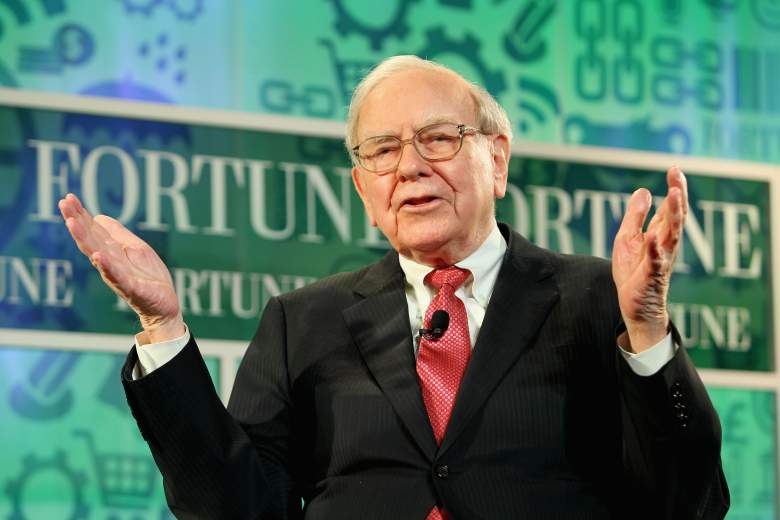

Getty Billionaire Warren Buffett AFP PHOTO/Nicholas KAMM Getty

Warren Buffett is a legendary investor and philanthropist. His advice and insights into investing are followed rapturously (his annual shareholder letters are covered extensively each year) and revered world-wide. “The Oracle of Omaha,” as he has been nicknamed, is currently worth $84.7 billion, making him the 3rd richest man in the world. As the Chairman and Chief Executive of Berkshire Hathaway, Buffett is a financial titan, with control and ownership of companies across nearly every conceivable industry. Berkshire Hathaway has been ranked the 9th largest conglomerate in the world by revenue.

Warren Buffetts Net Worth is $84.7 billion

A famously fastidious man, Buffett has also led major philanthropic efforts, most notably The Giving Pledge, along with Bill Gates. The Pledge is a moral and financial commitment from some of the wealthiest individuals in the world to donate half of their wealth to charitable causes. One of largest private donations of wealth ever, Buffett has led the charge, promising to donate 99% of his massive fortune to selected charities. He has already given away $27 billion of his own money. While he’ll be giving away most of his wealth, his children will still fare decently. They will each be left with a $2 billion foundation to manage.

Here’s what you need to know about Warren Buffet’s net worth and how he makes his money:

1. All of His Wealth Comes From Investments, Thanks to His Timeless Strategy

GettyWarren Buffett, chairman of Berkshire Hathaway Inc., arrives for the Allen & Company Sun Valley Conference on July 8, 2014 in Sun Valley, Idaho. Many of the worlds wealthiest and most powerful businessmen from media, finance, and technology attend the annual week-long conference which is in its 32nd year. Getty

Buffett is famous for his investment strategies, namely, invest in what you know and let it grow. This is known as long-term investment horizons. He is often quoted for his saying, “If you don’t feel comfortable owning something for 10 years, then don’t own it for 10 minutes.” Warren Buffett looks for defensible advantages in companies and always sticks to his core areas of competence, hopefully finding companies that offer the potential for exponential value creation.

While he has not won every bet – he famously passed on investing in Google and Amazon and has cost himself and shareholders billions on companies like the Dexter Shoe Company or the Waumbec Textile Company – his wins far outweigh his losses. Buffett’s leadership at Berkshire Hathaway has driven 18.3% annualized returns in book value over the past 30 years, 7.5% better than the S&P 500.

2. His Wealth Has Been Accumulating Since Age 11

Warren Buffett speaks during the Forbes’ 2015 Philanthropy Summit Awards Dinner on June 3, 2015 in New York City. Getty

Warren Buffett purchased his first stock at the tender age of 11. He chose the Cities Service Preferred stock for $38 apiece. Stock picking was not his only way of making money – he has stated he was making $175 a week delivering the Washington Post. Notably, this was more than his current teachers were being paid. He also sold used golf balls and stamps, polished vehicles, and started a pinball machine business. By the age of 16, he had amassed an impressive $53,000! By his high school graduation, he had purchased a 40-acre farm in Omaha.

After several successful turns as a stockbroker and securities analyst in his 20’s, first at his father’s firm and later with legendary value investor Benjamin Graham, Buffett amassed a sizeable yet still believable wealth of $1 million by his 30th birthday. However, it was his investment in Berkshire Hathaway beginning in 1962, then a textile manufacturing firm, that would open the door to incredible wealth. Berkshire Hathaway started as a group of textile manufacturing companies dating back to the late 1800s. By age 35, Buffett’s was worth $26 million from various partnerships and investments. With these funds, Buffett bought controlling stock in Berkshire Hathaway, taking over the company and firing the owner. Though it was a textiles manufacturer, Buffett began a slow divestment of textile mills, first moving into the insurance business and then other endeavors. He has often said the purchase of Berkshire, specifically the purchase of a textile manufacturer, is the worst investment he has ever made. His wealth increased throughout his 40s and he officially became a billionaire by the age of 56. Incredibly, he continued to live on his modest $50,000 a year salary from Berkshire and save and invest the rest of his wealth.

