Twitter Sam Bankman-Fried

Sam Bankman-Fried is the founder and former CEO of FTX who presided over a cryptocurrency empire that spectacularly collapsed. He was part of a major effort to help Ukraine, is a major Democratic political donor, spent heavily to influence the 2022 midterm elections, and contributed toward a PAC helping Joe Biden’s presidential campaign.

Bloomberg called the FTX collapse “one of history’s greatest-ever destructions of wealth.”

On November 11, 2022, Bankman-Fried, the second largest donor to the Democratic Party in the United States, announced on Twitter, “Today, I filed FTX, FTX US, and Alameda for voluntary Chapter 11 proceedings in the US….I’m piecing together all of the details, but I was shocked to see things unravel the way they did earlier this week.”

A “liquidity crisis” brought down Bankman-Fried’s $32 billion “business empire” in cryptocurrency, according to FT.com. Bankman-Fried is 30 years old. According to Reuters, he set up FTX, a top cryptocurrency exchange, in 2019.

FTX was involved in efforts to help Ukraine. “FTX is converting crypto contributions to Ukraine’s war effort into fiat for deposit at the National Bank of Ukraine,” CoinDesk reported in March 2022.

Here’s what you need to know:

1. FTX Is Under Criminal Investigation After Its Collapse

FTX is under investigation by the Securities and Exchange Commission and the Department of Justice, CNBC reported, including for possible crimes.

The Royal Bahamas police force is now conducting an investigation.

“In light of the collapse of FTX globally and the provisional liquidation of FTX Digital Markets Ltd., a team of financial investigators from the Financial Crimes Investigation Branch are working closely with the Bahamas Securities Commission to investigate if any criminal misconduct occurred,” the police wrote in a statement posted to Facebook.

According to CNBC, “the Biden White House and two powerful Democratic committee chairs” have publicly criticized FTX and called for greater regulation.

Binance, which is another cryptocurrency exchange, was considering purchasing FTX but has changed its mind, CNBC reported.

The FTX Future Fund team resigned en masse, writing in a statement,

We were shocked and immensely saddened to learn of the recent events at FTX. Our hearts go out to the thousands of FTX customers whose finances may have been jeopardized or destroyed.

We are now unable to perform our work or process grants, and we have fundamental questions about the legitimacy and integrity of the business operations that were funding the FTX Foundation and the Future Fund. As a result, we resigned earlier today.

According to Reuters, over $1 billion in “client funds” have vanished since the collapse.

Daily Mail reported that Bankman-Fried is accused of having “secretly transferred $10 billion of customer funds from FTX to the trading company Alameda Research, which is run by his girlfriend Caroline Ellison.”

2. Bankman-Fried Is the Second Largest Democratic Political Donor & Spent Millions of Dollars to Influence the 2022 Midterm Elections

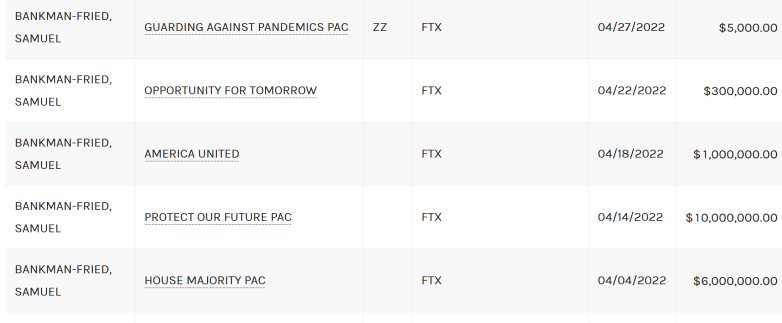

FECBankman-Fried campaign donations

Before the bankruptcy, Bankman-Fried was “the second-largest donor to Democrats after George Soros,” according to Ft.com. He pledged to give $1 billion to political candidates but then backed off that pledge, the site reported.

He gave more than $36 million to Democrats in 2021-2022, according to Open Secrets.org. He gave $235,200 to Republicans in the same time period.

Bradley Beychok, co-founder of American Bridge 21st Century, a Democratic PAC, told FT.com that Bankman-Fried “came on the scene out of nowhere [and] became a large supporter of different causes and candidates very quickly.”

CNBC reported that Bankman-Fried was “the primary force behind the political action committee Protect Our Future, which has raised more than $14 million and could tip the scales in House races in Ohio and Oregon” during the 2022 midterm elections.

Heavy.com found more than $26 million in donations from Bankman-Fried to Protect Our Future PAC in federal campaign finance records.

Of that PAC, FT reported that it “endorsed 25 Democrats in congressional races this cycle, of which 18 have so far won their respective races.”

You can read through Bankman-Fried’s campaign donations here on the Federal Election Commission website.

