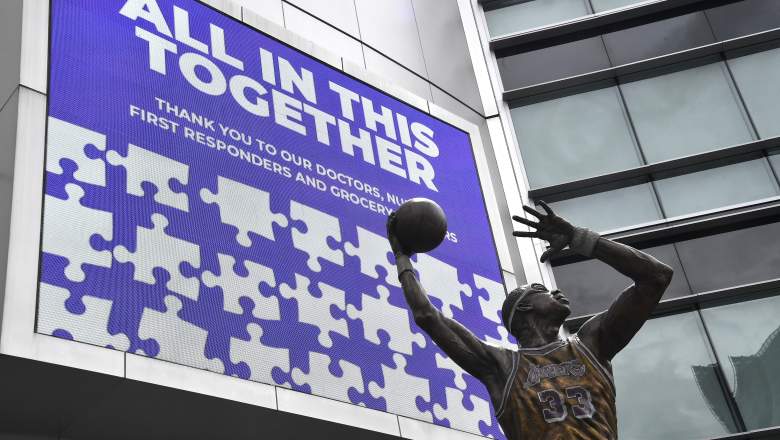

Getty LOS ANGELES, CALIFORNIA - APRIL 08: Live music venue The Staples Center which remains closed In Los Angeles due to restrictive Coronavirus measures on April 08, 2020 in Los Angeles, California. (Photo by Frazer Harrison/Getty Images)

Few teams in all of professional sports can rival the revenue generation that the Lakers can pull off. They’re in the mids, going back to 2011, of what is easily the richest local television deal in the NBA, a 20-year, $4 billion contract, which brings in much more than the team gets from its share of the $2.6 billion annually the NBA gets for its national television contract. Forbes ranked the Lakers No. 2 in NBA valuation, at $4.4 billion.

Odd, to say the least, that the Lakers applied for—and were granted—one of the federal small-business loans that were set up with the intention of helping local mom-and-pop businesses weather the coronavirus storm that has sunk the American economy over the past two months.

On Monday, the team acknowledged that it had received $4.6 million in federal assistance from the Small Business Administration’s Paycheck Protection Program. The team, heading off a public-relations disaster, said it would be returning the loan.

In a statement to CNBC, the team said:

“The Lakers qualified for and received a loan under the Payroll Protection Program. However, once we found out the funds from the program had been depleted, we repaid the loan so that financial support would be directed to those most in need. The Lakers remain completely committed to supporting both our employees and our community.”

The Lakers Qualify as a Small Business

According to the SBA, the program provides, “a loan designed to provide a direct incentive for small businesses to keep their workers on the payroll. SBA will forgive loans if all employees are kept on the payroll for eight weeks and the money is used for payroll, rent, mortgage interest, or utilities.”

The Lakers qualified as a small business because they have fewer than 500 employees and have not laid off employees in the wake of the coronavirus crisis. They apparently forgot to mention that their highest-paid employee, LeBron James, gets $37 million per year and that the team has 20 current and former employees who are slated to get more than $125 million this year.

The SBA’s PPP program was established early in April as part of the CARES Act, the federal legislation that has attempted to prop up the U.S. economy as the coronavirus has caused states to enter crippling lockdowns.

Lakers One of Many to Return Loans

The program has been riddled with problems, though. Genuine small businesses have struggled to get access to PPP loans while large, multimillion-dollar businesses and publicly traded companies have been able to get large chunks. The $350 billion fund set up to dole out loans dried up within weeks of its establishment.

The Lakers are not the only entity to be in the uncomfortable position of needing to return a loan. Steak Shack received and returned a $10 million loan and Ruth’s Chris Steak Houses returned $20 million in loans after getting considerable public pressure. Potbelly sandwich shops returned $10 million.

Auto Nation, the country’s biggest string of car dealerships, returned $77 million in loads even after it insisted it was eligible for them.

READ MORE: Poll Shows L.A. Fans’ Favorite Team & Player (Guess Who?)