WCTH Writer Reveals Secrets Behind That Shirtless Nathan Scene

A "When Calls the Heart" screenwriter revealed that there was more to the shirtless Nathan scene than what we got to see.

A "When Calls the Heart" screenwriter revealed that there was more to the shirtless Nathan scene than what we got to see.

Sherrod has another update about her real estate business Indigo Road.

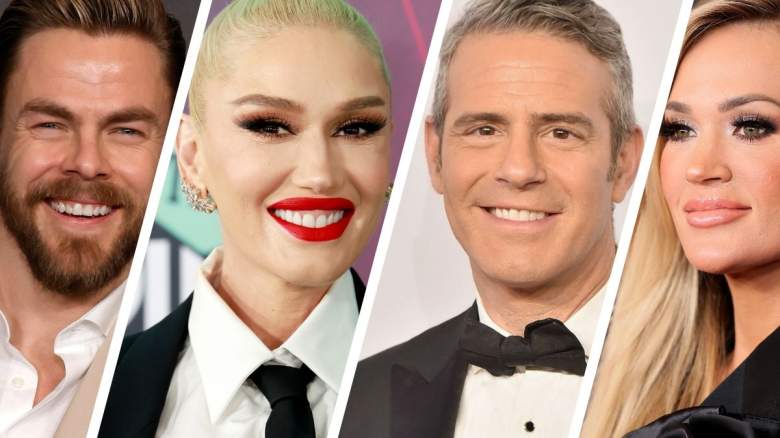

The "Dancing With the Stars" alum shared scary details.

In a lengthy interview at her home, Kathie Lee Gifford got Jimmie Allen to share stunning details of what led to his fall from grace.

A former "Bachelorette" star had some fans confused after a social media post seemed to suggest she was pregnant.

The "Dancing With the Stars" alum cleared up the confusion.