They list a $4 million donation by Bankman-Fried to Protect Our Future on June 13, 2022. He gave another $10 million to Protect Our Future on April 14, 2022, FEC records show. He also donated thousands of dollars to the campaigns of Democratic Senate and Congressional candidates around the country. He gave $3 million to Protect Our Future in March 2022, FEC records show, and $9 million in February.

He also gave $6 million to the House Majority PAC and $1 million to America United.

According to CNBC, Bankman-Fried “contributed $5 million toward pro-Biden super PAC Future Forward” during the 2020 presidential campaign.

According to CNBC, Bankman-Fried was a “regular presence on Capitol Hill over the past year as an industry advocate.”

3. Bankman-Fried Recently Visited the Biden White House & Was Involved in Helping Ukraine as It Fought a War Against Russia

Bankman-Fried visited the Joe Biden White House, according to an article that Beincrypto.com posted in August 2022.

Citing White House visitor logs, the site reported that Bankman-Friend “and other officials from the crypto exchange visited White House officials Charlotte Butash and Steve Ricchetti.”

The visits occurred in May 2022. The site noted:

Gabriel Bankman-Fried, Director of Guarding Against Pandemics, was also a part of the meetings, as was FTX head of policy and former CFTC commissioner Mark Wetjen. The fourth member was Elria Katz, FTX’s director of government relations and policy.

Bankman-Fried visited Ricchetti in April and May 2022, Beincrypto.com reported, adding that the topic of discussion was not clear but might have been crypto currency regulation.

Who is Charlotte Butash? According to her LinkedIn page, she is a policy advisor to the White House deputy chief of staff. She previously worked for a law firm and as a “volunteer vetting attorney” for the “Biden-Harris Transition,” her page says.

Who is Steve Ricchetti? According to Open Secrets.org, Ricchetti is a counselor to President Joe Biden who worked previously as Biden’s campaign finance chair. He also worked for Biden when Biden was vice president and has held a number of top political positions in the Democratic Party, including as a Senate lobbyist and executive director for the Democratic Senatorial Campaign Committee, Open secrets reported.

People on social media have raised questions about Bankman-Fried’s ties to Ukraine.

“We just gave $25 to each Ukrainian on FTX,” he wrote on Twitter in February 2022. “do what you gotta do.”

A press release on the Aid to Ukraine efforts reads:

The official website for Aid For Ukraine, an initiative that raises funds from the crypto community for the benefit of Ukraine’s military and humanitarian needs, has officially launched. The initiative is powered by the Ministry of Digital Transformation of Ukraine, FTX, and Everstake. This is the first instance of a cryptocurrency exchange providing a conduit for crypto donations to a public financial institution.

4. Bankman-Fried’s Net Worth of $16 Billion Was Erased in a Week’s Time

What is Bankman-Fried’s net worth? According to CNN, it was $16 billion the week before the FTX meltdown, which wiped it out.

FTX had recently moved its headquarters to the Bahamas, CNN reported.

According to Fox Business, Bankman-Fried’s net worth is now estimated at 0.

Bankman-Fried’s mother, Barbara Fried, is a professor at Stanford University.

“Barbara H. Fried’s scholarly interests lie at the intersection of law, economics, and philosophy,” her bio reads. “She has written extensively on questions of distributive justice, in the areas of tax policy, property theory and political theory. She is also the author of a path-breaking intellectual biography of Robert Hale, one of the leading legal realists.”

5. Bankman-Fried Tweeted, ‘I F***** Up’

Bankman-Fried tweeted an apology on November 10, 2022.

“1) I’m sorry. That’s the biggest thing,” he wrote. “I f***** up, and should have done better.”

He added, “2) I also should have been communicating more very recently. Transparently–my hands were tied during the duration of the possible Binance deal; I wasn’t particularly allowed to say much publicly. But of course it’s on me that we ended up there in the first place.”

He continued in a lengthy stream of tweets:

3) So here’s an update on where things are.

[THIS IS ALL ABOUT FTX INTERNATIONAL, THE NON-US EXCHANGE. FTX US USERS ARE FINE!]

[TREAT ALL OF THESE NUMBERS AS ROUGH. THERE ARE APPROXIMATIONS HERE.]

4) FTX International currently has a total market value of assets/collateral higher than client deposits (moves with prices!).

But that’s different from liquidity for delivery–as you can tell from the state of withdrawals. The liquidity varies widely, from very to very little.

5) The full story here is one I’m still fleshing out every detail of, but as a very high level, I f***** up twice.

The first time, a poor internal labeling of bank-related accounts meant that I was substantially off on my sense of users’ margin. I thought it was way lower.

