Getty

Presidential candidate Bernie Sanders has finally released his long-awaited 10 years of tax returns. You can read the full tax returns in the story below. The tax returns are from 2009 to 2018.

He has previously released his 2014 tax return and published it on his website, which included a full list of itemized deductions. But many have been clamoring for more returns. Sanders said that his newer returns will show that he is a millionaire thanks to book sales. He makes $174,000 a year as a senator, but his book royalties were far greater than that. According to his Senate financial disclosure, he received $1.7 million in book royalties in 2016 and 2017, including $1.3 million in advances from the publisher MacMillian, Burlington Free Press shared. His books have been on bestseller lists. His Senate disclosure form also showed royalty payments from “We Shall Overcome,” a folk album that included Sanders on their cassette tape. These royalties were more modest, at $539.47 in 2017 and $2,520.60 in 2016. He also gets a $5,000 a year pension payment from being mayor for eight years in Burlington. His wife Jane Sanders also has a number of mutual funds as assets. Sanders has said that as far as his speaking fees go, he donates those to charity. Burlington Free Press shared that in 2016, he donated all $4,050 from five appearances to charity.

Here are all 10 years worth of returns, which you can view below:

2009 Return:

2010 Return:

2011 Return:

2012 Return:

2013 Return:

2014 Return:

2015 Return:

2016 Return:

2017 Return:

2018 Return:

Here’s a closer review of his 2014 tax return so you can compare it to his more recent tax returns.

The 2014 tax return shows his salary and an itemized list of deductions and income. We’re providing a few screenshots to help you decipher the return, but you can view the full tax return above. It’s relatively straightforward, since Sanders had a fairly low income at the time as compared to other candidates. Today, Sanders has said that his tax return will be a little different because he’s now a millionaire thanks to money earned from writing his book.

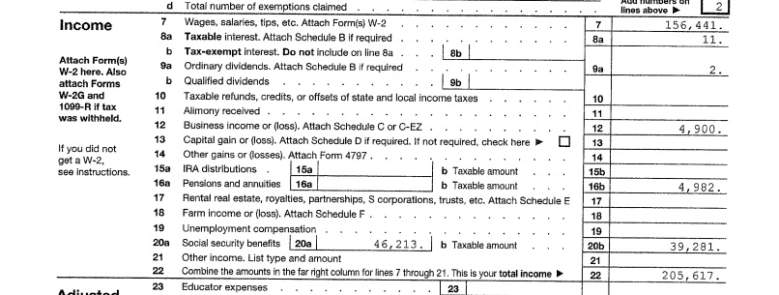

We’ve provided two screenshots from the 2014 tax return below. For example, in the photo below you can see his income was $156,441 in wages in 2014, plus $39,281 in Social Security benefits and $4,982 in pensions. They also had a business income of $4,900.

Bernie Sanders tax return (BernieSanders.com)

Among the deductions on his 2014 return were:

-

- $22,946 on home mortgage interest

- $14,843 on real estate taxes

- $9,666 on state and local income taxes

- $8,000 in gifts to charity

- $350 in gifts to charity other than by cash or check

- $4,473 in unreimbursed job expenses, which according to tax law can include fees such as union dues and travel

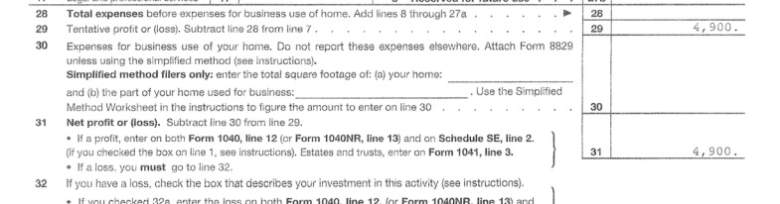

Jane Sanders, his wife, also brought in an additional income of $4,900. As you can see in the screenshot below from the tax return, they did not claim any expenses from her business:

Bernie and Jane Sanders claimed no expenses from Jane’s business. (BernieSanders.com)