If you missed the IRS direct deposit deadline on May 13, you will not be able to submit your banking information on the Get My Payment portal, but that doesn’t mean you won’t receive your stimulus check.

If you weren’t able to set up direct deposit with the IRS by the May 13 deadline, you’ll receive your stimulus payment by mail, if you’re eligible.

Here’s what you need to know:

Can You Still Update Your Address & Track Your Check Now That the IRS Direct Deposit Deadline Has Passed?

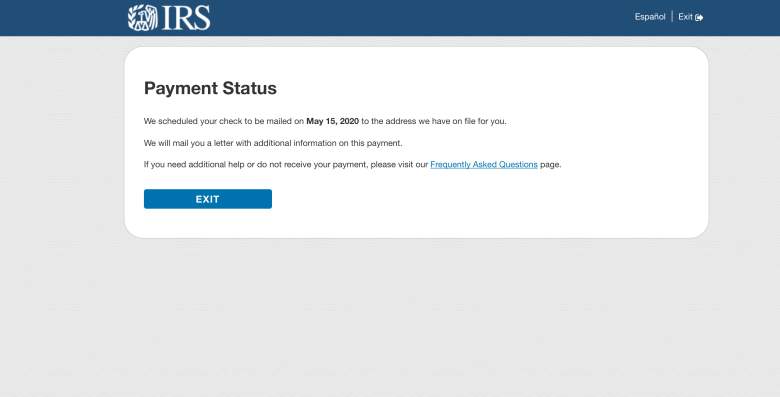

IRSThis is what you might see if you log onto the Get My Payment portal.

Even though the deadline for updating direct deposit information with the IRS has passed, the Get My Payment portal is still open. If you log into it, you should find information on when your payment is scheduled to be mailed. This message will look similar to the image above.

If you need to change your address, the easiest way is to file your latest tax return, if you haven’t done so already. There’s more info below on different ways you can update your mailing address with the IRS.

The IRS has closed the direct deposit portal so it can shift focus to processing paper checks for people who don’t have direct deposit set up.

According to the IRS’ news release announcing the deadline, over 130 million Americans have already received their stimulus payments through direct deposit. IRS Commissioner Chuck Rettig said the bureau was “working hard” to get through millions of payments on a faster timeline than expected and that people should expect to receive their mailed payments by late May or into June.

The payment portal for non-filers is still open. For people who aren’t required to file a federal tax return, you are still able to update your direct deposit information with the IRS through the Non-Filers: Enter Payment Info Here tool.

How to Check or Edit the Address You Have on File With the IRS

It’s easy to update your information with the IRS. Simply visit the IRS’ page for updating information and choose which of the following methods you want to use to update your address:

Fill Out an IRS Form

There are two forms you can fill out with the IRS to change your address: Form 8822, Change of Address or Form 8822-B, Change of Address or Responsible Party – Business.

File an Updated Tax Return

If you have already filed your 2019 tax return with your new address, the IRS will process that address as your current one.

Submit a Written Statement

Send the IRS a signed written statement that includes your full name, old address, new address and Social Security number, ITIN or EIN. Mail this signed statement to the address where you filed your last return.

Provide ‘Oral Notification’ by Phone

The last option is to speak with an IRS representative over the phone. You’ll need to provide the following information to ensure your identity in order to change your address:

- full name

- new address

- old address

- date of birth

- social security number, ITIN or EIN

However, thanks to the impacts of the coronavirus pandemic, the IRS website indicates “IRS live phone assistance is not available at this time.”

READ NEXT: Coronavirus Stimulus Check Second Round: When Will the Next Round of Payments Be, if at All?