Leading TV streaming company Roku (ROKU) is enjoying a successful debut on the Nasdaq, so far. Tha stock opened higher than its offer price and ended the day with a breathtaking gain of 66%.

The initial public offering is garnering a lot of attention from investors and non-investors alike as one of the companies that led the cord-cutting revolution hits Wall Street.

Here’s what you need to know.

Since its inception on July 5, recommended stocks by Stirling Strategic Investor have returned 6.62% by Sept. 11 vs. the S&P return of 3.32%.

If you subscribe now, you can get $20 off the annual price using promo code 20DISCH

1. Roku Raises Nearly $220 Million; Stock Up 66%

The company priced about 15.7 million shares at $14 per share, the top of the range, raising about $219.8 million.

Shares of Roku opened at $15.98 and ended at $23.26, more than 66% higher.

The company itself sold 9 million shares, while certain shareholders sold about 6.7 million.

The company said in its SEC filing that was unable to say exactly how it will use the cash, but it will likely be for general corporate purpose and that there will be wide discretion over how to allocate the funds.

“The principal purposes of this offering are to increase our capitalization and financial flexibility and create a public market for our Class A common stock,” Roku said.

Morgan Stanley and Citigroup are the lead underwriters of the deal. Allen & Co., RBC Capital Markets, Needham, Oppenheimer and William Blair are co-managers.

As part of the overallotment options, the underwriters can buy a little more than 2.35 million more shares at the offering price within 30 days of the debut.

2. The Company Is No. 1 in Market Share

Roku is the pioneer of streaming television and management wants you to know that (Roku says this a lot in filings, its site, etc.).

The company’s devices connect your TV to the internet so that you can stream programming on apps like Netflix (NFLX) or on demand.

Roku is the top TV streaming company by market share, according to Parks Associates, Wireless Week reported in August.

Roku had 37% of the streaming market in the first quarter of 2017, up from 30% in the year-ago period. Amazon’s Fire TV had 24% of the market, while Google’s Chromecast had 18% and Apple TV had 15%.

Roku stressed the importance of over-the-top content (content coming direct through the internet) audiences in its filing.

“As traditional TV audiences shrink, OTT audiences have become increasingly important to advertisers who must continue to reach large audiences,” it said. “Our growth in active accounts and hours streamed has attracted more content publishers and advertisers to our TV streaming platform, creating a better user experience, which in turn attracts more users.”

3. Platform Revenue Will Be the Bread and Butter

The company is not profitable, unsurprising for an IPO these.

Based on the six months ended June 30 2017, revenue is rising from the year-ago period. And earnings before interest, taxed, depreciation and amortization (EBITDA) show a narrowing loss for the year-on-year comparison.

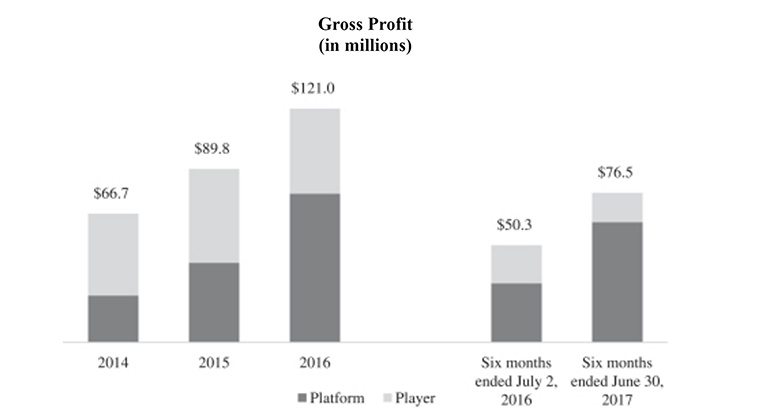

There are two sources of revenue, player revenue and platform revenue.

Player revenue is the sale of devices, online from Amazon (AMZN) and others and also brick-and-mortar stores like Best Buy (BBY).

Platform revenue comes “from advertising sales, subscription and transaction revenue share, sales of branded channel buttons on remote controls and licensing arrangements with TV brands and service operators,” the company said.

For the first half of the year, revenue was $199.7 million, with 59% player revenue and platform revenue was 41%. While smaller, platform revenue is growing much, much more.

Roku makes more revenue and gross profit in the fourth quarter, due to holiday shopping.

4. Early Investor Menlo Will Have 29.3% Voting Power

As discussed, those who invested in Roku while it was fundraising will be selling about 6.7 million shares.

Menlo Ventures, one of the earliest funders of the company, is one of the sellers. Shawn Carolan, a managing member of Menlo and one of Roku’s directors, will sell 6 million shares.

Menlo invested in Roku twice in 2008 and once in 2009.

It will own 30% of Class B share and have 29.3% of the voting power after the IPO.

The rest of the shares will be sold be Sky Ventures Limited. Sky Ventures is part of the News Corp. (NWS) empire, affiliated with the UK’s Sky satellite broadcaster.

5. Licensing Partnerships Are Expected to Drive Growth

Roku had 15.1 million active accounts by June 30.

The users streamed more than 6.7 billion hours of programming during that time, up 62% from the same period a year ago.

The fastest-growing channel for new accounts comes from licensing partner relationships, which accounted for 42% of new accounts last year. That’s up from 26% in 2015.

Average revenue per user (ARPU) was $11.22 for the first half of 2017 and is growing compared to previous period.

Are you a thoughtful investor looking for uncommon investment ideas?

Stirling Strategic Investor is a new source of high-quality investment ideas from seasoned investment professionals Tim Collins and Kim Khan, formerly senior members of TheStreet.com. Tim and Kim share 50 insightful equity trade’s per year for $100. That’s just $2 per trade.

We provide the first two ideas at Stirling Strategic Investor for free. We look forward to providing you uncommon ideas of true value.

Learn more at Stirling.

Comments

Roku Soars 66% in IPO: 5 Fast Facts You Need to Know