Even though millions of Americans have received the first government COVID-19 stimulus check, others are still waiting for theirs. If that’s you or someone you know, we understand how frustrating it can be as many people badly need the money.

There could be many reasons you didn’t get your first stimulus check (the second round of stimulus checks is still uncertain; those passed the Democratic House but still need approval in the Republican Senate, where it’s considered unlikely to pass.)

As for the first stimulus check, the IRS started sending out the checks in phases, not all at once, beginning on April 10.

The deadline to seek IRS direct deposit deadline passed on May 13, so you will not be able to submit your banking information on the Get My Payment portal. That just means it will take longer as you’re likely getting a paper check, presuming you meet qualification requirements.

Here’s what to do if you didn’t get your stimulus check:

Call the IRS

GettyThe IRS has launched a phone hotline where you can receive updates on your stimulus check.

You can now call the IRS hotline at 1-800-919-9835 to get updates on your stimulus check payment. On May 18, the IRS announced it was adding 3,500 telephone representatives to answer your questions about the checks.

That’s a change from previously, when the IRS was not accepting phone calls about economic stimulus checks. Instead, the IRS was directing you to its website, Get My Payment.

The IRS has attempted to answer most common questions about the stimulus checks on its website. See those questions and answers here. They deal with everything from eligibility to how to calculate your payment.

Wait – You Might Be Getting a Paper Check

GettyCovid-19 stimulus checks haven’t arrived for all.

We know that might not be the answer you’re seeking. But you may just have to wait. It’s possible that, for multiple reasons, the IRS might be mailing you a check instead of using direct deposit. If you’ve fallen into that category, it could take several months to receive your check. Paper checks didn’t even start going out until late April, according to The Chicago Tribune. In addition, the IRS is sending checks to those with lowest income first. It’s also possible you didn’t provide the IRS with the basic information the agency needs to send your check.

As of May 6, the IRS had already sent out 130 million stimulus checks but was still expected to send out millions more, The Associated Press reports.

If you filed your 2019 tax returns late, the IRS might still be processing it, which is simply delaying your check, according to Money. If you didn’t file a 2019 return, the IRS is using 2018.

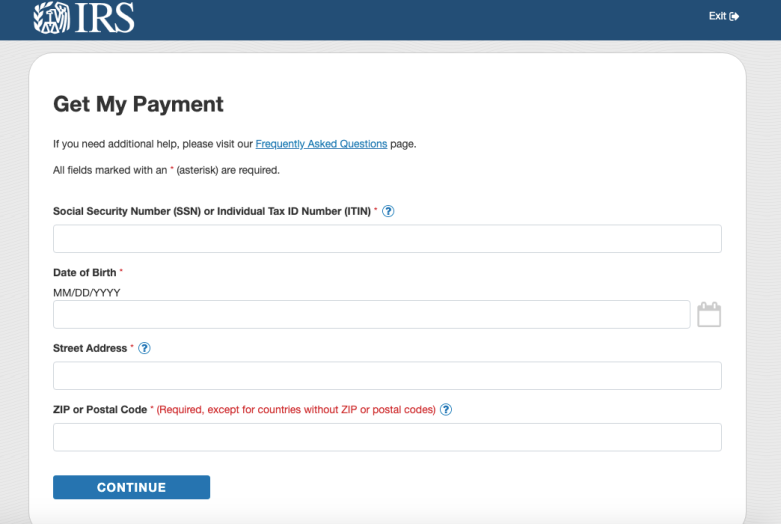

Check Your Payment Status Through the IRS Portal

IRSHere’s what the application for the IRS Get My Payment portal looks like.

You can check your payment status through the IRS portal here. If that portal tells you “payment status not available,” the IRS says there are multiple possible reasons:

You are required to file a tax return, but:

We haven’t finished processing your 2019 return

The application doesn’t yet have your data; we’re working on adding more data to allow more people to use it.You don’t usually file a return, and:

You used Non-Filers: Enter Payment Info Here but we haven’t processed your entry yet

You receive SSI or VA benefits; information has not been loaded onto our systems yet for people who don’t normally file a tax return.You’re not eligible for a payment.

Check Whether You Have Inactive Bank Account

Getty

If the IRS tried to send your check to an old bank account, and it was rejected, you’re getting a paper check, which will take longer to receive.

“If the account is closed or no longer active, the bank will reject the deposit and you will be issued a check that will be mailed to the address we have on file for you,” the IRS says. “This is generally the address on your most recent tax return or as updated through the United States Postal Service (USPS). You do not need to call the IRS to change your Payment method or update your address at this time.”

