New York Jets OLB Brandon Copeland exemplifies all the qualities of a leader on and off the field. (Photo by Bryan M. Bennett/Getty Images)

New York Jets outside linebacker Brandon Copeland doesn’t just want his legacy to be imprinted on the field. The Maryland-born star understands that with the responsibility of being a professional athlete comes the lifestyle of a generous salary and plenty of benefits.

We often hear players who struggle with the handling of such lucrative wages, which consequently means the income intended to last for the entirety of one’s playing career might be enough for a few seasons. At the fan level, many also struggle to understand financial literacy, therefore harming their chances of becoming financially independent. Working alongside Capital One, Copeland wants to change that narrative and help individuals of all ages understand how to manage their money.

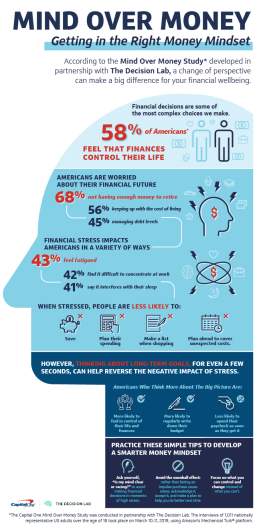

The just released Capital One Mind Over Money Study found that stress results in a negative impact on financial decision making. When individuals incur stress, they are less likely to save, plan their spending, make a list when shopping or plan ahead to cover unexpected expenses.

Heavy recently caught up with the 28-year-old and discussed the importance of financial literacy, his tenure in the league and his offseason plans.

Heavy: Do you recall a personal moment where you felt especially compelled to begin dedicating a portion of your career to teaching financial literacy?

A few moments, actually. Ultimately, is all boils down to growing up in Baltimore and coming from a single-parent family. My mother worked very hard to provide for my younger brother and me. So, it was early on that I decided I wanted to be in a financially secure situation when I get older.

Now many years later, my off-the-field activities include ensuring others understand how to manage their finances. I came up with the idea of teaching my own class when I entered the league and the goal is to create a really relaxed environment without any judgement. Because it’s my alma mater, I personally chose the University of Pennsylvania for the inaugural course. Looking ahead, I’m excited to work with Capital One and explaining their Mind over Money study.

Heavy: In your opinion, do you think it’s a generational concern that in 2020, 77% of people feel anxious about their financial situation?

BC: Honestly, it’s a concern for anyone. To be honest, 77% might still be low considering most participants probably didn’t want to admit to their anxiety. I think we all deal with it at one point. One of the reasons we started the class was to help people make more financial decisions with their money. Stress dictates a lot of these decisions, but it’s all about facing the situation head-on so they don’t allow immediate stress to govern their choices.

Heavy: On the way to becoming more financially stable, what are some self-care tips do you suggest that individuals can do to lessen the stress that debt carries?

BC: At the root of it, it’s really about understanding what money is going in and out on a monthly basis. Another thing that helped me was downloading Capital One app CreditWise. It’s a monthly credit monitoring app that explains your credit score and why it increases and decreases each month. Poor financial decisions can result in a domino or snowball effect, with more consequences to follow. I almost compare it to my workout regimen during the season. Serious dieters can’t afford a cheat meal, otherwise it results in a snowball effect and it can create serious damage in the future.

Heavy: What’s the biggest lesson you learned about managing money and how do you think it coincides with anything you’ve learned about the game of football?

BC: Parallel to money, it’s not allowing stress or what happened in the last play to dictate your actions moving forward. For example, there could be a great day in the stock market or when you saved more than anticipated, but the goal is consistency.

Furthermore, understanding your why and the long-term perspective. We all are doing this for a different reason, between supporting family or saving for a new house. We’ve been programmed to think our why is what we are seeing across social media when in reality the endgame is to be more financially comfortable. In football terms, you don’t celebrate like you’ve won the Super Bowl in Week 1. You have to make sure you keep your why and take the steps along the way to do so.

If you relate to any of those responses and are serious about these changes, you’re in luck. The Study also determined that when you adopt a ‘bigger-picture’ mindset about long-term goals for even a few seconds a day, that leads to healthier financial behaviors, causing you to become better at saving and budgeting and more confident about being able to handle unexpected financial emergencies.