An email about Amazon CreditBuilder was sent by mistake, Synchrony Bank says.

Synchrony Bank says an email about Amazon Credit Builder accounts was sent to some customers in error as a result of a “glitch.” The emails, which told the customers that a trial deposit had been made into their Amazon Credit Builder accounts, sparked concerns about fraud. Synchrony Bank and Amazon have assured customers that while the email was not supposed to be sent, it did come from the bank and was not a phishing attempt or a hack or a scam, as some believed.

“We are aware of an unplanned customer notification that is affecting some consumers & are investigating the issue. We apologize for any confusion & concerns this may have caused. You do not need to take any further action at this time,” Synchrony said in a Twitter message to customers.

An email from Synchrony Bank about Amazon Credit Builder was sent in error.

Amazon directed customers to contact the bank for more information and said, “Thank you for bringing this to our attention! We’ve been informed the e-mail you’ve received has been sent in error from our business partner, Synchrony Bank. Please disregard the e-mail.”

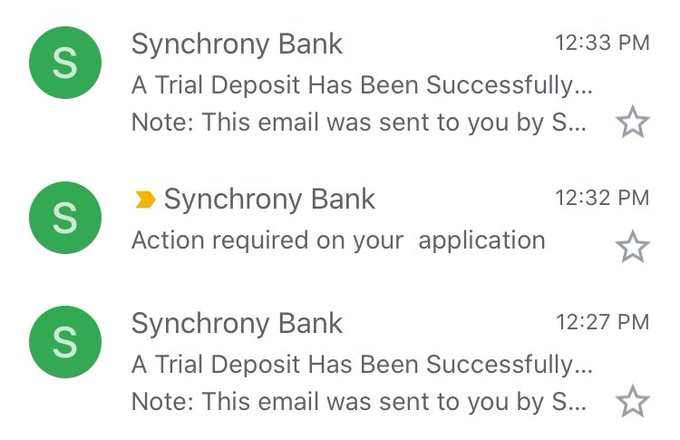

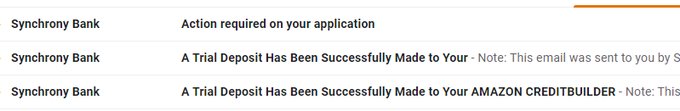

Other users said on Reddit that they received multiple emails from Synchrony Bank, with the first email being about a trial deposit, followed by a second email about the same thing and a third email titled “action is required on my application.”

The First Email Did Not Ask Recipients to Take Any Action

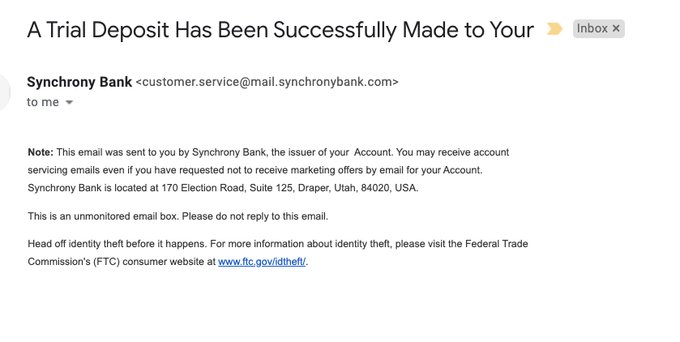

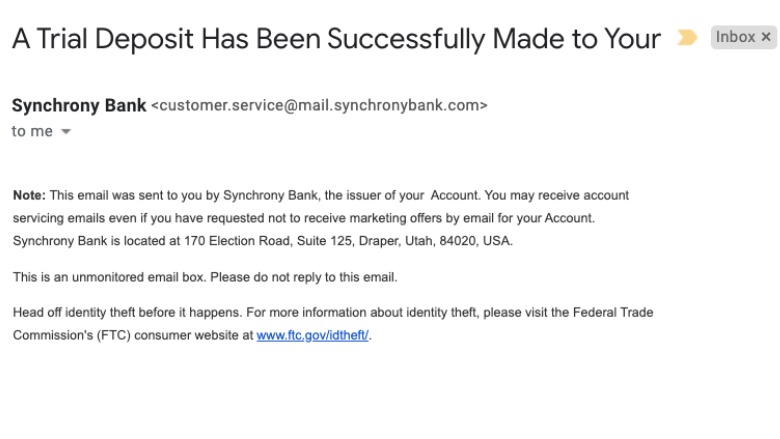

The email sent by Synchrony Bank had the subject, “A Trial Deposit Has Been Successfully Made to Your AMAZON CREDITBUILDER.”