Despite his early success, Buffett actually made 99% of his wealth after his 50th birthday. He still owns about 17 percent of Berkshire, the conglomerate he has run since 1965, despite having donated more than 40 percent of his holdings.

3. His Firm Is Worth $480 Billion

GettyWarren Buffett speaks onstage at the FORTUNE Most Powerful Women Summit on October 16, 2013 in Washington, DC. Getty

Buffett has continued to acquire companies companies and grow Berkshire Hathaway. The failed textile firm is now worth an eye-watering $480 billion by market value, with Buffett remaining its largest shareholder. Within the conglomerate’s impressive portfolio are major brands from Dairy Queen to Fruit of the Loom to GEICO. It is estimated that Berkshire itself owns over 60 companies. Through the firm, Buffett also owns controlling and partial stakes in other companies. For example, Berkshire owns a 9.2% stake in Wells Fargo. Buffett calls the financial services giant one of his favorite companies.

Hathway’s successes in the mid-2000s actually landed him the title as the richest person in the world in 2008; however, the crown was short-lived, handing the label back to his bridge partner Bill Gates in 2009.

4. Despite Massive Wealth, He’s Famously Frugal

GettyWarren Buffett participates in a discussion during the White House Summit on the United State Of Women June 14, 2016 in Washington, DC. The White House hosts the first ever summit to push for gender equality. Getty

One of the most surprising things about Warren Buffett is that, unlike other flashy billionaires, he is a spendthrift. His modest home in Omaha – the one he purchased before he made his first millions, is worth just .01% of his total wealth. Buffett paid $31,500 for the home in 1958, or about $250,000 in today’s dollars. It is now worth an estimated $652,619 and Buffett likes to call it the “third-best investment he’s ever made.”

He is a man of few indulgences. Buffett eats one of three McDonald’s meal options every morning, never spending more than $3.17, which he is sure to pay using exact change, a tradition he has had for the past 54 years. He is also partial to soda, particularly Coca-Cola. He drinks at least five cans every day. On a typical day, Buffett said he has three Cokes during the day and two at night. It doesn’t hurt that he also owns 9% of the soft drink giant.

He is not completely bereft of spending though. GM Chief Executive Mary Barra once convinced Buffett to replace his 2006 DTS with a 2014 Cadillac XTS by explaining all of the features he was missing out on by driving an older model. The base model XTS sells for around $61,000.

He has adopted one or two of the spending styles of the uber-rich–most notably, he owns a private jet. Actually, he owns a whole jet company. Buffett first bought a Bombardier Challenger 600 over over 20 years ago, naming it “The Indefensible.” To this day, he has stated it is a good investment as a business tool. Hence, he renamed his aircraft: “The Indispensable”. In fact, Buffett liked private plane travel so much, after three years as a customer he actually bought the private airplane leasing provider NetJets in 1998 for $725 million.

Still, for the most part he is frugal. “I buy everything I want in life,” he once said. “Would 10 homes make me more happy? Possessions possess you at a point. I don’t like a $100 meal as well as a hamburger from McDonald’s.”

5. His Passion for Investing Is Matched by His Passion for Philanthropy

GettyBill Gates and Warren Buffett speak with journalist Charlie Rose at an event organized by Columbia Business School on January 27, 2017 in New York City. Gates and Buffett spoke on a range of topics including their friendship, business, philanthropy, global health, innovation, and leadership. Getty

Once his wealth and status as a billionaire had been well established, Buffett announced an interest in giving some of his fortune away. In 2006, he published a pledge letter that we would be giving away at least 85% of his wealth. In 2010, he teamed up with Bill and Melinda Gates to form The Giving Pledge, an initiative that asks the world’s wealthiest people to dedicate the majority of their wealth to philanthropy. In fact, the number one contender for his crown as the biggest philanthropist ever is actually Bill Gates.

As of 2018, more than 175 individuals have signed up with the total amount pledged reaching over $365 billion. Pledgers range in age from 30 to 90 and hail from 22 different countries including Australia, Brazil, Canada, China (mainland and Taiwan), Cyprus, Germany, India, Indonesia, Israel, Malaysia, Monaco, Norway, Russia, Saudi Arabia, Slovenia, South Africa, Tanzania, Turkey, Ukraine, UAE, the United Kingdom, and the United States.

Buffet himself has donated more than $27 billion of his own money over the past decade, making him one of the most generous philanthropists in history. These donations include roughly $21.9 billion to the Gates Foundation. His most recent donation of $3.17 billion came in the form of Berkshire Hathaway stock to the Gates Foundation and a few other selected charities. This marked his 12th annual donation. Buffett also donated to the Susan Thompson Buffett Foundation, named for his late first wife, and the Howard G. Buffett, Sherwood and NoVo Foundations, respectively overseen by his children, Howard, Susan and Peter. Some critique the Susan Thompson Buffett Foundation lack of transparency, particularly in light of the $2.5 billion the Foundation received on the event of Susan Thompson’s death.

Usually, the donations come in the form of Berkshire Hathaway stock, as they did in this case. The organizations in turn sell the stock to finance their activities. That is pretty helpful given that Berkshire Hathaway’s A Stock has traded up to $325,000 per share in the past six months.

Buffett is generally socially liberal and has made noted donation to progressive causes, most significantly giving $1.2 billion to abortion rights organizations from 2001 to 2012.

He has stated that he would like to leave “enough money so that they [his children] would feel they could do anything, but not so much that they could do nothing.”