We’ve had a China IPO this week and couple of biotechs. Combine the two and you get a stock that’s up more than 70% on its first day of trading.

Zai Lab (ZLAB) priced an upsized offering of its American Depositary Shares Wednesday and shares jumped higher as it began trading on the Nasdaq.

Here’s what you need to know.

1. The IPO Raises More Than Expected; Stock Soars

Zai Lab raised $150 million, a good deal more than the $100 million originally projected. It sold 8.33 million ADSs at $18 per share, the top of its range.

The company was originally expected to price 5.9 million shares between $16 and $18.

Shares opened sharply higher at $28.18 and closed at $31.11, up 73%.

J.P. Morgan, Citigroup and Leerink Partners are the underwriters for the deal.

Under the overallotment provisions, the underwriters have the option to buy a further 1.25 million ADSs.

Since its inception on July 5, recommended stocks by Stirling Strategic Investor have returned 6.62% by Sept. 11 vs. the S&P return of 3.32%.

If you subscribe now, you can get $20 off the annual price using promo code 20DISCH

2. Zai Lab’s Lead Drug Treats Cancer

Zai Lab’s leading drug candidate is niraparib, which is a treatment for ovarian cancer.

Tesaro (TSRO) is developing and commercializing the drug and already launched it as Zejula in the United States in April.

“We intend to develop niraparib for Chinese patients across multiple tumor types and anticipate beginning two Phase III studies of niraparib in patients with ovarian cancer, one in the second half of 2017 and the other in the first half of 2018,” Zai Lab said in an SEC filing. “In addition, we intend to pursue niraparib in other indications.”

“In the longer term, we plan to build a premier, fully integrated drug discovery and development platform that brings both in-licensed and internally-discovered medicines to patients in China and globally,” the company added.

3. The Company Has Three Late-Stage Drugs

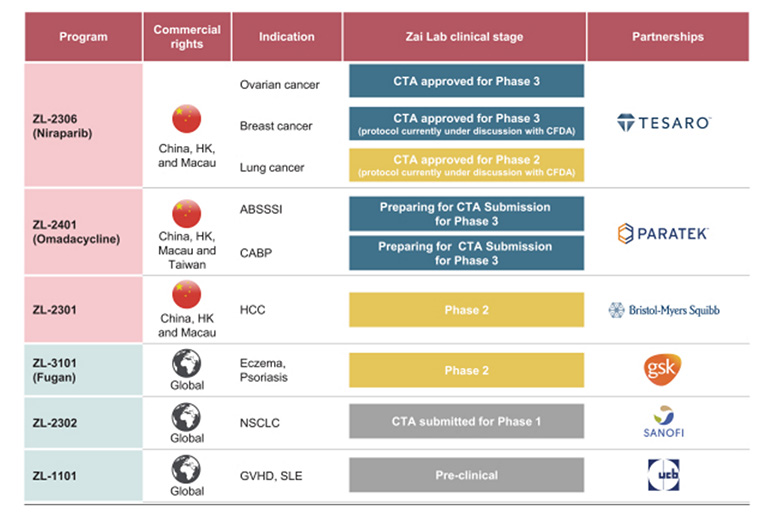

The company has three drugs in late-stage clinical trials in China, Hong Kong, Macau and “in certain circumstances” Taiwan. Its partnerships are with Tesaro, Paratek (PRTK) and Bristol-Myers Squibb (BMY).

There is the aforementioned niraparib, which is in Phase III clinical trials to treat ovarian and breast cancer.

Omadacycline is a broad-spectrum antibiotic which is being prepared for submission for Phase III trials.

And ZL-2301 is treatment for hepatocellular carcinoma, the most common type of liver cancer, is in Phase II clinical trials.

4. Very Familiar Biotech Financials

There are no products to sell in its area of the world, so there is no revenue.

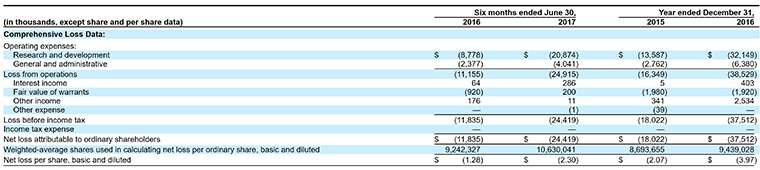

The biotech lost $2.30 per share in the six months ended June 30, 2017, wider than the loss of $1.28 per share in the year-ago period.

“Historically, we have financed our operations principally through proceeds from private placements of preferred shares and warrants of $164.5 million,” the company said.

With the IPO funds, the company expects to have cash enough to operate through fiscal year 2020.

5. This Is Where the Money Goes

Zai Lab has much more money to use after this IPO, but in earlier filings the company said it planned to use the proceeds in several ways.

- About $38 million to complete Phase III studies of niraparib and omadacycline.

- About $20 for commercial efforts for niraparib in China, Hong Kong and Macau.

- About $40 million for new business development and licensing opportunities.

- About $15 million in R&D.

The remainder for working capital and general purposes.

Are you a thoughtful investor looking for uncommon investment ideas?

Stirling Strategic Investor is a new source of high-quality investment ideas from seasoned investment professionals Tim Collins and Kim Khan, formerly senior members of TheStreet.com. Tim and Kim share 50 insightful equity trade’s per year for $100. That’s just $2 per trade.

And if you subscribe now, you can get $20 off the annual price using promo code 20DISCH

Since its inception on July 5, recommended stocks have returned 6.62% by Sept. 11 vs. the S&P return of 3.32%.

We provide the first two ideas at Stirling Strategic Investor for free. We look forward to providing you uncommon ideas of true value.

Learn more at Stirling.