(Athenex)

The steady drum of biotech companies debuting on the capital markets continued last week with cancer therapy developer Athenex.

The company has several products in development and is turning to the capital markets for the money to continue clinical trials, including a late-stage trial breast cancer treatment.

Here’s what you need to know.

1. IPO Raised $66 Million, Less than Expected

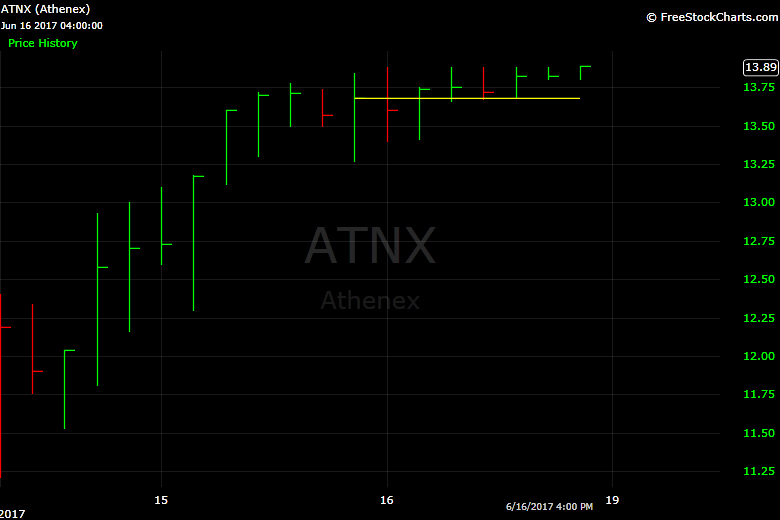

Athenex weekly chart. (FreeStockCharts.com)

Athenex (ATNX), which trades on the Nasdaq, priced 6 million shares at $11 per share, the low end of its expected range. The company was aiming for raising $72 million, pricing at $12 per share.

But there was demand after the stock went public Wednesday. Shares finished at $13.89, up about 26% from the IPO price.

Credit Suisse, Deutsche Bank and JP Morgan were the lead underwriters of the deal. ICBC International is a co-manager of the deal.

The underwriters have the overallotment option of buying 900,000 additional shares at the IPO price within 30 days of the offering.

2. Biotech Banking on Cancer Treatments

Athenex’s business is essentially developing products that will help with the treatment of cancer, mainly by working in combination with existing cancer treatments.

The company has two research platforms. There is the Orascovery platform mentioned above and there is the Src Kinase platform.

Src Kinase is research on a protein that is involved in regulating cell growth that “is strongly implicated with blocking metastasis,” Athenex said in its regulatory filing.

“Defects in Src Kinase are implicated in a number of cancers, and inhibiting this protein may limit the growth or proliferation of cancerous cell types,” Athenex said.

Let’s look at Oraxol, which comes from the Orascovery program.

Oraxal is is an oral rather than intravenous therapy for patients whose tumors respond to paclitaxel. Paclitaxel is prevalent IV chemotherapy that treats breast, ovarian, lunch, bladder, prostate, melanoma, esophageal and other types of solid tumors.

“Current clinical data suggests the potential for a better clinical response and tolerability profile, which is likely attributed to the pharmacokinetic (the movement of a drug in and through the body) profile achieved with oral dosing,” Athenex said.

“Oraxol is presently in a Phase 3 trial in metastatic breast cancer and poised to enter into a combination study for treatment of advanced gastric cancer with ramucirumab through a clinical trial collaboration with Eli Lilly (LLY),” it added.

3. Market Expected to Continue to Grow

For the potential market, there were 1.7 million new cancer cases diagnosed in 2016 and 600,000 died from cancer, the company said, citing the National Cancer Institute. The cost of cancer care has risen sharply mainly due to new therapeutics, the company said.

While that is certainly a difficulty for those ill, it does speak to the potential market of Avenex’s new drugs.

The market for paclitaxel is expected to have a compound annual growth rate (CAGR) of 12% to 2020.

4. Current Revenue Dwarfed by the Deficit

(Athenex)

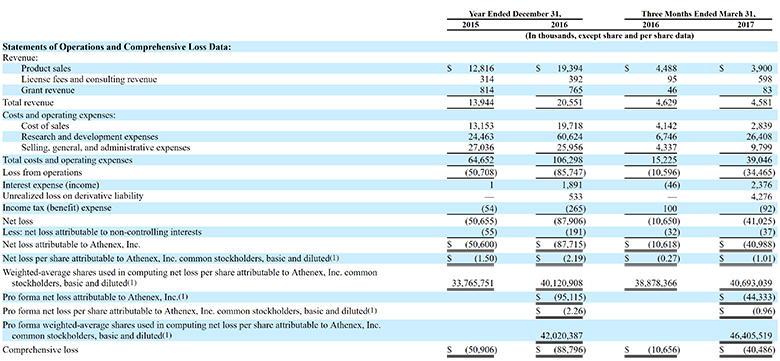

For biotech-heads who like to see at least a little revenue there is (a little) good news.

After Athenex’s accountants raised “substantial doubt” about whether the company could continue concern, the company bought QuaDPharma (drug manufacturing and support) in 2014 and Polymed (polymers for pharma products) in 2015.

The revenue from those acquisitions was $19.4 million in 2016, up from $12.8 million in 2015. In the latest quarter ended March 31 revenue was $4.5 million, up from $3.9 million in the year-ago period.

The total deficit as of March 31 was about $236 million.

The company loss widened to $87.7 million in 2016 from $50.6 million in 2015.

5. China a ‘Significant Opportunity’ for Athenex

(Athenex)

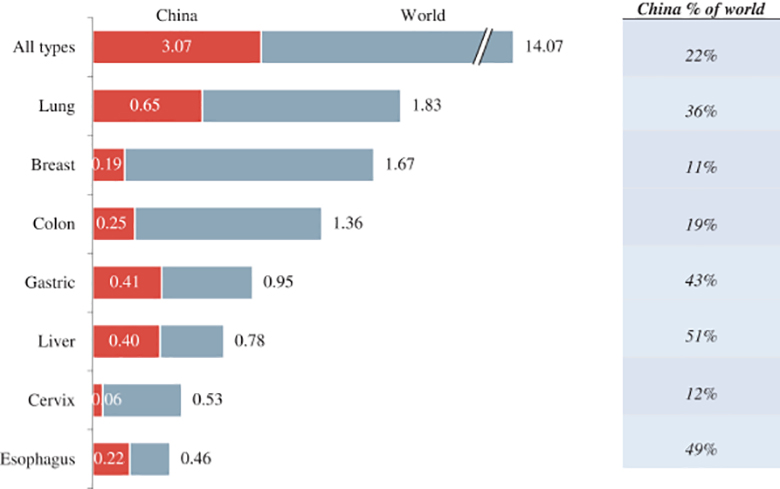

China is a “significant opportunity, forecasted to be the second largest pharmaceutical market in the world in 2017, including traditional and modern medications,” Avenex said.

There China pharma market is expected to grow to $158 billion in 2020 from $109 billion in 2015, which would be a compound annual growth rate of 7.5.

“China provides an opportunity to access largely untapped clinical trial pools and develop drugs for a population for whom global standard therapies are not available,” Avenex said. “Because of China’s large population size, representing approximately one-fifth of the world population and, according to data from the World Health Organization and Globocan, in 2012 China accounted for approximately 22% of global new cancer cases.”

In addition, we conduct manufacturing operations at our facility in Chongqing, China to manufacture our proprietary product candidates.

Comments

Athenex (ATNX) $66 Million IPO : 5 Fast Facts You Need to Know