It may have been a dream for both Michael Avenatti and Patrick Dempsey, aka ‘McDreamy,’ both race car drivers and aficionados, to own a coffee restaurant in Washington State, home of Starbucks. But it soon became a bad dream for Dempsey and now, apparently, for Avenatti who was arrested and charged with bank and wire fraud Monday, according to the U.S. Attorney’s Office, Central District of California.

Avenatti, 48, is alleged to have “embezzled a client’s money in order to pay his own expenses and debts” — as well as those of his coffee business, Tully’s coffee under his company Global Baristas — and also “defrauded a bank by using phony tax returns to obtain millions of dollars in loans.”

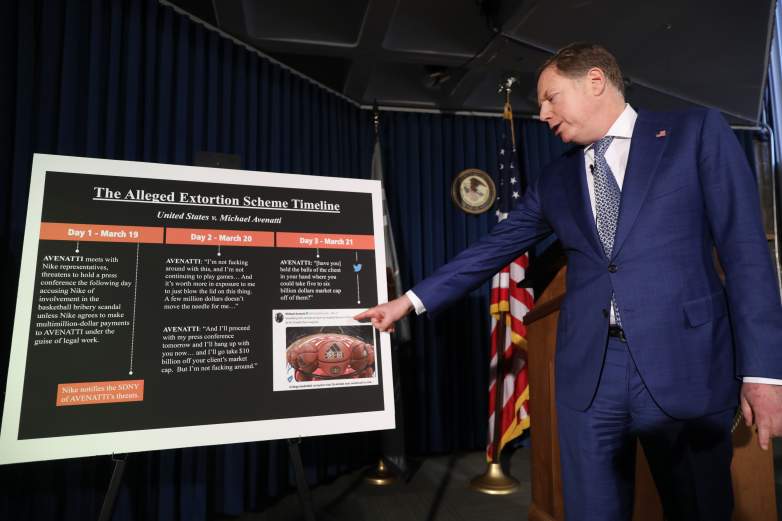

The two-count felony complaint charges him with wire fraud and bank fraud. But the high-profile lawyer who represents adult actor Stormy Daniels and Supreme Court Justice Brett Kavanaugh accuser Julie Swetnick, was also arrested and charged Monday in New York on a separate federal case that alleges he tried to extort Nike.

Read the full complaint here:

The announcement of his arrest was made just minutes after Avenatti posted this tweet:

But the first compliant has to do with his alleged fraud that, in part, paid off debts owed by his coffee business, Global Baristas US LLC, which operated Tully’s Coffee cafe’s in California and Washington state.

According to an affidavit filed with the criminal complaint in this case, Avenatti, recently divorced, negotiated a settlement which called for $1.6 million in settlement money to be paid on January 10, 2018, but then gave the client a bogus settlement agreement with a false payment date of March 10, 2018. The affidavit states that Avenatti misappropriated his client’s settlement money and used it to pay expenses for his coffee business, as well as for his own expenses.

“When the fake March 2018 deadline passed and the client asked where the money was, Avenatti continued to conceal that the payment had already been received,” the Department of Justice wrote in a press release.

Avenatti also allegedly defrauded a bank in Mississippi by submitting to the lender false tax returns in order to obtain three loans totaling $4.1 million for his law firm and coffee business in 2014. According to the affidavit, Avenatti obtained the loans by submitting fabricated individual income tax returns (Forms 1040) for 2011, 2012, and 2013, reporting substantial income even though he had never filed any such returns with the Internal Revenue Service. The phony returns stated that he earned $4,562,881 in adjusted gross income in 2011, $5,423,099 in 2012, and $4,082,803 in 2013, according to the affidavit. Avenatti allegedly also claimed he paid $1.6 million in estimated tax payments to the IRS in 2012 and paid $1.25 million in 2013.

“In reality, Avenatti never filed personal income tax returns for 2011, 2012 and 2013 and did not make any estimated tax payments in 2012 and 2013. Instead of the millions of dollars he claimed to have paid in taxes, Avenatti still owed the IRS $850,438 in unpaid personal income tax plus interest and penalties for the tax years 2009 and 2010, court papers state. The affidavit also alleges that, as part of his loan applications, Avenatti also submitted a fictitious partnership tax return for his law firm,” the DOJ said.

Read the full complaint here:

Avenatti was released on $300,000 bond and said he expects to be “fully exonerated.”

