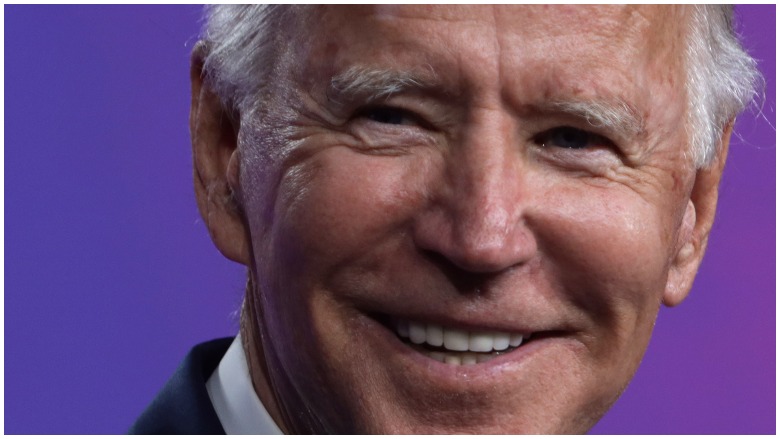

The tax plan from 2020 presidential candidate Joe Biden has been attacked at both the first presidential debate and the vice-presidential debates, during political advertisements and by surrogates from Biden’s opponent, President Trump.

During the first presidential debate, Trump said that Biden’s plan would hurt business growth and has continued to say Biden will raise everyone’s taxes.

Here is what Biden said about his tax plan during the first presidential debate: “I’m going to eliminate a significant number of the taxes. I’m going to make the corporate tax 28%. It shouldn’t be 21%. You have 91 companies federal, I mean, the fortune 500, who don’t pay a single penny in tax making billions of dollars.”

There have also been political ads accusing Biden of wanting to raise taxes on the middle class and misinformation circulating on social media about Biden’s tax plan, such as one post claiming that Biden would more than double the tax rate on a family making $75,000 a year.

Here’s the truth about the Biden plan.

Biden’s Tax Plan Hit the Wealthy & Corporations the Hardest

The Pew Research Center defines the middle class as “adults whose annual household income is two-thirds to double the national median, about $42,000 to $126,000 annually in 2014 dollars for a household of three.” Investopedia noted that a cost-of-living adjusted look at the middle income of all U.S. states in 2016 showed that median income ranges from $75,000 to $85,000, with no state’s middle income topping $100,000.

Based on those metrics, Biden’s plan would definitely not raise taxes on middle-class Americans, which he also states on his website. “While Trump and his allies have sought to mislead, deceive, and flat-out lie by suggesting Biden will raise taxes on ordinary Americans, fact-checkers have called this desperate line of attack what it is — false,” the website reads.

According to the plan on Biden’s website, he would:

- Raise the corporate tax from its current 21% to 28%

- Impose a 21% tax on the foreign earnings of U.S. companies located overseas

- Levy a tax penalty on corporations that relocate jobs overseas for products sold to Americans

- Apply a 15% minimum tax on corporations’ “book income” (income before taxes are assessed)

- Make the top individual income tax rate from its current 37% to 39.6%

- Require earners of more than $1 million to pay the same tax rate for investment that they pay for wages

- Expand the Child Tax Credit to $3,000 for children between the ages of six and 17 and $3,600 for children under six

- Raise the amount in tax credits people could receive for child care to $8,000

- Offer a tax credit of up to $15,000 for families buying their first home

Biden’s Tax Plan Could Conceivably Raise $4 Trillion

The Committee for a Responsible Federal Budget (CRFB) reported that Biden’s plan would create revenue of “$3.35 trillion and $3.67 trillion over a decade if enacted in full starting in 2021.”

The CRFB also said that Biden’s plan could more than pay for itself with a balance of tax credits that could cost around $400 billion and increased taxes and fees on corporations, banks and high earners that would raise $3.4 to $4.1 trillion. Here was their analysis:

Major proposals by the Biden campaign would raise $1.6 to $1.9 trillion over a decade from corporations, $1.0 to $1.2 trillion from high earners through the income tax, and $800 billion to $1 trillion from Social Security payroll taxes on high-wage earners. Biden also supports a fee on banks, which we believe will raise $100 billion, tax credits for renters and first-time homebuyers that we estimate will cost $300 billion, and an increase of the Child and Dependent Care Tax Credit, which we estimate will cost $100 billion.

Some Critics Have Said Biden’s Tax Plan Could Hurt Businesses & the Self-Employed

The Philadelphia Inquirer noted that Biden’s plan would create a doughnut hole of nontaxable wages for Social Security payroll taxes, which are paid by a person’s employer and their employee. Currently, the rate is 12.4% and applies to earnings up to $137,700. Under Biden’s plan, earners between $137,700 and $400,000 would be exempt from that 12.4%, while earnings above $400,000 would not.

However, some editorials have questioned whether his plan could damage the self-employed.

Jared Dillian wrote a Bloomberg Opinion piece in which he said that “Taxing Social Security earnings above $400,000 won’t hit the top 0.1%–the people we like to think of the plutocracy–but it will hit the top 2%.”

Dillian’s biggest criticism was reserved for how the social security payroll tax, which is paid by both employers and employees, could affect those who are self-employed. “Making the Social Security tax progressive, thereby increasing marginal rates into the 50% range for self-employed people, who would pay both sides of the tax, would be a huge disincentive to entrepreneurship,” he wrote. “If Biden’s plan passes, our marginal income tax rates would become grotesque, with a hypothetical couple paying 24% in taxes on incomes up to $320,000, rising to 51% on $408,000 in income if that couple is self-employed.”

Another editorial questioned whether the proposal could pay for itself.

“Biden’s plan — coupled with the Trump administration piling up massive debt — invites the question of whether our pandemic-shrunken economy can afford much more federal borrowing,” Marc Joffe wrote in an opinion piece for The Hill. Joffe noted that the high-end estimates of how much Biden’s spending plans for health care, climate change, infrastructure and education could add $2 trillion to the deficit over the next 10 years.

According to the CRFB, Biden’s plan would likely “moderately slow the pace of economic growth,” which could mean less revenue over time; they estimate revenue could be reduced by $2 to $6 billion because of that slowed growth.

READ NEXT: Fact Check: Is Donald Trump More Than $400 Million in Debt?