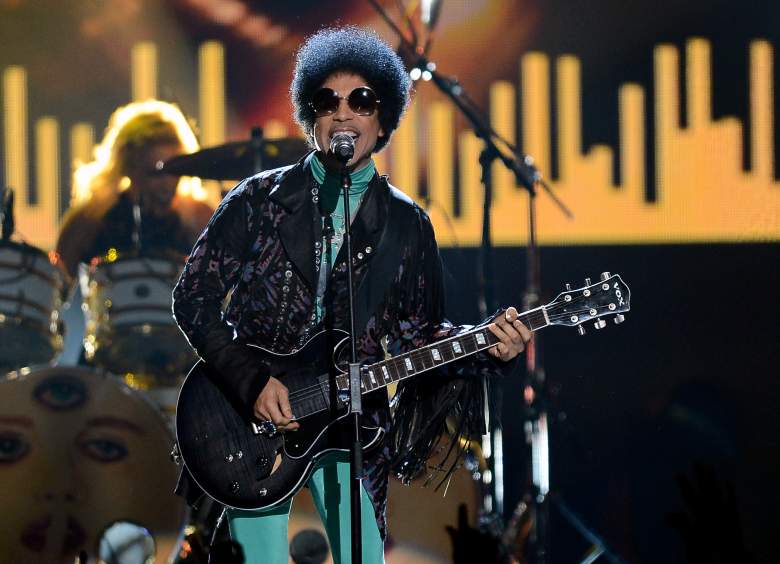

The battle over Prince’s estate could take months or years to settle. The lack of a known will further complicates the situation. (Getty)

When Prince died at age 57 on April 21, he left behind no known will or trust to determine the division of his estimated $300 million estate. His sister Tyka Nelson and five half-siblings made their first appearance for the probate hearing on Monday to begin sorting out who gets what, but a hefty chunk of their famous brother’s money could end up in the hands of the government.

On April 27, a Carver County district judge appointed Bremer Trust to serve as a special administrator to manage Prince’s estate, according to the Star Tribune. Bremer Trust will have the authority to manage and supervise Prince’s assets and determine the rock star’s heirs. All the siblings signed off on the special administrator appointment except half-brother John Nelson, but CNN notes that doesn’t mean he opposed the move, he just didn’t sign.

Tyka filed documents the day before requesting Bremer to serve as the official administrator of Prince’s estate since her brother had no known will. “I do not know of the existence of a will and have no reason to believe that the decedent executed testamentary documents in any form,” she said in the documents. The search for a will continues.

The lack of a known will has created several headaches for Prince’s heirs, which could take months or even years to settle in court.

Here’s what you need to know.

1. At Least 50 Percent of Prince’s Estate Will Go to the Government

The government will take a majority of Prince’s estate in taxes. (Getty)

The federal and state government will take the first cut of Prince’s estate. Since there is no known will and Prince had no wife or publicly known children, the “Purple Rain” singer’s assets are subject to a maximum 40 percent federal tax and a minimum 16 percent state tax by Minnesota. With an estimated $300 million estate, the government could collect up to $150 million.

Martin Neumann, a partner at Weinstock Manion with expertise in probate and estate planning, explained to Forbes.com how the taxes will be collected:

The IRS is going to be a partner with the estate for a long time to come to the tune of 40 cents on the dollar. So part of what will be handled is an agreement with the taxing authority with how the estate taxes are paid and over what period of time.

To help pay down the taxes, the family could choose to monetize some assets such as the estimated 2,000 unreleased songs locked in a vault under Paisley Park. Bremer Trust drilled into the vault whose code only Prince possessed, according to ABC News. The vault was a large room filled with shelves and sealed with a large spinning wheel.

Prince talked about the vault on The View in 2012 (see the video above) and whether he would ever release those unheard tracks. He told co-host Sherri Shepherd, “One day, someone will release them. I don’t know that I’ll get to release them. There’s just so many.”

2. The Remainder of Prince’s Estate Will Be Divided Among His Sister and 6 Half Siblings

Once the tax situation is settled, the remainder of Prince’s estate will be split between his sister, Tyka Nelson, and their six half-siblings. Nelson filed a motion in Carver County on April 26 that listed her and half-siblings Omarr Baker, John Nelson, Norrine Nelson, Sharon Nelson, Alfred Jackson and Lorna Nelson — who died in 2006 — as heirs to their brother’s fortune, according to the Star Tribune.

The first meeting between the siblings was contentious and ended in shouting, a source with firsthand knowledge told CNN. Half-brother Alfred Jackson and his attorney would not confirm for the outlet who did the shouting except to say it wasn’t him.

