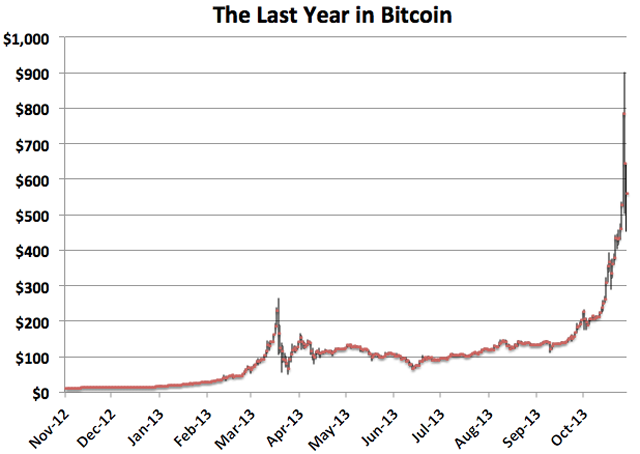

A chart shows the meteoric rise of Bitcoin over the last year.

Bitcoin has been in the news constantly lately. Most recently, it was a massive price hike and subsequent drop. The price hike was likely caused by increased attention from America during the Senate Hearings about virtual currency.

While such spikes make Bitcoin seem like it just can’t stop its massive gaining in price, there are plenty of detractors. The Atlantic recently described Bitcoin as the technology equivalent of a Segway, the extinct motorized scooter, relegated to mall cops and hokey people with too much money.

Here’s what they said:

Segway hasn’t exactly been “to the car what the car was to the horse and buggy,” like its founder Dean Kamen said it would. It hasn’t even been to the moped what the moped was to the horse and buggy. Or what the bicycle was. It’s just been a (sometimes morbid) punchline. And one that’s almost too impossible to believe. Did you know that Kamen thought he’d need an around-the-clock factory churning out 10,000 Segways a week to meet initial demand?

The article goes on to describe the wide praise of the Segway, with Steve Jobs even standing behind the gyroscopically-controlled motor scooter.

So, which is it? Is Bitcoin just another beanie babie (a fad), a Segway (a good idea with a lot of promise and no real practicality or support), or perhaps worse of all, a tulip (an overpriced commodity that maybe deeply cut its country’s economy)?

These suggestions will continue to come up in Bitcoin’s future. Beanie Babies, Tulips, and Segways will repeatedly be used to make fun of Bitcoin and for good reason, it sure does seem like a Ponzi scheme.

But is it really?

I’m going to break apart these various accusations, fortunately none of them are too technical, and explain why I believe that buying Bitcoin is a good idea if you wish to speculate, invest, or in short, buy it. In the future, I believe Bitcoin will not be able to be speculated upon, as the price will steadily grow, rather than violently.

Is Bitcoin a Fad?

Bitcoin is absolutely a fad, so there’s no mistake made by detractors calling the cryptocurrency this. There’s no doubt about it, at this point in time, most people using BTC are likely doing so because they think it’s “a cool thing,” and most users have no real need for the currency. After all, how often does the average person have to send money internationally, and would want to do so without incurring large fees or involving banks? Almost never.

But wait a second, just because Bitcoin is a fad, doesn’t mean that it’s just a fad. Here’s a great example: Sriracha, an extremely popular hot sauce, has been called a fad. It, much like Bitcoin, has reached extreme popularity in recent times, but Sriracha has been on the market for quite awhile. It only recently hit some critical mass that suddenly made it ubiquitous throughout the USA. So Srirachi is both a fad, and a quality product. The fad aspect is what popularized, but the thing is, once that fades, and the explosion in popularity ceases, Sriracha will reach a stable level of sales and popularity, and the real question you have to ask yourself is: will the fad benefit Sriracha? It seems obvious that Sriracha, like Bitcoin, will not always be a fad, but that its fad stage is what’s propelling it toward its ultimate stable destiny.

Bitcoin’s price, unlike Sriracha, is necessarily tied to how popular it is, and detractors most common argument is that the wildly unstable price will keep people from using Bitcoins from its true use as a cryptocurrency, but the thing is, Bitcoin cannot really be both a popularly used currency and wildly unstable.

Still, Bitcoin’s price can only be permanently unstable if it is a fad, and is gaining popularity. If it stops, Bitcoin’s price will either rapidly descend, probably to nothing, or it will find stability and value and begins its life as a currency.

Which is more probable? Well, with Beanie Babies, their price went to virtually zero, but Beanie Babies are mere decorations, Bitcoin is the first kind of money that can instantly be transmitted across the globe for almost no transaction fee. The value of that has yet to be determined, but it sure doesn’t seem trivial.

In short, Bitcoin is a fad, but it’s not just a fad. For the same reason, it’s not a Tulip or a Segway. Bitcoin is widely used and traded. While the price could plummet, why should it? Why would something that is a huge fad turn into nothingness. Bitcoin’s value is driven by its promise as an idea and a future implementation. Segways, Tulips, and Beanie Babies aren’t very useful.

Bitcoin isn’t fully useful either, but it could be extremely useful. If it became useful, however, it would be revolutionary. All that needs to happen is for Bitcoin to reach price stability, and all that it takes for that to happen is a lot of money in the market. Right now the whole Bitcoin market is worth around 6 billion dollars, but if it were worth one hundred times that, a Bitcoin would cost $60,000, and price instability wouldn’t be an issue.

Therefore, once Bitcoin hits a certain point of popularity, which it is on course to do, its true function will become possible. Because of this, Bitcoin will reach some pivotal point of stability, and then maintain steady growth when as many people seek to accept Bitcoin as possible.

So Should I Buy It?

Bitcoin is a strange kind of gamble, and I wouldn’t put any money on it you can’t afford to lose, but there has never been a time, short of the massive price hike, where you wouldn’t have made money on Bitcoin if you invested in it.

Full Disclosure: I own Bitcoin.

Comments

Should I Buy Bitcoins? What You Need to Know