling Strategic Investor is a new source of high-quality investment ideas from seasoned investment professionals Tim Collins and Kim Khan, formerly senior members of TheStreet.com. Tim and Kim share 50 insightful equity trade’s per year for $100. That’s just $2 per trade.

And if you subscribe now, you can get $20 off the the annual price using promo code 20DISCH.

Tim and Kim’s first recommendation, Mobileye, was recently acquired at a 34% premium by Intel. We provide the first two ideas at Stirling Strategic Investor for free. We look forward to providing you uncommon ideas of true value.

Learn more at Stirling.