Getty

Alibaba-funded logistics and supply-chain company Best Inc. (BSTI) sent a worrying signal to the market after it slashed the size of its initial public offering and priced at the low end of its expected range.

Just Monday the Chinese company was planning on raising about $870 million, but that’s down to around $450 million now. At the end of August the company was indicating a $1 billion IPO.

It’s a sure sign of lackluster demand and Alibaba (BABA) might jump in and support the offering on the open market.

Here’s what you need to know.

1. A Once Billion-Dollar Deal Is Down to $450 Million

Best sold a total 45 million American Depositary Shares (ADSs) at $10 per share, the low end of an already lowered expected range.

That’s much smaller than the $869.4 million expected just a couple of days ago. Best planned to price 62.1 million shares between $13 to $15 a share.

Shares opened trading on the NYSE at $11.48 and closed at $10.56 after a steady afternoon decline.

Majority shareholder Alibaba said it may chip in and buy up to 150 million of ADSs on the IPO terms, the company said in its filing before the IPO traded.

It’s still a big China offering and the big hitters are underwriting. The lineup of lead underwriters are Citigroup, Credit Suisse, Goldman Sachs, J.P. Morgan and Deutsche Bank.

CITIC CLSA, KeyBank Capital, Oppenheimer and Stifel are co-managing the deal.

As part of the overallotment, “certain” selling shareholders and the company grant the underwriters rights to buy an additional 6.75 million ADSs.

After fees and discounts, the company expects to take in $447.3 million.

It will use:

- Up to $65 million in tech infrastructure investment.

- Up to $200 million expanding its logistic and supply chain network and Best Store+ network.

- The rest of general corporate purposes.

Since its inception on July 5, recommended stocks by Stirling Strategic Investor have returned 6.62% by Sept. 11 vs. the S&P return of 3.32%.

If you subscribe now, you can get $20 off the annual price using promo code 20DISCH

2. What Best Does

There are a lot of Bests out there, although not the catalog store nostalgic Virginians such as myself will remember.

In China, Best is a B2B and B2C supply chain provider that also has a proprietary tech section, Best Cloud.

“We believe we are well positioned to transform the logistics and supply chain industry in China and capture growth opportunities in the New Retail era, which is the seamless integration of online and offline retail to offer a consumer-centric, omni-channel and global shopping experience through digitization and just-in-time delivery,” the company said in its IPO filing.

In additions to Best Cloud there is:

- Best Express – a delivery company that serves 100% of China’s provinces and cities and 98% of its districts and counties.

- Best Freight – a less-than-truckload delivery company in the top three of 2017 daily freight volume.

- Best Global – cross-border, door-to-door supply chain services with warehouses in the U.S. and Germany and presence in Australia, Japan and Canada.

- Best UCargo – a real-time bidding platform for truckload capacity.

- Best Store+ – a “last-mile” service, which looks to provide online merchandising, store management for convenience stores and package pickup and drop-off B2C services.

It had more than 500 corporate supply-chain customers in 2016.

3. Alibaba Is the Biggest Shareholder

Alibaba and Best are completely intertwined and most of the funding for Best came from the Chinese e-commerce giant.

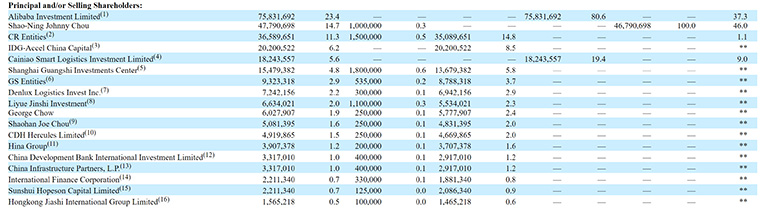

As shown in the graphic above, Alibaba own 23.4% of Best. In addition, the company received funding from Cainiao Network, which is also one of its largest logistic partners. Alibaba had a 47% equity stake in Cainiao Network on March 31, 2017, according to the filing.

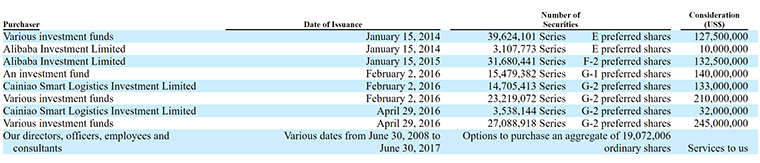

Below are the list of the Best funders and shares they received.

4. Gross Margins Are Improving Steadily

Best is still in big-revenue-growth mode, so don’t look for profitability.

Reported in renminbi, the company said revenue rose 68.3% in 2016 from the year before, and 71.5% in 2015 from 2014. Net losses widened to RMB1.36 billion in 2016 from RMB1.06 billion in 2015 and RMB718.5 million in 2014.

For the six months ended June 30, 2017, revenue was $1.2 billion, up 133.5% from the same six months a year ago. Net losses for the six months ended June 30 were $92.1 million, 1.06% narrower than the year-ago period.

Gross margin steadily improved. It was -0.1% in the six months ended June 30, 2017, compared with -8% in that period of 2016.

Operating expenses for the first six months of 2017 soared 77.6% mainly due to a 101.2% jump in selling expenses.

That has due to “delivery of merchandise to our membership stores and staff costs in connection with the expansion of BEST Store+ network,” the company said.

5. Online Growth and Offline Convenience Are Key

For the e-commerce market the company highlighted several opportunities in its filing.

- Under-developed offline retail infrastructure and inefficient distribution system.

- Growth in internet population and penetration.

- Growth in mobile commerce and increasing popularity of social media platforms.

- Geographically dispersed population. Limited access to major offline retailers will continue to drive online consumption in tier three and tier four cities and other areas.

It’s also bullish on the need for more convenience stores across China.

“In 2016, there were around 6.6 million convenience stores in China, including chains and mom-and-pop shops which collectively generated $340 billion of sales,” the company said.

There are the fastest-growing offline channel segment, it added, citing iResearch.

Are you a thoughtful investor looking for uncommon investment ideas?

Stirling Strategic Investor is a new source of high-quality investment ideas from seasoned investment professionals Tim Collins and Kim Khan, formerly senior members of TheStreet.com. Tim and Kim share 50 insightful equity trade’s per year.

We provide the first two ideas at Stirling Strategic Investor for free. We look forward to providing you uncommon ideas of true value.

Learn more at Stirling.