Congress has approved a new COVID-19 relief agreement which will include extended business loans through the Paycheck Protection Program (PPP.) Here’s exactly what House Speaker Nancy Pelosi and Senate Majority Leader Mitch McConnell have said so far about the new plan.

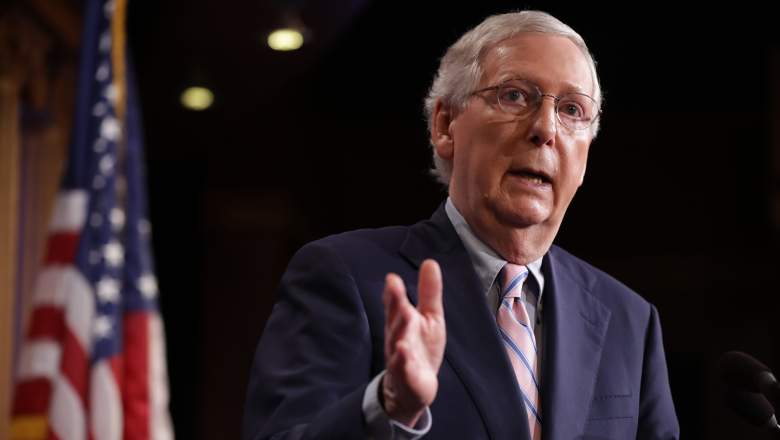

McConnell Said PPP Will Help the Hardest-Hit Small Businesses

In a statement about the new COVID-19 agreement, which quoted what he said on the Senate floor, McConnell said:

There will be another major rescue package for the American people. As our citizens continue battling the coronavirus this holiday season, they will not be fighting alone. We’ve agreed to a package of nearly $900 billion. It is packed with targeted policies to help struggling Americans who have already waited too long. For workers at the hardest-hit small businesses, there will be a targeted second draw of the Paycheck Protection Program. We have not worked so hard to save as many jobs as possible, all these months, only to fumble the ball with vaccinations already underway.

In a second statement released on December 21, McConnell added: “It would be insanity for us to have saved these jobs all this time only to drop the ball with the end in sight. So this bill will send more than $280 billion to re-open the PPP for a targeted second round. And we made sure churches and faith-based organizations will stay eligible.”

McConnell went on to say that he believed this agreement could have been reached earlier.

Pelosi Said in a Statement That This New Bill Will ‘Help Small Businesses … Recover’

In a joint statement with Senate Democratic Leader Chuck Schumer, Pelosi said about PPP:

Democrats secured critical funding and policy changes to help small businesses, including minority-owned businesses, and nonprofits recover from the pandemic. The agreement includes over $284 billion for first and second forgivable PPP loans, expanded PPP eligibility for nonprofits and local newspapers, TV and radio broadcasters, key modifications to PPP to serve the smallest businesses and struggling non-profits and better assist independent restaurants, and includes $15 billion in dedicated funding for live venues, independent movie theaters, and cultural institutions. The agreement also includes $20 billion for targeted EIDL Grants which are critical to many smaller businesses on Main Street.

So in summary, $284 billion has been earmarked for small businesses, with PPP eligibility expanded from what it was in the first round.

The new bill will only provide short-term relief, Politico reported, covering up to three-and-a-half months of payroll costs. But a Census Bureau survey reported that many employers think it will take at least six months to get back to normal operations.

Senate Minority Leader Chuck Schumer said that this will not be enough for a small business owner scared about losing their business.

The first Paycheck Protection Program closed on August 8, 2020, and it included SBA forgiveness if certain qualifications were met. It had $525 billion, which is more than the current program is providing, but many businesses that needed funds were not able to qualify, Politico reported.