Oasis Midstream Partners’ (OMP) initial public offering didn’t get off to a promising start, as the company raised less than expected, pricing below the expected range, and the stock fell below the offering price to start trading.

Oasis Midstream is a master limited partnership (MLP) formed by Oasis Petroleum (OAS).

Here’s what you need to know.

Since its inception on July 5, recommended stocks by Stirling Strategic Investor have returned 6.62% by Sept. 11 vs. the S&P return of 3.32%.

If you subscribe now, you can get $20 off the annual price using promo code 20DISCH

1. The IPO Raised Less Than Expected

Oasis Midstream plans to raised $127.5 million, less than the $150 million anticipated. It priced 7.5 million shares at $17 per share, under the stated range of $19 to $21 per share.

The stock opened at $16.75 on the NYSE and was trading around $16.70 in midday trading.

Morgan Stanley, Citigroup and Wells Fargo are the lead underwriters of the deal.

Credit Suisse, Goldman Sachs, Deutsche Bank, J.P. Morgan and RBC Capital lead a staggering list of 21 co-managers.

In the overallotment provision, the underwriters have a the option to buy an additional 1.125 million shares within 30 days of the offering.

The company plans to give nearly 100% of net proceeds after fees and expenses to OAS.

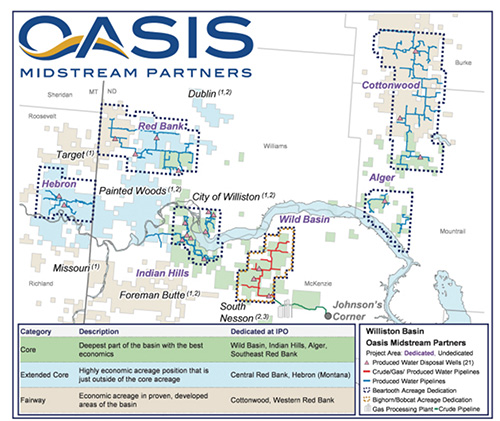

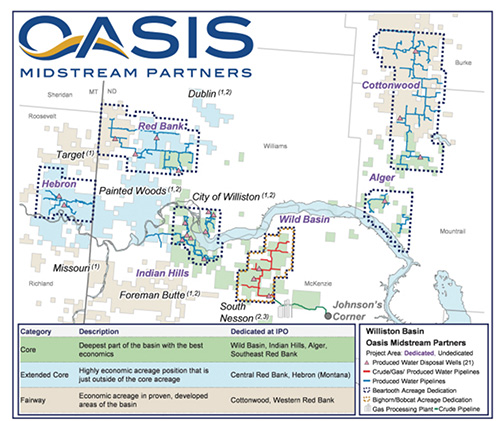

2. Oasis Midstream Operates in the Williston Basin

As an MLP formed by OAS, Oasis Midstream will “own, develop, operate and acquire a diversified portfolio of midstream assets in North America that are integral to the oil and natural gas operations of Oasis and are strategically positioned to capture volumes from other producers,” the company said in a statement.

The company currently operates in the Williston Basin in eastern Montana, western North Dakota, South Dakota and Saskatchewan.

“Following this offering, Oasis intends for us to become its primary vehicle for midstream operations, which generate stable and growing cash flows and support the growth of its high quality assets in the Williston Basin and any other areas in which Oasis may operate in the future,” the company said in its filing.

Oasis Midstream operates in to main areas, both supported by “significant acreage dedications from Oasis” in and out of the Wild Basin (part of the Williston Basin), it added.

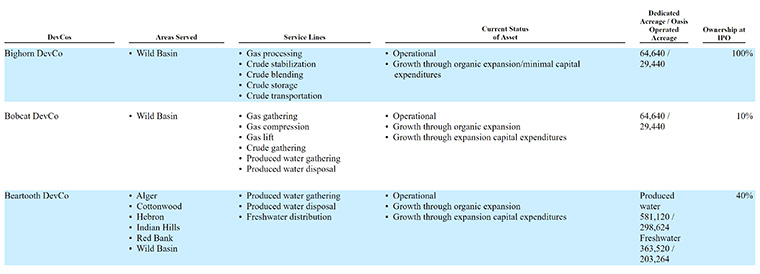

3. Oasis Midstream’s Assets

The graphic above shows the assets of Oasis Midstream.

Its development companies predict operating income of $139.3 million for the 12 months ending Sept. 30, 2018.

About 40% will come from natural gas assets, 10% from crude oil and 50% by water-related midstream assets, according to the company.

4. OAS Will Have About a 70% Limited Partner Interest

After the offering, OAS will have about a 70% limited partner interest in Oasis Midstream. OAS will also have a 100% non-economic interest in Oasis Midstream’s general partner, which owns all the incentive distribution rights.

“Upon the consummation of this offering, our partnership agreement will provide for a minimum quarterly distribution of $0.3750 per unit for each whole quarter, or $1.50 per unit on an annualized basis,” the company said.

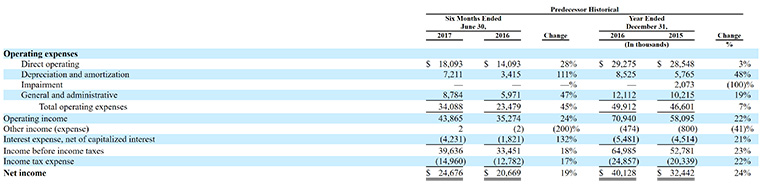

5. Revenue Climbed from the Year-Ago Period

Revenue for the six months ended Jun 30, 2017 was $78 million, up 33% from the same period a year ago.

The company said the rise was due to a jump in natural gas revenue and higher oil volumes as it started up a natural gas processing plant and oil gathering system in the second half of 2016.

Total revenue for 2016 was $120.9 million, which was up 15% from the year-ago period. That mainly attributed to increased water volumes and natural gas volumes.

“Our revenues are primarily generated from charging fees for the midstream services we provide, including under the commercial agreements we will enter into or become a party to with OMS and other wholly owned subsidiaries of Oasis in connection with the offering,” the company said.

Are you a thoughtful investor looking for uncommon investment ideas?

Stirling Strategic Investor is a new source of high-quality investment ideas from seasoned investment professionals Tim Collins and Kim Khan, formerly senior members of TheStreet.com. Tim and Kim share 50 insightful equity trades per year.

Tim and Kim’s first recommendation, Mobileye, was recently acquired at a 34% premium by Intel. We provide the first two ideas at Stirling Strategic Investor for free. We look forward to providing you uncommon ideas of true value.

Learn more at Stirling.

Comments

Oasis Midstream IPO: 5 Fast Facts You Need to Know