The IRS adds: “As required by law and for security reasons, a letter about the Payment will be mailed to each recipient’s last known address within 15 days after the Payment is made. The letter will provide information on how the Payment was made and how to report any failure to receive the Payment.”

If you don’t have a bank account at all, you’re getting a paper check, which takes longer. “We will mail your Payment to the address we have on file for you. This is generally the address on your most recent tax return or as updated through the United States Postal Service (USPS),” the IRS says.

Check With Your Tax Preparing Service, if You Have One

GettySome H&R Block and TurboTax customers reported not receiving their stimulus checks.

Some people who used TurboTax or H&R Block reported that they haven’t received their checks. The IRS explains:

When you filed your tax return, if you chose a refund settlement product for direct deposit purposes, you may have received a prepaid debit card. In some cases, your Economic Impact Payment may have been directed to the bank account associated with the refund settlement product or prepaid debit card. If the refund settlement product or the associated account is closed or no longer active, the bank is required to reject the deposit and return it to the IRS.

In that case, the IRS will process the returned payment and will automatically mail the check “to the address on the 2019 or 2018 tax return, or the address on file with the U.S. Postal Service.” Mailed checks can take longer to receive.

Make Sure You’re Not a Dependent on Someone Else’s Tax Returns

GettyDo college students who are adult dependents get stimulus checks? No.

If you are a dependent on someone else’s tax returns (like a parent’s), you don’t qualify for a stimulus check, according to the IRS. A lot of college students have fallen into this category.

Make Sure You’re Not Over the Income Limits & That You Meet Other Qualifications

Getty(L-R) Treasury Secretary Steven Mnuchin, Senate Majority Leader Mitch McConnell (R-KY), House Minority Leader Kevin McCarthy (R-CA), Vice President Mike Pence and Rep. Kevin Brady (R-TX) applaud U.S. President Donald Trump during a bill signing ceremony for H.R. 748, the CARES Act in the Oval Office of the White House on March 27, 2020 in Washington, DC.

It might be possible that you simply didn’t qualify for a stimulus check. You have to fall under certain income limits to qualify for a COVID-19 stimulus check. Here are those limits, according to the IRS:

U.S. citizens and U.S. resident aliens will receive the Economic Impact Payment of $1,200 for individual or head of household filers, and $2,400 for married filing jointly if they are not a dependent of another taxpayer and have a work eligible Social Security number with adjusted gross income up to:

$75,000 for individuals if their filing status was single or married filing separately

$112,500 for head of household filers and

$150,000 for married couples filing joint returnsTaxpayers will receive a reduced payment if their AGI is between:

$75,000 and $99,000 if their filing status was single or married filing separately

112,500 and $136,500 for head of household

$150,000 and $198,000 if their filing status was married filing jointlyThe amount of the reduced payment will be based upon the taxpayers specific adjusted gross income.

The IRS says you need a work-eligible social security number to get a check. According to the IRS, if you’re “a nonresident alien” under the law, then you don’t qualify for a check.

Make Sure You Gave the IRS Your Basic Information

Getty

Not everyone needs to file a tax return to get a stimulus check, but some people do. You can find out if you need to file a tax return here.

Some categories of people don’t need to file tax returns to get their checks. The IRS says:

You are not required to file a tax return and will automatically receive a $1,200 Payment if you received Social Security retirement, SSDI, survivors benefits, SSI, Railroad Retirement benefits, or VA Compensation and Pension (C&P) benefits in 2019. You do not need to contact the IRS, Social Security Administration (SSA), the Railroad Retirement Board (RRB) or Veterans Affairs. The IRS will use the information from your 2019 benefits to generate a Payment to you if you did not file tax returns in 2018 or 2019. You will receive your Payment as a direct deposit or by mail, just as you would normally receive your federal benefits.

But what if you aren’t one of the people above and you didn’t file a federal tax return for 2018 or 2019? “You have to provide basic information to the IRS to receive your Payment. The IRS urges you to take one of the following actions as soon as you can,” the IRS says of those people.

You can use the non-filers payment tool to enter information the IRS needs here. If the IRS doesn’t get your information, you won’t get a check.

Some people have run into glitches on this site. If the IRS rejects your information, make sure you’ve spelled it exactly as it appears on your tax return. Spell out avenue instead of ave. (and things like that) and watch for abbreviations, spelling, and punctuation differences. One hack that works for some people: Type your information in all caps. You could also try eliminating all punctuation. Try your 2018 information if 2019 doesn’t work.

READ NEXT: Is a Sore Throat an Early Symptom of Coronavirus?