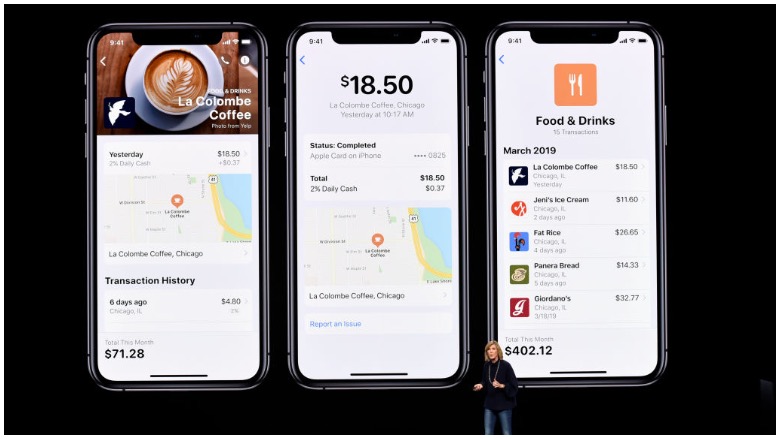

Getty Jennifer Bailey, vice president of Apple Pay, speaks during an Apple product launch event at the Steve Jobs Theater at Apple Park on March 25, 2019 in Cupertino, California.

The Apple Card is now available, however, only for select users via email invite, according to Wired. The card will become available to everyone later this month.

The Apple Card was announced at an event in March and immediately peaked the interest of millions. According to a March 2019 press release, the Apple Cared is built on simplicity, transparency, and privacy. The card was designed to help customers “lead a healthier financial life.”

“Apple Card builds on the tremendous success of Apple Pay and delivers new experiences only possible with the power of iPhone,” vice president of Apple Pay Jennifer Bailey said in the press release. “Apple Card is designed to help customers lead a healthier financial life, which starts with a better understanding of their spending so they can make smarter choices with their money, transparency to help them understand how much it will cost if they want to pay over time and ways to help them pay down their balance.”

The Apple Card is reportedly very similar to the credit cards that already fill wallets across the world. To get a card, applicants must open the Wallet app on their iPhone and enter some basic information. Next, Goldman Sachs, the bank backing the card, will either approve or deny the application within minutes. If approved, the Apple Card will appear in the wallet app and be available for use right away.

Here’s what you need to know:

1. Apple Partnered with Goldman Sachs and Mastercard

“Apple Card is gonna be the new flex,” Jorge Caballero wrote on Twitter.

According to the press release, Apple partnered with Goldman Sachs and Mastercard to provide the support of an issuing bank and global payments network.

“Simplicity, transparency and privacy are at the core of our consumer product development philosophy,” David M. Solomon, chairman and CEO of Goldman Sachs, said in the release. “We’re thrilled to partner with Apple on Apple Card, which helps customers take control of their financial lives.”

Apple says that Goldman Sachs is focusing on the customer. They are creating a different credit card experience, which never shares or sells data to third parties for marketing and advertising. In addition, Mastercard will provide Apple Card users with the ability to shop at merchants around the globe.

“We are excited to be the global payments network for Apple Card, providing customers with fast and secure transactions around the world,” Ajay Banga, president and CEO of Mastercard, said in the release.

2. Apple Card Lives in the Wallet App on the iPhone

Latvian gadget designer Ben Geskin shared a photo of the Apple Card on his Instagram page in May 2019. The sleek-looking card has a minimalistic design, showing only the cardholder’s name, a chip, and the Apple, Mastercard, and Goldman Sachs logos.

Cardholders can purchase things quickly by using Apple Pay on their iPhone or by using the Apple-designed titanium card anywhere in the world.

The Apple Card is designed with security in mind, according to Apple. The goal is to to make sure the cardholder the only person who can use it. The advanced security technologies of Apple Pay like Face ID, Touch ID, and unique transaction codes are built-in. In addition, the physical card has no numbers on the front or back.

Advanced security and no visible account numbers provide one level of security. In addition, cardholders will get instant notifications after every purchase, so they will be the first to know if something is wrong. And, if something is wrong, users can notify Apple via 24/7 text support and they will take care of it. Users will not be liable for any fraudulent charges.

3. Apple Card Offers Weekly and Monthly Summaries

Apple Card users will be able to see their weekly or monthly spending habits directly in the Wallet app. All purchases will be categorized, making it easy to spot spending trends, according to Apple.

“Tap Food and Drinks to view a list of purchases from places like Whole Foods Markets, Dunkin’, and DoorDash,” the product page says. “Or Entertainment to see what you’ve spent on movies, concerts — even your Apple Music subscription. You can also tap a merchant name to see all your purchases from them.”

Not only will the Apple Card show users how they spend their money, but it will also show them where they spent it. If a cardholder doesn’t recognize a charge, they can use Maps to pinpoint where the purchase was made.

“Here’s a neat Apple Card thing: you know how the promo images all show a card in the app with a gradient design? That gradient dynamically reflects the categories of your purchases – so my card, with just a lone Starbucks purchase so far, is orange,” Nilay Patel wrote on Twitter.

4. Every Purchase Made With an Apple Card Earns ‘Daily Cash’

According to the press release, “Customers will receive a percentage of every Apple Card purchase amount back as Daily Cash. Unlike other cash back rewards, Daily Cash is added to customers’ Apple Cash card each day and can be used right away for purchases using Apple Pay, to put toward their Apple Card balance or send to friends and family in Messages.”

Cardholders will get three percent back on everything they buy from Apple, whether it’s at the Apple Store, apple.com, the App Store, or iTunes, including games, in‑app purchases, and services like Apple Music subscriptions and iCloud storage plans.

Cardholders will get 2 percent back every time they buy something using Apple Pay, in every category with no limits. If cardholders happen to make a purchase without Apple Pay, they will still receive one percent cash back.

5. Payment is Due on the Last Day of the Month & There Are No Hidden Fees

According to the product page, Apple Card payments will be due on the last day of the month. Cardholders will get reminders when their due date is coming up. In addition, users can set up weekly or biweekly payments to sync up with a paycheck.

The Apple Card reportedly does not have any fees to ensure cardholders are not taken by surprise when they see their balance. According to the site, there are no annual fees, no cash advance fees, no international fees, no over‑the‑limit or returned‑payment fees, and no hidden fees.

In addition to no fees, Apple Card aims to provide interest rates that are among the lowest in the industry. The company says they want to help customers make informed choices. Apple Card reportedly shows a range of payment options and calculates the interest cost on different payment amounts in real-time. Also, according to Apple, if a customer misses a payment, they will not be charged a penalty rate.

“I just really want an @Apple credit card,” Johnny Ray wrote on Twitter. “I’m READY.”