6) My sense before:

Leverage: 0x

USD liquidity ready to deliver: 24x average daily withdrawalsActual:

Leverage: 1.7x

Liquidity: 0.8x Sunday’s withdrawalsBecause, of course, when it rains, it pours. We saw roughly $5b of withdrawals on Sunday–the largest by a huge margin.

7) And so I was off twice.

Which tells me a lot of things, both specifically and generally, that I was sh** at.

And a third time, in not communicating enough. I should have said more. I’m sorry–I was slammed with things to do and didn’t give updates to you all.

8) And so we are where we are. Which sucks, and that’s on me.

I’m sorry.

9) Anyway: right now, my #1 priority–by far–is doing right by users.

And I’m going to do everything I can to do that. To take responsibility, and do what I can.

10) So, right now, we’re spending the week doing everything we can to raise liquidity.

I can’t make any promises about that. But I’m going to try. And give anything I have to if that will make it work.

11) There are a number of players who we are in talks with, LOIs, term sheets, etc.

We’ll see how that ends up.

2) Every penny of that–and of the existing collateral–will go straight to users, unless or until we’ve done right by them.

After that, investors–old and new–and employees who have fought for what’s right for their career, and who weren’t responsible for any of the f*** ups.

13) Because at the end of the day, I was CEO, which means that *I* was responsible for making sure that things went well. *I*, ultimately, should have been on top of everything.

I clearly failed in that. I’m sorry.

4) So, what does this mean going forward?

I’m not sure–that depends on what happens over the next week.

But here are some things I know

15) First, one way or another, Alameda Research is winding down trading.

They aren’t doing any of the weird things that I see on Twitter–and nothing large at all. And one way or another, soon they won’t be trading on FTX anymore.

16) Second, in any scenario in which FTX continues operating, its first priority will be radical transparency–transparency it probably always should have been giving.

Giving as close to on-chain transparency as it can: so that people know *exactly* what is happening on it.

17) All of the stakeholders would have a hard look at FTX governance. I will not be around if I’m not wanted.

All of the stakeholders–investors, regulators, users–would have a large part to play in how it would be run.

Solely trust.

18) But all of that isn’t what matters right now–what matters right now is trying to do right by customers. That’s it.

19) A few other assorted comments:

This was about FTX International. FTX US, the US based exchange that accepts Americans, was not financially impacted by this shitshow.

It’s 100% liquid. Every user could fully withdraw (modulo gas fees etc).

Updates on its future coming.

10) So, right now, we’re spending the week doing everything we can to raise liquidity.

I can’t make any promises about that. But I’m going to try. And give anything I have to if that will make it work.

11) There are a number of players who we are in talks with, LOIs, term sheets, etc.

We’ll see how that ends up.

12) Every penny of that–and of the existing collateral–will go straight to users, unless or until we’ve done right by them.

After that, investors–old and new–and employees who have fought for what’s right for their career, and who weren’t responsible for any of the f*** ups.

13) Because at the end of the day, I was CEO, which means that *I* was responsible for making sure that things went well. *I*, ultimately, should have been on top of everything.

I clearly failed in that. I’m sorry.

14) So, what does this mean going forward?

I’m not sure–that depends on what happens over the next week.

But here are some things I know.

15) First, one way or another, Alameda Research is winding down trading.

They aren’t doing any of the weird things that I see on Twitter–and nothing large at all. And one way or another, soon they won’t be trading on FTX anymore.

16) Second, in any scenario in which FTX continues operating, its first priority will be radical transparency–transparency it probably always should have been giving.

Giving as close to on-chain transparency as it can: so that people know *exactly* what is happening on it.

17) All of the stakeholders would have a hard look at FTX governance. I will not be around if I’m not wanted.

All of the stakeholders–investors, regulators, users–would have a large part to play in how it would be run.

Solely trust.

18) But all of that isn’t what matters right now–what matters right now is trying to do right by customers. That’s it.

19) A few other assorted comments:

This was about FTX International. FTX US, the US based exchange that accepts Americans, was not financially impacted by this shitshow.

It’s 100% liquid. Every user could fully withdraw (modulo gas fees etc).

Updates on its future coming.

20) At some point I might have more to say about a particular sparring partner, so to speak.

But you know, glass houses. So for now, all I’ll say is:

well played; you won.

21) NOT ADVICE, OF ANY KIND, IN ANY WAY

I WAS NOT VERY CAREFUL WITH MY WORDS HERE, AND DO NOT MEAN ANY OF THEM IN A TECHNICAL OR LEGAL SENSE; I MAY WELL HAVE NOT DESCRIBED THINGS RIGHT though I’m trying to be transparent. I’M NOT A GOOD DEV AND PROBABLY MISDESCRIBED SOMETHING.

22) And, finally:

I sincerely apologize.

We’ll keep sharing updates as we have them.

READ NEXT: The Death of Takeoff