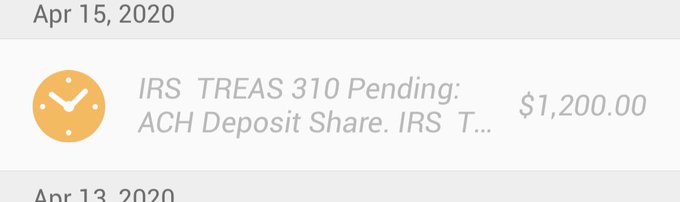

People who are waiting for their much-needed COVID-19 stimulus check are reporting, in many cases, that the checks are arriving in their bank accounts now but are listed as “pending.”

What does this mean? It means the funds should be accessible shortly. According to Politico, people should have access to the money that’s pending by Wednesday, April 15, 2020. First, banks received a Treasury Department transmission; then, the IRS started processing the actual payment on Monday, and finally people will get the actual money “on Wednesday,” Politico reports. The “pending” notation is just part of the banking process between the Treasury Department and your bank. Some payments could clear sooner; in fact, some people say they already have access to their money, as the IRS is sending the payments out in waves, not all at once, due to how many there are.

“We are ahead of schedule on delivering the economic impact payments. … We started processing those last Friday. We expect that over 80 million hard-working Americans will get the direct deposit by this Wednesday,” Treasury Secretary Steven Mnuchin said on April 13.

On Wednesday, if you still haven’t received your payment, you can visit the IRS Economic Impact Payments page and click on “Get My Payment.” You then should be able to get the payment within a couple days. Social Security recipients will get a direct deposit without doing anything. “We are very pleased that that is ahead of schedule,” said Mnuchin.

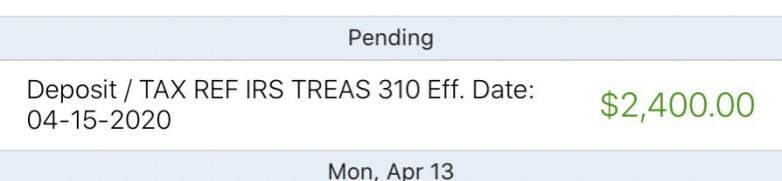

Some people have shared screenshots of the pending stimulus check transaction that also show an April 15 deposit date (when the funds will be accessible to use). The screenshots show the checks landing in those people’s accounts on April 13, meaning a two-day hold period before clearing.

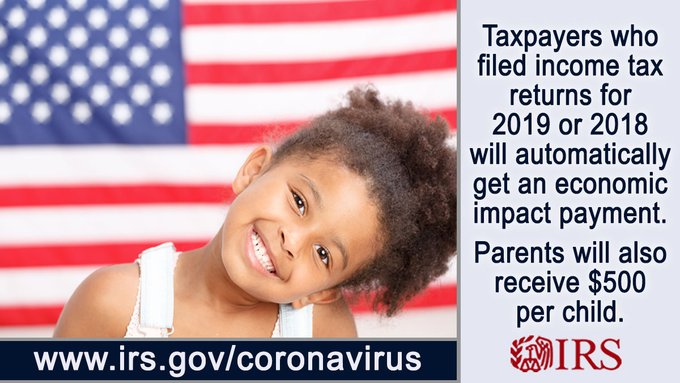

The checks are typically $1,200 for single people but are $2,400 for married people who file jointly and can be more for those with children.

A taxpayer sent this example to Heavy.

As of April 13, some people say they haven’t gotten their stimulus check yet; some people say they have and can already access it; and some people say that it’s in their account but “pending.” The IRS wrote on Twitter that it sent the first batch out on Saturday: “#IRS deposited the first Economic Impact Payments into taxpayers’ bank accounts today. We know many people are anxious to get their payments; we’ll continue issuing them as fast as we can.” Thus, if your check is pending but your friend’s has arrived, it’s probably just because the IRS sent them out at different points.

“I have a couple friends who say theirs are pending and 1 who has it in his account,” wrote one woman on Facebook. “Mine is pending,” wrote another woman in response to a query from Heavy. “The amount shows up but says pending just like my direct deposit when I get my paychecks the day before payday.”

According to GVwire, the Treasury Department “was expected to begin notifying banks of the incoming payments Friday (April 10),” and that takes a few days generally to complete, “meaning the money would finally become available to spend mid-week.” Thus, if it’s listed as pending in your account, it’s a good sign. It should only take a couple days to clear at the most. The hold isn’t going to be a long one.

Politico reported on Thursday, April 9, that people with direct deposit will “get access to the money next week.” If you don’t have direct deposit, it’s a different story. The IRS will mail paper checks starting in early May, but it might be five months before some people receive theirs, according to Politico.

Here’s what you need to know:

People Revealed Their Stimulus Checks Are ‘Pending’ in Reports on Twitter

Many people took to social media to say their stimulus checks were in pending status in their bank accounts.

People posted memes to Twitter indicating their happiness that the stimulus money has (almost) arrived.

Some people were almost in disbelief that the money is real. “It’s not that I didn’t think the stimulus checks were real,” wrote one woman. “But like, mine hit my account today as a pending transaction and I’m already afraid to spend it for some reason? Like, anyone else feel like it’s somehow a trap?”

Note: It’s not. You don’t have to pay it back, and it won’t be taxed.

The IRS is clearly rolling the checks out in phases because not everyone’s seeing them yet.

The memes and jokes flew, even though to many the stimulus checks are a much-needed boost to their bank accounts due to COVID-19 related issues.

Some people thought it was weird that the checks had holds on them at all. “I just wanna know why the stimulus checks are pending in our accounts. Y’all don’t trust the source of funds?” wrote one man on Twitter.

Who Qualifies for a Stimulus Check?

The IRS has provided a detailed breakdown on its website to help you figure out how much money you stand to get. Some people won’t get economic stimulus checks at all, including those who make too much money or who are counted as dependents on other people’s tax returns (such as college students whose parents declare them as dependents).

“The IRS is committed to helping you get your Economic Impact Payment as soon as possible,” the IRS explains. “The payments, also referred to by some as stimulus payments, are automatic for most taxpayers. No further action is needed by taxpayers who filed tax returns in 2018 and 2019 and most seniors and retirees.”

Who is eligible? Here are the IRS guidelines:

U.S. residents will receive the Economic Impact Payment of $1,200 for individual or head of household filers, and $2,400 for married filing jointly if they are not a dependent of another taxpayer and have a work eligible Social Security number with adjusted gross income up to:

$75,000 for individuals

$112,500 for head of household filers and

$150,000 for married couples filing joint returnsTaxpayers will receive a reduced payment if their AGI is between:

$75,000 and $99,000 if their filing status was single or married filing separately

112,500 and $136,500 for head of household

$150,000 and $198,000 if their filing status was married filing jointlyThe amount of the reduced payment will be based upon the taxpayers specific adjusted gross income.

Eligible retirees and recipients of Social Security, Railroad Retirement, disability or veterans’ benefits as well as taxpayers who do not make enough money to normally have to file a tax return will receive a payment. This also includes those who have no income, as well as those whose income comes entirely from certain benefit programs, such as Supplemental Security Income benefits.

Retirees who receive either Social Security retirement or Railroad Retirement benefits will also receive payments automatically.

Who likely won’t get a check? People whose adjusted gross income is greater than:

$99,000 if your filing status was single or married filing separately

$136,500 for head of household

$198,000 if your filing status was married filing jointly

Dependents, people without valid Social Security numbers, and “nonresident aliens” don’t qualify, the IRS says.

Find the IRS page on stimulus check eligibility here.

READ NEXT: Can You Get Coronavirus From Money?