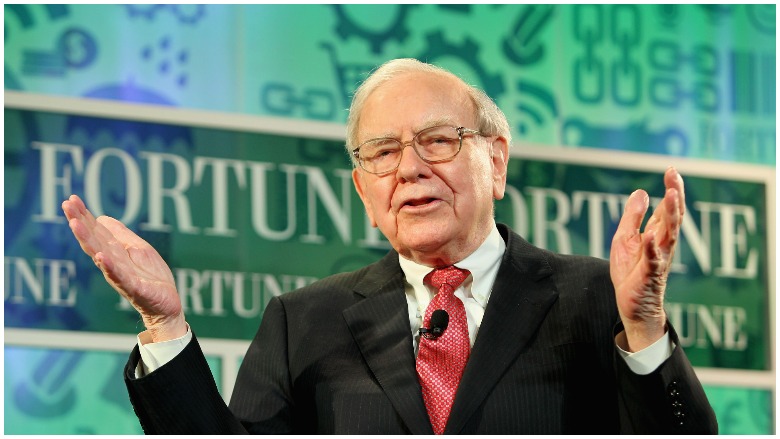

Warren Buffett, the 89-year-old “Oracle of Omaha,” has expressed optimism about the U.S. economy at the first-ever online-only annual Berkshire-Hathaway meeting, which was exclusively live-streamed by Yahoo Finance.

Buffett is president and CEO of Berkshire-Hathaway, which owns many companies, such as Geico and Dairy Queen and also owns stakes in companies such as Apple and Coca-Cola. Like many investment portfolios, it has dipped due to the economy‘s response to coronavirus, many industries’ inability to produce revenue and general stock market volatility.

In 2018, his net worth was upwards of $80 billion and as a very prominent value investor, his annual meeting usually attracts large crowds. However, Buffett spoke on the live-stream from Omaha in an empty room that would normally be packed with thousands of investors.

Fun stats from @WarrenBuffett about attendance at #BRK2019 meeting so far. 16,200 people showed up at exhibit yesterday, several thousand more than last year and new record. And Berkshire-owned Nebraska Furniture Mart did $9.3 million in sales at special shareholder promotion.

— Paul R. La Monica (@LaMonicaBuzz) May 4, 2019

Buffett also held the meeting without his business partner of 60 years and the company’s vice chairman, Charlie Munger, by his side, stating, “The 96-year-old is in fine shape … but it just didn’t seem like a good idea to make him take the trip to Omaha for this.

Buffett Reports Big Losses in the First Quarter

GettyBuffett at last year’s 2019 annual Berkshire-Hathaway shareholders meeting.

Buffett said,”…I was convinced of this in World War II, I was convinced of it during the Cuban Missile Crisis, 9/11, the Financial Crisis — that nothing can basically stop America,” according to reporting from CNBC.

Yahoo Finance also reported his words’ optimistic tone: “We haven’t faced this exact problem, we haven’t faced anything that quite resembles this problem. But we faced tougher problems, and the American miracle, the American magic has always prevailed and it will do so again.”

However, his comments come after the company’s earnings statement shows losses of $49.7 billion during the first quarter, due to fallout in the airline and financial industries. In comparison, the New York Times reported that the investment gain in 2019 was $56.3 billion.

Shares of the Berkshire-Hathaway (BRKA) have fallen 20% this year.

Airline and Banking Markets Played Role in Losses

GettyUnited Airlines seen significant losses on the stock market.

Berkshire-Hathaway owns large shares in Delta Airlines, Southwest Airlines, United Airlines and American Airlines, all of which have been hit hard by the coronavirus pandemic’s effect on the economy and travel in particular.

United Airlines says coronavirus pandemic is worst crisis ‘in the history of aviation’ https://t.co/HgmQlvlvUc

— MarketWatch (@MarketWatch) April 30, 2020

Delta’s stock has lost half of its value per share since the start of the year, dropping from $59.04 per share to $24.12 per share to date. Likewise, shares of Southwest Airlines have dropped $25.16 since the beginning of the year. In response, Berkshire-Hathaway sold millions of shares of Delta and Southwest in early April, but still owned around more than 50 million shares of each, according to Investopedia until recently, when he announced that he sold all of his shares in the airline market, as CNBC reported.