The seventh half-brother, Duane Nelson, died in 2011, but his 13-year-old granddaughter, Victoria, could stand to collect a portion of her grand uncle’s estate, according to KSTP, ABC’s local affiliate in Minneapolis.

A woman named Darcell Johnston filed documents in probate court on Monday claiming she is also a half-sister to Prince, same mother but different father, according to TMZ. Some members of Prince’s family only learned of her existence a few days ago.

Matters could be further complicated if Prince has an unknown love child that steps forward. Many people are claiming they are the sons and daughters of the music icon, but only one man so far has presented a legitimate story to spark an investigation.

“He was born in the ’80s and his mother crossed paths with Prince a couple times,” John Hibbert, co-owner of Heirs Hunters International, told ABC News. The Los Angeles-based company searches for possible heirs to estates.

If this man or any person that comes forward is determined as Prince’s child, they would stand to inherit the entire estate.

3. The Greatest Challenge Is Putting a Price on the Use of Prince’s Name and Image

The use of Prince’s name and image as well as his unpronounceable symbol will be considered in the estate’s value. (Getty)

Prince’s estate, estimated at $300 million, includes the $7 million Paisley Park studio, his $16 million, 187-acre home in Chanhassen, Minnesota, and his music catalog, which Bloomberg values at $100 million or more. The tougher value to determine is the “right of publicity,” which is the ability to control or license a person’s name or image, according to KMSP, the local Fox affiliate in Minneapolis. This could be worth hundreds of millions of dollars.

Minnesota has a common law, but no specific law granting “right of publicity,” which means its unclear if this control can pass down to Prince’s heirs. The family will have to go to court to determine this right before they can make money on post mortem licensing deals, according to Forbes.com.

“It’s going to be a battle in the courts,” Tiffany Blofield, an intellectual-property attorney, told KMSP.

4. More Than 4 Million of Prince’s Albums and Songs Have Sold Since His Death

Prince’s death caused a spike in his music sales. (Getty)

Prince’s music sales have spiked dramatically since his death on April 21. On the day he died, Prince sold 239,000 album and 1.034 million song downloads, according to Nielsen Music (via Billboard). The numbers doubled in the days between April 22 and 27 with 496,000 albums sold and 2.24 million songs downloaded bringing the total to more than 4 million albums and songs sold combined.

In comparison, the week before his death, Prince sold just 5,000 albums and 14,000 song downloads in the week ending on April 15.

Prince regained control of his music catalog in 2014 when he signed a deal to return to Warner Bros. Records. He had a notorious falling out with his former label in 1996, which involved him changing his name to a symbol and referring to himself as “The Artist Formerly Known as Prince.”

Billboard broke down Prince’s best-selling albums and most download songs based on reports by Nielsen Music:

Best Selling Albums: April 21-27

– The Very Best of Prince sold 291,000 copies

– Purple Rain (Soundtrack) sold 168,000 copies

– The Hits/The B-Sides sold 73,000 copies

– Ultimate sold 41,000 copies

– 1999 sold 38,000 copies

Best Selling Songs: April 21-27

– “Purple Rain” downloaded 377,000 times

– “When Doves Cry” downloaded 280,000 times

– “Little Red Corvette” downloaded 227,000 times

– “Let’s Go Crazy” downloaded 215,000 times

– “Kiss” downloaded 210,000 times

5. Michael Jackson’s Estate Tax Battle Is the Closest Precedent for the Prince Situation

Jackson’s estate is still battling the IRS over its actual value and how much his name and image are worth, a fight that Prince’s estate could soon face. (Getty)

The eerie similarities between Prince and Michael Jackson’s death go beyond “friendly doctors” and possible drug overdoses.

Jackson’s estate is still tied up in tax court with the IRS following disputes over its actual value. The two sides have resolved some “valuation disputes,” but the fight over the value of Jackson’s name and image continues. The court battle is the closest precedent to Prince’s situation, according to The Wall Street Journal (except the King of Pop did have a will).

Another challenge Prince’s heirs will face is determining the value of future earnings from things like product endorsements, a biographical film or, in Jackson’s case, a themed Cirque du Soleil show. For Prince, his estate could choose to turn Paisley Park into a tourist attraction like Elvis Presley’s Graceland.

There are very little rules to follow for the IRS and the celebrities when it comes to image rights for their estates, which means for the immediate future, everyone’s case will be different.

“Michael Jackson will be different from Prince who will be different from Madonna,” Jonathan Blattmachr, retired estate-tax lawyer from Milbank, Tweed, Hadley & McCloy LLP, told WSJ. “It’s horribly speculative as to what the value is.”

Comments

Prince’s Estate: 5 Fast Facts You Need to Know