Getty

The coronavirus outbreak has millions of Americans concerned about how to pay their bills as businesses have been forced to close down or significantly reduce hours or services. The sudden drop in income has especially raised alarm about whether people would be forced from their homes due to inability to make rent or mortgage payments.

Can you be evicted during a national emergency? It depends, but the federal government has taken steps to protect families against evictions or foreclosures, and temporary moratoriums on evictions have been enacted by several state governors.

The U.S. Senate has also been negotiating a $2 trillion aid package. One of the most talked-about provisions is a plan to send $1,200 to adults earning up to $75,000. The amount would decrease for adults who earn up to $100,000. But if the coronavirus outbreak lasts several weeks or months, more aid may become necessary.

Here’s what you need to know.

Homeowners With FHA-Insured Mortgages Were Protected For 60 Days Beginning March 18

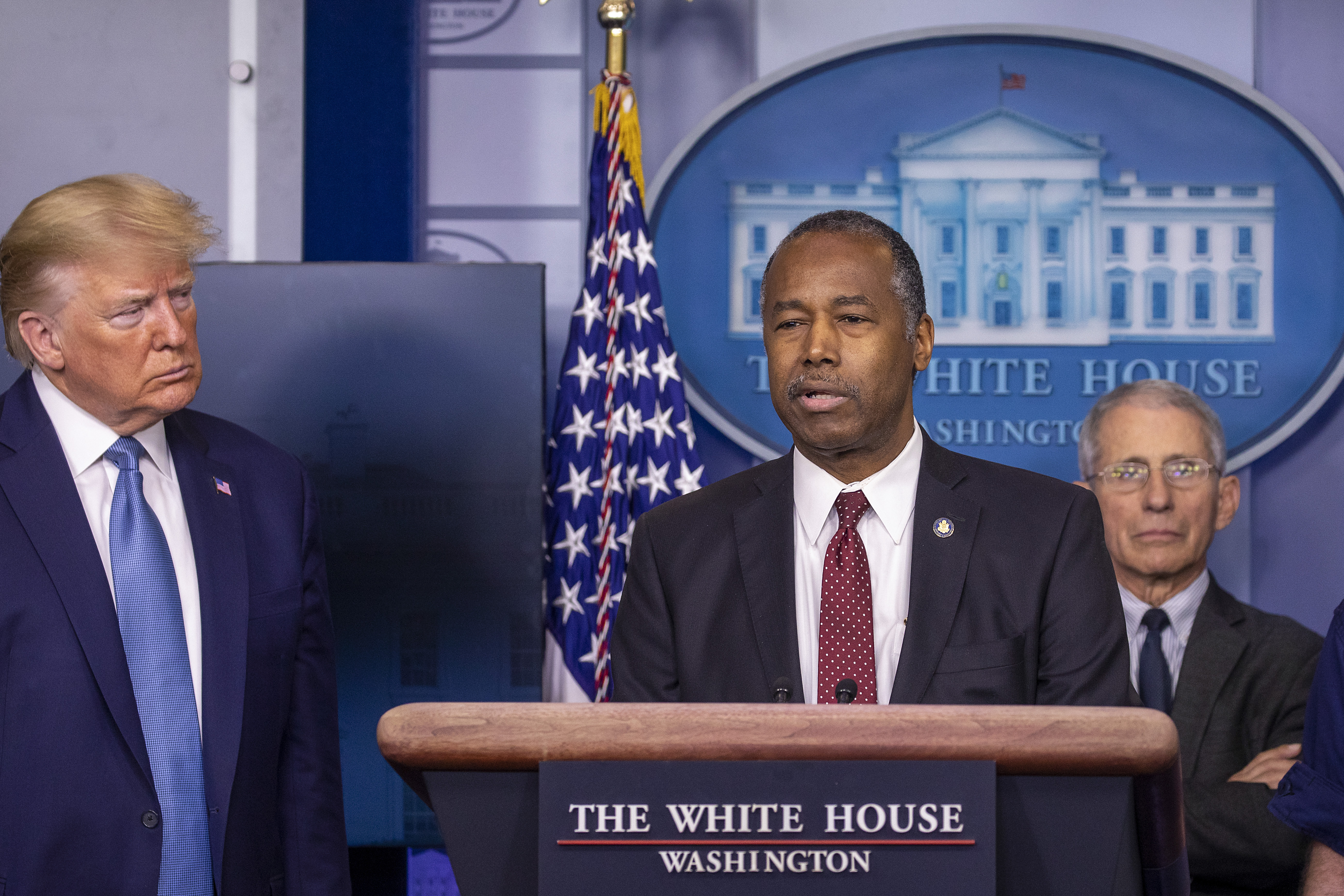

President Trump declared a national emergency on March 13 to help prevent the spread of the coronavirus. The declaration allows the executive branch and federal agencies more flexibility in order to assist health care professionals and officials nationwide.

Five days after this announcement, Department of Housing and Urban Development (HUD) Secretary Ben Carson announced that homeowners who may struggle to make payments on time amid the health crisis would receive some breathing room. Evictions and foreclosures have been suspended for homeowners with mortgages issued by the Federal Housing Administration. First-time home buyers, those with lower credit scores, and buyers without large down payments typically receive FHA loans, which are backed by the federal government.

