The Chicago Bears offense is on a significant come-up, but a player once considered to be integral to that rise now appears to be on the outside looking in.

General manager Ryan Poles has spent this offseason endearing himself to Bears fans by making a series of moves that should set the franchise up for a significant leap in 2023 after posting the NFL’s worst record one year ago. Though he has yet to make a splashy move at left tackle or add a fearsome edge defender, the biggest criticism any cynic can lob at the fledgling GM involves the first major move he made in the job — dealing what eventually became the No. 32 overall pick to the Pittsburgh Steelers in return for wide receiver Chase Claypool at last year’s trade deadline.

The decision was questionable then — especially considering how the Bears bottomed out in the second half of the season — and it has aged even worse. Claypool made just 14 catches, gaining only 140 yards and failing to find the end zone across seven games in Chicago in 2022. Complicating the issue are reports that the Bears have taken issue with Claypool’s work ethic during his first summer with the franchise.

As it stands now, Chicago has invested significantly in a former second-round wideout whose production has dipped in all three of his NFL campaigns and who is clashing with management. Claypool’s trade value is also at an all-time low.

If Claypool isn’t meshing well enough into the culture to earn the playing time that will be required for the Bears to build back his value, then cutting bait and writing the receiver off as a sunk cost is a move that will inevitably be on the table.

Chase Claypool’s Play, Attitude Jeopardizing Roster Spot With Bears

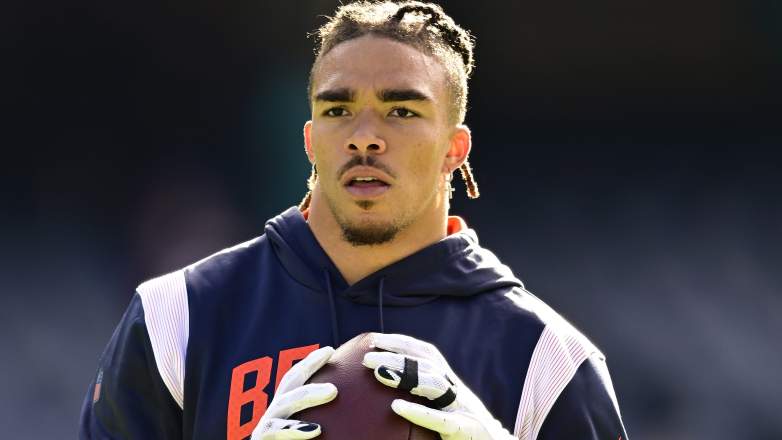

GettyWide receiver Chase Claypool of the Chicago Bears gets tackled by New York Jets defenders Soloman Thomas (left) and C.J. Mosley (right) during an NFL game in November 2022.

Initial discussions of Chicago cutting Claypool were often met with scoffs and eye rolls — and rightfully so. He is a 25-year-old physical specimen who caught nine touchdown passes during his rookie campaign and who the Bears acquired mid-season, rendering the offensive learning curve about as steep as it gets in the NFL. Claypool is entering the final season of an affordable four-year, $6.6 million rookie contract and is carrying a more-than-manageable 2023 salary cap hit just shy of $3 million.

But as Claypool enters a contract year and the Bears add more pass-catching talent around quarterback Justin Fields, the wideout will begin to make less sense if his attitude doesn’t improve along with his numbers on the field. Letting an asset run his course and prove himself worthy or unworthy is one thing. Throwing good money after bad on a new deal for Claypool is another, assuming circumstances don’t change for the better.

Jake Rill of Bleacher Report on Monday, July 17, listed Claypool among the team’s top three potential cut candidates as training camp approaches later this month.

“Chase Claypool has a high ceiling as an offensive playmaker. … But [he] didn’t quite show it after getting traded from the [Steelers] last season,” Rill wrote. “The Bears are hoping Claypool can become a viable receiving option alongside Darnell Mooney and D.J. Moore, but the team has a lot of other WRs on the roster who could potentially push Claypool out of a sizable role.”

“Claypool could even end up as a cut candidate if he struggles during training camp,” Rill continued. “That’s why it’s important for him to show up and excel this summer.”

Bears May Move on From Chase Claypool Even if He Plays Well in 2023

GettyWide receiver Chase Claypool of the Chicago Bears warms up prior to an NFL game against the Miami Dolphins in November 2022.

Another interesting layer to the Claypool saga is that the franchise may look to move on from the wideout regardless of his play this season. Assuming the Bears don’t cut Claypool and he is an active member of the offense, the trade deadline that marks his one-year Chicago anniversary could also mark the end of his tenure in Chicago.

The issue is that while the Bears have significant cap space remaining (approximately $32 million as of July 17), they also took on considerable salary at the wide receiver position in the Moore trade. Moore carries a cap number of nearly $20.2 million in 2023 as well as price tags north of $16 million in each of the next two years. Mooney and Claypool will both hit free agency next summer, and it’s unlikely that both will produce the kind of numbers necessary to command a $12-$15 million annual salary in what has become a crowded offensive huddle.

Chicago may well decide to keep only one player, meaning the other will be a candidate for travel come the mid-season trade deadline. Mooney had a considerably better season in 2021 than any Claypool has ever produced, and his career trajectory is less troubling, even despite a serious ankle injury that cut Mooney’s 2022 campaign short.

There remains a chance that Claypool comes on in 2023, rewrites his career narrative and remains with the Bears. However, the more likely scenario is that he’s playing in a different uniform at some point in the next 12 months via a choice to walk in free agency, an in-season trade or, potentially, a preseason cut.

Comments

Polarizing Bears Playmaker May Not Survive Training Camp