Here’s what you need to know about Global Baristas, owned by Avenatti and his former partner Dempsey:

1. Patrick ‘McDreamy’ Dempsey Sued Avenatti to Get Out of the His Coffee Business Partnership

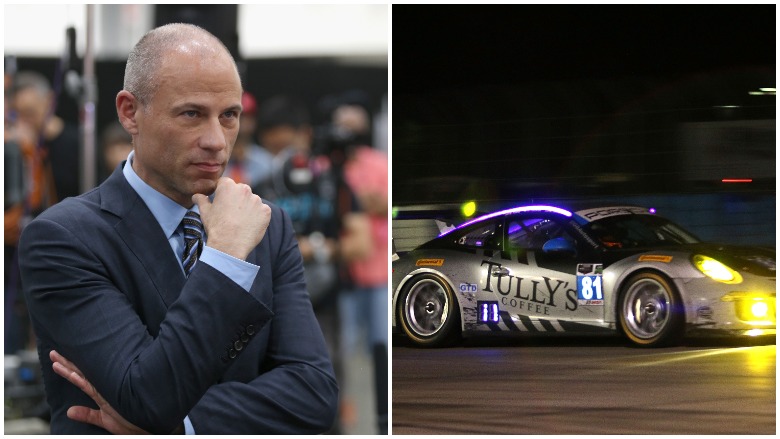

GettyPatrick Dempsey of the Dempsey Del Piero-Proton team at LeMans in 2013. Michael Avenatti is also a race car driver.

In 2013, “Grey’s Anatomy” star Patrick Dempsey sued Avenatti to get out of his role as “part owner and public face” of Tully’s Coffee Shops, the bankrupt Seattle-based chain that first opened in 1992, that the actor and lawyer acquired for $9 million in a bidding war that included Starbucks.

Avenatti was to put up the all the capital to purchase and operate the company, Global Baristas, according to the deal.

Instead, Avenatti borrowed $2 million, which he didn’t tell Dempsey about, against the company’s assets, the actor claimed in his lawsuit.

The match was supposed to be a good one and help to promote the coffee business; Avenatti had the money (which is now alleged to be money obtained by fraudulent means) and Dempsey had the name, although Bloomberg said Dempsey identified himself as “member and manager.”

Things did not work out.

2. Dempsey Had ‘Several Personal Claims Against Avenatti,’ But They Took the Case to Arbitration & Issued a Joint Statement Saying They ‘Resolved Our Differences’

GettyThe partly owned Porsche sports racing car by Avenatti is shown in action at night during the 12 Hours of Sebring at Sebring International Raceway on March 15, 2014.

The Seattle Times reported at the time, Dempsey had “…several personal claims …against Avenatti” he wanted to deal with in arbitration. In the end, both agreed to end the litigation and a joint statement was issued saying that they were “happy that we have resolved our differences and have put this behind us.”

Tully’s currently has less than 20 shops in the Seattle area. Keurig owns the coffee brand, Keurig Tully’s Coffee Inc. And the situation for Tully’s and Global Baristas, Avenatti’s company is not a good one. Last year at this time, dozens of the original stores have been shuttered with shops being evicted and Keurig itself was suing Avenatti and Global Baristas.

But in Avenatti fashion, according to the Seattle Times, a company rep emailed the paper saying Avenatti was counter-suing Keurig and the case, as of January 2018, was “nothing more than Keurig trying to beat Global to the courthouse …(and) Keurig better buckle up because they will be held accountable for their fraudulent conduct.”

3. Global Baristas & Avenatti Had a $5 Million Tax Lien, According to Documents Obtained by Heavy & There Were no Shortage of Lawsuits Against Avenatti’s Company

Michael Avenatti at the 2019 Adult Video News Awards at The Joint inside the Hard Rock Hotel & Casino on January 26, 2019 in Las Vegas

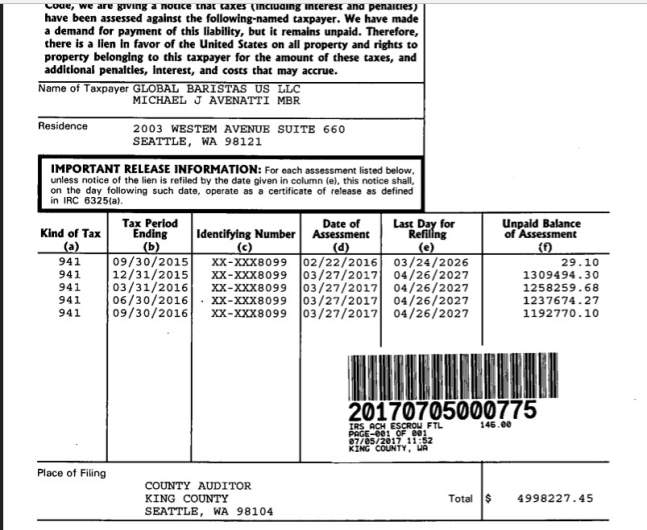

IRS documents provided to Heavy show Avenatti and his coffee company are looking at more than $5 million in tax liens. The kind of tax the government alleges Global Baristas and Avenatti failed to pay are what’s called 941 taxes.