The moratorium on evictions and foreclosures went into effect on March 18. It lasts for 60 days. Secretary Carson said in a prepared statement, “Today’s actions will allow households who have an FHA-insured mortgage to meet the challenges of COVID-19 without fear of losing their homes, and help steady market concerns. The health and safety of the American people is of the utmost importance to the Department, and the halting of all foreclosure actions and evictions for the next 60 days will provide homeowners with some peace of mind during these trying times.”

The Federal Housing Finance Agency (FHFA) also instructed Fannie Mae and Freddie Mac to halt evictions and foreclosures until June. It applies to individuals with “enterprise-backed single-family” mortgages.

Renters Who Live In FHA-Insured Properties Are Also Protected From Eviction

The eviction suspension applies to renters in addition to homeowners. The letter HUD specifically points out that the moratorium applies to all FHA-insured properties.

The Federal Housing Administration backs loans for various properties; the agency is not limited to just mortgages for individuals. The HUD website explains, “FHA insures mortgages on single family homes, multifamily properties, residential care facilities, and hospitals. It is one of the largest insurers of mortgages in the world, insuring more than 46 million mortgages since its inception in 1934.”

HUD also oversees public housing. The department’s “insurance programs for multifamily properties support the availability of over 300,000 affordable rental units, including those for seniors and people with disabilities.”

The letter from HUD, which you can read in full here, explained in part:

“As a result of this unprecedented global pandemic, many jurisdictions have reduced services, businesses have closed, and other activities have been curtailed. In addition, this pandemic impedes the ability of Americans to work and provide for their families. This directly impacts the financial wellbeing of individuals, families, and businesses. Therefore, as part of a broader federal government effort, the Secretary of HUD is authorizing a moratorium on foreclosures.

Furthermore, Americans have been asked to remain in their homes to stem the tide of COVID-19. To ensure families are not displaced during this critical period, the Secretary of HUD is also authorizing a moratorium on evictions for FHA-insured properties.

Properties secured by FHA-insured Single Family mortgages are subject to a moratorium on foreclosure for a period of 60 days. The moratorium applies to the initiation of foreclosures and to the completion of foreclosures in process.

Similarly, evictions of persons from properties secured by FHA-insured Single Family mortgages are also suspended for a period of 60 days.

In addition, deadlines of the first legal action and reasonable diligence timelines are extended by 60 days.”

Landlords Have Been Urged to Halt Rent Increases & Suspend Evictions Until June

According to data compiled by the National Multifamily Housing Council, an estimated 36 percent of American families live in rental properties. That equates to more than 43 million families. About 47 percent of those families earn household incomes of $35,000 per year or less.

The NMHC issued guidelines on March 22 urging landlords to offer assistance to their residents as the coronavirus outbreak continues. For example, the council asked apartment owners to halt any planned rent increases until June and waive late fees.

The organization advised companies to negotiate payment plans for renters who have seen their incomes drop due to businesses being shuttered or hours reduced. The NMHC also asked that evictions be suspended until June if the specific resident can show their income was impacted by the pandemic. The organization’s website clarifies that this “would not apply to evictions for other lease violations such as property damage, criminal activity or endangering the safety of other residents of the community.”

Several Governors Have Suspended Evictions For Residential & Commercial Tenants

Governors in multiple states have implemented protections for both families and businesses impacted by the coronavirus pandemic to guard against evictions. According to the National Low Income Housing Coalition, the following states have paused evictions and foreclosures or have plans to do so, as of March 25:

- California

- Connecticut

- Delaware

- Indiana

- Illinois

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maryland

- Massachusetts

- Michigan

- Minnesota

- New Hampshire

- New Jersey

- New York

- North Carolina

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- Tennessee

- Texas

- Virginia

- Washington

- Washington, D.C.

In New York, Governor Andrew Cuomo announced that in addition to a 3-month suspension of evictions, the state would offer additional assistance to people whose employers were forced to close down. He explained on March 19 that mortgage payments would be suspended for those who can prove financial hardship due to the virus. The Commercial Observer also reported overdraft fees for credit cards and ATMs would be waived for the time being.

In Washington, Governor Jay Inslee halted evictions and foreclosures until at least mid-April. According to the Seattle Times, law enforcement officials were also barred from enforcing eviction orders that were based solely on inability to pay.

In California, Governor Gavin Newsom signed an executive order suspending residential evictions through May 31.

According to the real estate website Million Acres, the following states do not yet have formal, statewide moratoriums on evictions and foreclosures, although individual cities may have their own protections in place:

- Alabama

- Alaska

- Arizona

- Arkansas

- Colorado

- Florida

- Georgia

- Hawaii

- Idaho

- Maine

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Mexico

- North Dakota

- Ohio

- Oklahoma

- South Dakota

- Utah

- Vermont

- West Virginia

- Wyoming

READ NEXT: Get to Know More About Anthony Fauci’s Daughters & Family