Back in December 2017, when its price reached close to US$20,000, Bitcoin looked like it had finally disrupted financial markets with the potential to enter the mainstream. A year later and things looked quite different. Bitcoin is now steadily trading below US$4,000 and has been constantly on a downward ride over the last year, losing more than half of its market capitalisation.

And yet cryptocurrency enthusiasts seem to ignore the fact that Bitcoin could yet enter an even more extreme death spiral. Bitcoin is not the only cryptocurrency whose market capitalisation has been hammered. Sell offs have happened across the board, with the price of major alternative coins such as Ripple and Ethereum falling in the past year.

It is not clear what the catalyst was for these price drops and selling. But what is clear is that cryptocurrency prices struggle to find a floor for a number of reasons. These range from the rising cost of mining, regulatory concerns, market manipulation, speculative trading, sky high power consumption, and the increasing scepticism from both the public and the world’s established financial industry.

1. Rising Cost of Mining

If its price continues to drop and the mining costs do not fall to the same extent, the incentives to update the public ledger and validate transactions can quickly disappear, threatening the very existence of Bitcoin as a viable payment system.

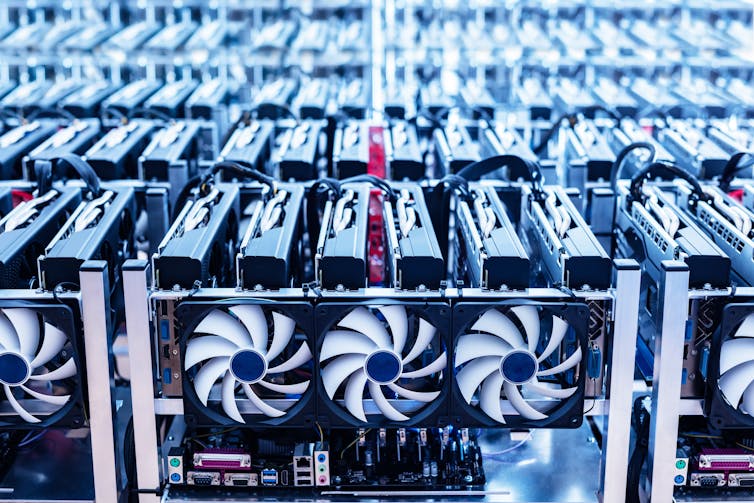

Bitcoin is dependent on a system of miners that verify transactions and record them on a digital ledger called the blockchain. This prevents copies being made of the digital tokens. As a reward for the energy and time involved, miners are rewarded in Bitcoin.

But the amount of work involved in mining keeps increasing (making it more costly), as the mining process was always designed to get more and more difficult, to limit the number of new Bitcoin that get issued. Seeing as mining requires vast amounts of energy, a number of miners have shut down their operations, as Bitcoin’s declining value has made mining less profitable.

Shutterstock

This is worrying for Bitcoin’s viability as there needs to be a minimum number of miners at work to maintain the public blockchain ledger. Without the mining activity, cryptocurrencies are just a set of encrypted numbers with no value. Any rational investor would stand clear of mining if the cost of mining is higher than the future price.

2. Regulatory Concerns

Regulators across the world are beginning to act on cryptocurrencies with diverging views. While countries like Switzerland and Malta are trying to become hubs for cryptocurrency businesses, others like China and the US have cracked down on cryptocurrency markets.

A case in point comes from the US markets regulator, the SEC. It announced in November 2018 that operators of two initial coin offerings (ICOs) must pay fines and restitution as they broke the law by selling unlicensed securities. This hardly comes as a surprise. In fact, it is likely only the beginning of a decisive intrusion of regulatory bodies in the opaque ecosystem of ICOs. Such a development might be enough to spook some investors to abandon cryptocurrencies altogether.

Read more:

Bitcoin’s rollercoaster ride reflects the biggest issue facing cryptocurrencies: regulation

Advocates of cryptocurrencies insist that more institutional investors will get involved in the space thanks to new products such as crypto-specific exchange-traded funds (ETFs). They expect these to take off in the same way that ETFs have become massively popular for conventional investors. But the SEC has not approved any crypto ETFs, and it would be overly optimistic to assume that this will happen in the near future.

3. Market Manipulation

Market manipulation and speculative activity are also important concerns when it comes to the crypto market, which could have been priced into recent performance. My recent research shows how well-informed traders buy cryptocurrencies in bulk, which pushes the price up and gets other buyers to follow suit, until the well-informed traders sell and send the price down, which again everybody follows.

Again, this hardly comes as a surprise. Cryptocurrency markets are incredibly opaque. Anyone paying attention to cryptocurrency trading knows that this kind of pump-and-dump activity and fictitious orders are designed to artificially move prices, exacerbating price swings at the expenses of, perhaps unsophisticated, retail investors.

4. Power Consumption

A third concern behind the constant price drop is the increasing costs of equipment and electricity. Bitcoin mining is incredibly power hungry. And this power demand is becoming so high in regions where mining is concentrated, such as Canada, that authorities are starting to deny supply to mining facilities.

Read more:

Bitcoin’s high energy consumption is a concern – but it may be a price worth paying

Again, this could threat the very survival of any cryptocurrency which is based on mining. This represents the vast majority.

5. Industry Scepticism

Large drops in prices are accompanied by a persistent scepticism around cryptocurrencies. To some extent this is due to the fact that the promise to bypass the mainstream, centralised economic system and enable peer-to-peer payments has been disappointing so far.

Major players in the world of finance, such as Berkshire Hathaway’s Warren Buffett and JP Morgan Chief Executive Jamie Dimon, constantly express their deep scepticism of cryptocurrencies, suggesting Bitcoin and the likes still face an uphill battle for acceptance.

The one upside to all this is that, although cryptocurrencies may have entered a death spiral, the blockchain economy is here to stay. As well as allowing safe peer-to-peer lending and transactions, it is being used to build more efficient supply chains and in the evolution of the internet of things – to name just a few of its applications. This will only grow as it is applied to everything from education to the media.![]()

By Daniele Bianchi, Assistant Professor of Finance, Warwick Business School, University of Warwick

This article is republished from The Conversation under a Creative Commons license. Read the original article.