RS tax lien pdf document screenshotThe 2017 IRS tax lien shows Global Baristas and Micheal Avenatti himself were, as of facing a $5 million government lien for unpaid employee income taxes, social security tax, or Medicare tax withheld from employee’s paychecks called the 941 tax.

According to the IRS, employers use Form 941 to report income taxes, social security tax, or Medicare tax withheld from employee’s paychecks and to pay the employer’s portion of social security or Medicare tax.” If Global Baristas and/or Avenatti have paid these assessed taxes that cover a period from September of 2015, that record is not either publicly available or Heavy is unable to locate such. The lien was placed in July of 2017.

Court records obtained by Heavy show that in Washington state there were a slew of cases and tax warrants filed against Avenatti’s company and in at least three other states including New York, California, and Minnesota.

Heavy first reported on these a year ago.

4. Washington State Slapped Avenatti With a Lien For Failing to Pay State Payroll Taxes, Though His Tully’s Employees Paid Their Share

US Attorney Nick Hanna announcing criminal charges against attorney Michael Avenatti on March 25, 2019 in Los Angeles. Avenatti was arrested today in New York and faces federal charges of bank fraud and wire fraud in California.

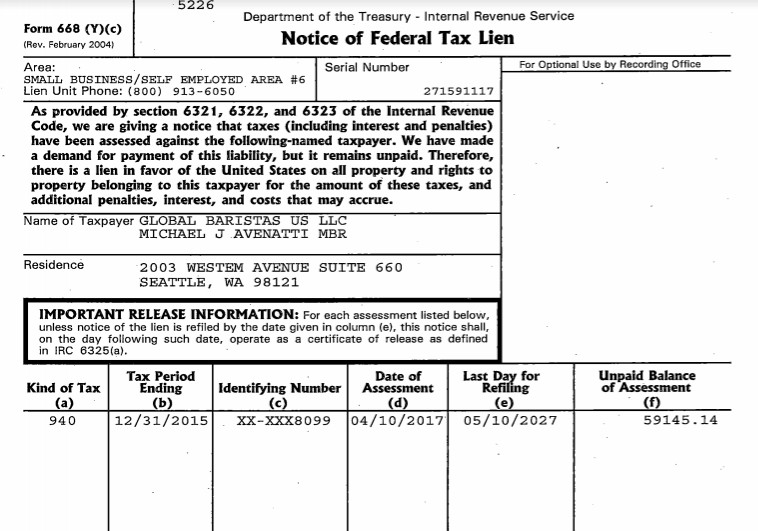

The company and Avenatti were also facing a near $60,000 lien from King County, Washington, for 940 taxes that the IRS explains is “annual Federal Unemployment Tax Act (FUTA) tax” that, “together with state unemployment tax systems …provides funds for paying unemployment compensation to workers who have lost their jobs.”

Screengrab of King County, Washington IRS tax lien against Global Baristas and Michael Avenatti

With 940 taxes, employers are supposed to pay both federal and a state unemployment tax.

5. Avenatti, Who Claims to Have Secured More Than $1 Billion in Judgments, Was Called a ‘Corrupt’ Lawyer by the US Attorney

Geoffrey Berman, U.S. attorney for the southern district of New York, speaks at a news conference on March 25, 2019 in New York City. Berman announced charges against Michael Avenatti, the former attorney for adult film actress Stormy Daniels and a fierce critic of President Donald Trump, for allegedly attempting to extort $15-$25 million from sportswear maker Nike.

In a press conference, federal prosecutors called Avenatti “a corrupt lawyer.”

“…the allegations paint an ugly picture of lawless conduct and greed,” U.S. Attorney Nick Hanna said.

Avenatti, however, has long touted his winning record of securing huge judgments for clients including the $454 million 2017 fraud verdict against Kimberly-Clark’s company Halyard Health. The very high-profile case was brought against the manufacturer of shoddy and faulty protective garments and gear worn by healthcare workers during the Ebola crisis.

The case got national attention following an Anderson Cooper story for CBS’ “60 Minutes.”