It was received Monday morning, November 25, by users around the United States, according to social media posts.

The email body reads, “Note: This email was sent to you by Synchrony Bank, the issuer of your AMAZON CREDITBUILDER Account. You may receive account servicing emails even if you have requested not to receive marketing offers by email for your AMAZON CREDITBUILDER account. Synchrony Bank is located at 170 Election Road, Suite 125, Draper Utah, 84020, USA.”

It continued, “This is an unmonitored email box. Please do not reply to this email.”

The email also included a message warning about fraud and identity theft. It read, “Head off identity theft before it happens. FOr more information about identity theft, please visit the Federal Trade Commission’s (FTC) consumer website.” The email also included a link to the FTC website, which appears to be legitimate.

The Email Was Sent by a Legitimate Synchrony Bank Email Account

The email was sent from a legitimate Synchrony Bank account, customer.service@mail.synchronybank.com, but it is not clear which customers received the concerning message. It did not appear to be an effort by a bad actor to phish those receiving the email. There were no apparent dangerous links in the email.

Many social media users said they do not have an Amazon Credit Builder account or are not aware of having an account with Synchrony Bank. But others have pointed out that Synchrony Bank issues cards for stores and other businesses, such as Sam’s Club, so customers may not be aware they have a credit card operated by the bank.

Security experts still recommend ignoring the email and not clicking any links inside of it as a precaution.

Synchrony Bank Said ‘the Email Did Not Include Any Customer Data or Personal Information’

In a statement posted to its website, Synchrony Bank said, “Synchrony distributed a notification via email or text message in error to some consumers. The email did not include any customer data or personal information. We are currently investigating the root cause. We apologize for any confusion; you do not need to take any action at this time.”

Amazon said in a statement, “Amazon is aware of a notification that was distributed by Synchrony in error to some customers. They are investigating the root cause. Additional inquiries can be sent to Synchrony.”

Synchrony Bank and Amazon teamed up in June 2019 to launch the Amazon Credit Builder cards, according to Nerd Wallet.

According to the Amazon website:

A secured credit card is designed for people who are looking to build or rebuild their credit and is backed by a refundable security deposit made when the account is opened. The deposit is equal to the credit limit. The Amazon.com Store Card Credit Builder and Amazon Prime Store Card Credit Builder are secured versions of the Amazon.com Store Card and Amazon Prime Store Card respectively. The Amazon Credit Builder functions and looks like the Amazon Store Card, with the exception that the credit line on the Amazon Credit Builder card will equal the amount of the refundable security deposit that you must maintain with Synchrony Bank. Continued and responsible use of the secured Amazon Credit Builder can help you build your credit history.

As an Amazon Credit Builder cardholder, you will enjoy the same benefits as you would on the Amazon Store Card (promotional financing for cardholders without an eligible Prime membership, and promotional financing or 5% back every day for cardholders with an eligible Prime membership). Learn more about upgrading to the unsecured Amazon Store Card.

“Credit Builder enables those on a controlled budget to shop on Amazon.com while building credit with responsible use,” Tom Quindlen, executive vice president and CEO of retail cards at Synchrony Financial, told Nerd Wallet.

Amazon adds, “Synchrony Bank will report to the major credit bureaus whether you make at least the minimum payment due on time every month. Building a history of on-time payments can help build your credit. … Unlike a debit card or a prepaid card, a secured credit card is an actual credit card. You need to make monthly payments on your balance (ideally the full balance, but at least the minimum payment due each month) by the payment due date. Synchrony Bank reports your credit activity to the major credit bureaus-providing the opportunity to build your credit, with responsible use.”

READ NEXT: College Student Strangled to Death in Her Car on Campus