Clementia Pharmaceuticals (CMTA) opened higher on the Nasdaq after pricing its initial public offering at the top of its range and selling more shares than anticipated.

The stock opened at $17 and was at $16.80 in midday trading.

Here’s what you need to know.

1. The Biotech Raises $120 Million

The lead underwriters are Morgan Stanley and Leerink Partners. Wedbush and BTIG Research are

co-managers of the team.

The underwriters have the options of buying 1.2 million additional shares to cover overallotment for 30 days after the offering.

2. Its Main Drug Could Be the Standard Treatment for a Bone Disease

Clementia concentrates on treatments for debilitating bone diseases.

Its lead product is palovarotene, which is designed to help those with two diseases:

- Firbrodysplasia Ossificans Progressiva (FOP), where soft-tissue flare-ups can cause bone to actually form in muscles, tendons and ligaments. The ultra-rare condition can lead to severe restriction of movement and death and there is no treatment for it at the moment, the company said.

- Multiple Osteochondroma (MO), also rare, causes benign bone tumors on bones. This results in “substantial morbidities” (simultaneous diseases).

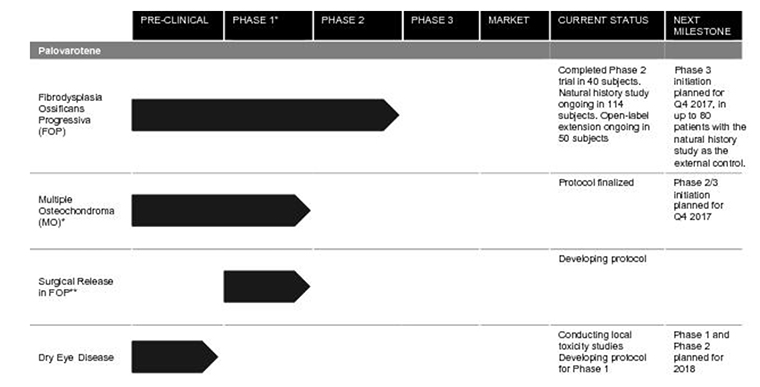

For palovarotene for the treatment of FOP and MO the company has “one Phase 3 trial and one Phase 2/3 trial, for two separate indications, planned to commence in 2017 with data read-outs planned in 2019 and 2020,” Clementia said in its S-1 filing. “We believe that if approved in FOP or MO, palovarotene could become the standard of care in either or both of these indications.”

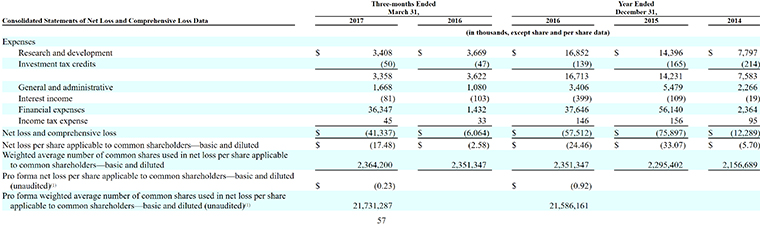

3. Its Deficit Stands at $191 Million

It’s a familiar story on the financial front for Clementia: no revenue, more expenses and widening losses.

By March 31, 2017, the company had an accumulated deficit of $190.8 million.

“Substantially all of our net losses have resulted from non-cash charges incurred in connection with the accounting of our preferred shares and embedded derivatives, as well as research and development activities and general and administrative costs associated with our operations,” the company said in its filing. “We expect to incur significant expenses and increasing operating losses for the foreseeable future.”

4. Most Cash Will Go to the Clinical Trials

If the company prices at the midpoint of the expected range, $14 per share, it would have about $90.6 million at its disposal after expenses and underwriter discounts.

If the underwriters exercise the overallotment options it would have about $104.6 million.

Here’s how Clementia plans to spend the money.

- It will use $65 million for its Phase 3 trial of palovarotene to treat FOP.

- It will use $25 million for the Phase 2/3 clinical trials for palovarotene to treat MO.

- About $10 million will be used for $10 million for Phase 1 and Phase 2 clinical trials of palovarotene for dry eye disease.

- The rest will be used for working capital and expenses.

5. Will There Be Enough Patients?

The risk section is always one of the longest parts of the IPO securities filing, with biotechs in particular. Hey, if the drug doesn’t get FDA approval, there goes the ballgame. No revenue and no profit.

But there are other risks that should be of more interest for the thoughtful investor.

First, it’s a newbie in Phase 3 clinical trials.

“The conduct of Phase 3 clinical trials and registration trials, and the submission of a successful (new drug application) is a complicated process,” Clementia said. “We have never conducted a Phase 3 clinical trial or registration trial before, have limited experience in preparing and submitting regulatory filings, and have not submitted an NDA before. Consequently, we may be unable to successfully and efficiently execute and complete these planned clinical trials in a way that leads to NDA submission and approval of palovarotene.”

Compliance is a very difficult part of drug development and the pharmaceutical industry is turning to the cloud to make it more reliable and efficient.

Veeva Systems (VEEV), which specializes in the compliant cloud for pharma, was selected as a good stock to go long by investment site Stirling Strategic Investor.

You can read why the company is strong and how the stock can go by signing up for a free trial here.

Second, the advantage of having the only drug for a rare disease is the rarity itself.

“The number of patients suffering from FOP and MO is small and has not been established with precision,” Clementia said.

If it’s smaller than expected, then there may not be enough patients for clinical trials to be completed. And if the drug is approved, the revenue may be very small.

Are you a thoughtful investor looking for uncommon investment ideas?

Stirling Strategic Investor is a new source of high-quality investment ideas from seasoned investment professionals Tim Collins and Kim Khan, formerly senior members of TheStreet.com. Tim and Kim share 50 insightful equity trade’s per year for $100. That’s just $2 per trade.

Tim and Kim’s first recommendation, Mobileye, was recently acquired at a 34% premium by Intel. We provide the first two ideas at Stirling Strategic Investor for free. We look forward to providing you uncommon ideas of true value.

Learn more at Stirling.

Comments

Clementia Raises $120M, Stock Climbs: 5 Fast Facts