“The world has changed for airlines,” he said. “When we sell something, very often it’s going to be our entire stake: We don’t trim positions.”

According to the Berkshire-Hathaway website, the conglomerate also owns large shares of Bank of America and American Express, both of which have experienced turmoil since the year started. Bank of America has lost $45.72 per share since the start of the year and during that same time period, the American Express share price fell from $29.09 to $10.64.

The conglomerate also owns Duracell, MedPro Group, Fruit of the Loom and Pampered Chef and owns large shares of Kraft Heinz, Apple, Phillips 66 and Charter Communications.

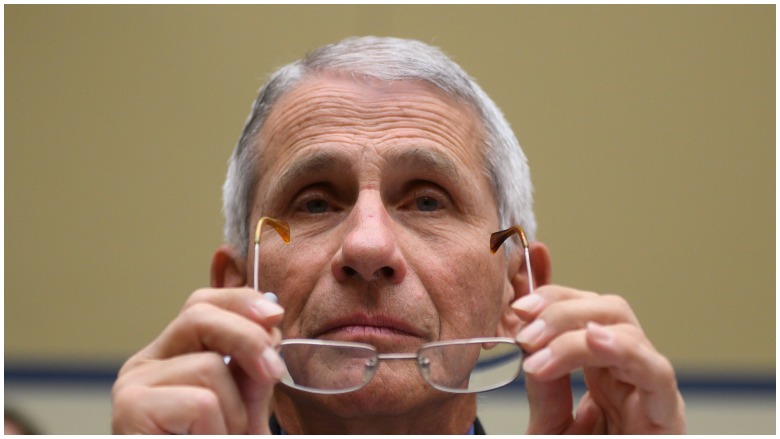

Buffett Thanked Dr. Anthony Fauci

GettyAnthony Fauci

Dr. Anthony Fauci, the White House health advisor tasked with addressing the nation’s coronavirus pandemic was mentioned on the live stream when Buffett said he felt a “huge debt of gratitude” for his “very straightforward manner” in advising the public on the pandemic.

“I feel extraordinary good to be able to hear from Dr. Fauci,” he said, commending Fauci’s stamina for being able to work “seemingly 24 hours a day” at his age.

During the live-stream, Buffett said he’s learning about the health implications along with the rest of the country.

“In school, I did ok in accounting, but I was a disaster in biology,” he admitted. “I’m not going to talk about any political figures this afternoon, but I do feel I owe a huge debt of gratitude to Dr. Fauci for helping on educating and informing me.”

However, he recalled his parents’ experience of going through the 1918 flu pandemic in Omaha.

“My dad and four siblings and his parents went through it,” he said. “And during that particular time, in maybe four months or so, Omaha had 974, I believe, deaths.”

Buffett Has Cash to Spend

Warren Buffett

BREAKING: Warren Buffett’s cash pile swelled to a record $137 billion, as Berkshire Hathaway spent most of the market turmoil on the sidelines https://t.co/gjeLPizCSz

— Bloomberg (@business) May 2, 2020

It’s not the first time the company has suffered losses.

The company reported a loss of $25 billion during the fourth quarter of 2018. The losses were primarily attributed to Kraft-Heinz, which had questionable operations and was put under investigation by the Securities and Exchange Commission, according to CNN.

However, Buffett typically keeps a large sum of cash to help mitigate such losses.

At the end of the quarter, he held $137.3 billion in cash, although he has been less vocal about using it during this down market compared to the financial crisis of 2008, the New York Times reported.

During the live-stream, Buffett touched on the uniqueness of the moment.

“The range of possibilities on the economic side are still extraordinarily wide,” he said. “We do not know what happens when you voluntarily shut down a substantial portion of your society.”

“I don’t think there is any parallel on the most important country in the world … in effect, sidelining its economy and its workforce. This is quite an experiment. It still has this enormous range of possibilities.”