Biotech Celcuity (CELC) proved investors are still happy to gamble on new drug discovery as shares soared nearly 50% on its first day of trading on the Nasdaq.

The initial public offering also raised more than expected.

Here’s what you need to know.

1. Celcuity Raised $22.8 Million and Shares Soared

Celcuity priced a more-than-expected 2.4 million shares at $9.50 per share, just above the midpoint of its $8 to $10 range. That raised $22.8 million. The company was expected to originally raise around $18, selling 2 million shares at the midpoint.

The stock opened at $12.35 and ended the day at $14.10, up 48%.

Craig-Hallum was the lead underwriter of the deal, which, under overallotment provisions, as the option to buy 300,000 more shares within 30 days of the offering.

Since its inception on July 5, recommended stocks by Stirling Strategic Investor have returned 6.62% by Sept. 11 vs. the S&P return of 3.32%.

If you subscribe now, you can get $20 off the annual price using promo code 20DISCH

2. The CELx Platform Diagnoses Live Tumor Cells

The company is focused on discovering new sub-types of cancer.

Its advantage is that its CELx diagnostic platform uses live tumor cells “to identify the specific abnormal cellular process driving a patient’s cancer and the targeted therapy that best treats it,” the company said in its latest SEC filing.

“Using dead cells prevents molecular diagnostics from analyzing in real-time the dynamic cellular activities, known as cell signaling, that regulate cell proliferation or survival,” Celcuity said.

Its platform can monitor real-time signaling in living tumor cells, resulting in a more accurate diagnosis.

CELx can also directly measure effectiveness of targeted therapy rather than using estimations based on statistical analysis of clinical trial.

The first commercially ready test of the platform diagnosed two subtypes of breast cancer that molecular diagnostics could not. After that, the company found “14 new potential cancer sub-types in breast, lung, colon, ovarian, kidney, bladder and hematological cancers,” the company said.

3. It Plans on Two Years’ Worth of Cash Requirements

With no drugs for sale and like almost all biotechs coming to the capital markets, Celcuity has no revenue.

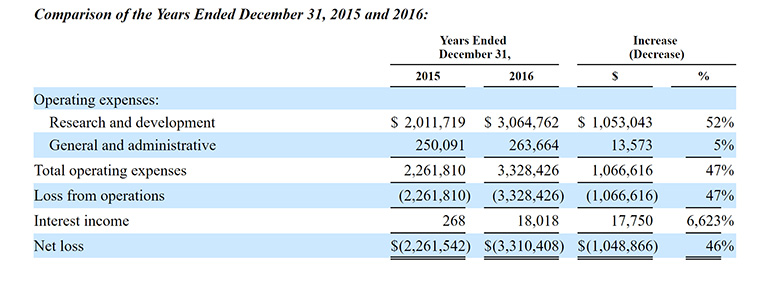

As it looks to develop its platform and conduct tests and then move to potential sales and marketing, expenses are naturally expected to rise.

“Based on our current business plan, we believe the net proceeds from this offering, together with our current cash and cash equivalents, will be sufficient to meet our anticipated cash requirements for at least 24 months following this offering,” the company said.

4. With 50 Programs, Revenue is Forecast at $1.6 Billion

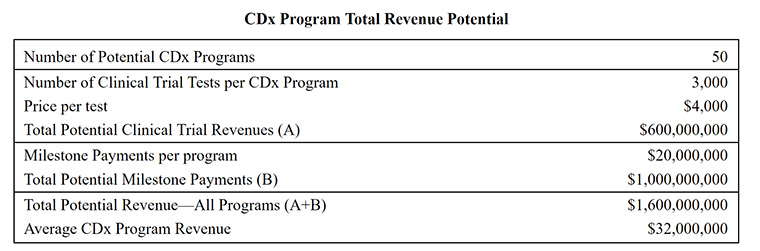

Celcuity is forecasting 50 potential CDx development programs.

With that” number of programs it is looking at about $1.6 billion in revenue.

“The number of clinical trial tests we estimate each CDx program will require assumes our partner will enroll 300-450 CELx selected patients for their clinical trials,” the company said. “The estimated amount of milestone payments is consistent with several recently announced CDx programs.”

5. Cash Will Mainly Go to R&D

The $23 million the company raised will be put into research and development, clinical studies and commercial activity.

Based on earlier SEC filings, the company will use:

- Around $8 million to fund R&D to find new cancer subtypes.

- Around $4 million for clinical trials to support clinical claims.

- Around $2 million for capital expenditures.

- Around $1.6 million for working capital and corporate purposes.

Are you a thoughtful investor looking for uncommon investment ideas?

Stirling Strategic Investor is a new source of high-quality investment ideas from seasoned investment professionals Tim Collins and Kim Khan, formerly senior members of TheStreet.com. Tim and Kim share 50 insightful equity trade’s per year for less than $2 per trade.

We provide the first two ideas at Stirling Strategic Investor for free. We look forward to providing you uncommon ideas of true value.

Learn more at Stirling.

Comments

Celcuity’s Soaring IPO: 5 Fast Facts You Need to Know