Getty

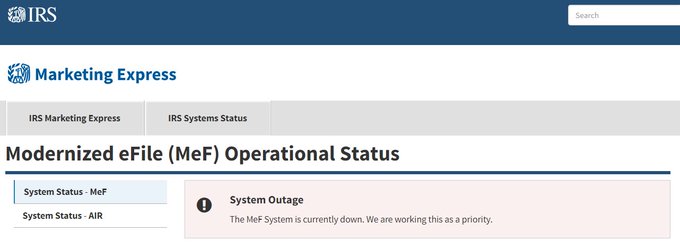

The IRS E-file system is down and the tax agency’s website and Direct Pay system are experiencing difficulties, causing delays for individuals and tax professionals trying to file their tax forms today. Efiling is experiencing quite a few problems, and many people may have to print their taxes and mail them at the local post office instead, if the problems are not resolved soon. There’s always a chance that the IRS might issue an extension if the problem isn’t resolved, but you shouldn’t rely on that. At this time, the IRS is saying to continue filing your taxes as normal. But if you do make a trip to the post office, you may experience long lines and other issues. Here is what’s happening and what you might do to help alleviate the long lines if you decide to go to the post office.

At this time, it’s not exactly clear why the e-file system has been having problems today. The service that people use to file taxes online is partly down, Acting IRS Commissioner David Kautter told CNN. During a Congressional hearing in the morning, he said: “On my way over here this morning, I was told that a number of IRS systems are unavailable at the moment. We are working to resolve this issue and taxpayers should continue to file their returns as they normally would.”

Kautter said the problem was “probably” internal technical issues, but he could not rule out external influences including a cyber attack, The Washington Post reported. He said the IRS was having issues accepting returns from software programs like Turbo Tax and H&R Block. He said taxpayers should still use those systems to file, but some returns weren’t going through.

The IRS said in a statement that the problem is ongoing. At this point in time, it’s not clear if the IRS will issue an extension due to the problems, and the IRS may be attempting a hard reboot to fix the problem.

“If we can’t solve it today we’ll figure out a solution,” Kautter said. “Taxpayers would not be penalized because of a technical problem the IRS is having.”

The IRS’ Direct Pay option currently says the option is unavailable. CPA Practice Advisor reported that when trying to make a payment for a tax client, one professional received the following error message: “This service is temporarily unavailable. We are working to resolve the issue. Please come back later and try again, or you can visit the Make a Payment page for alternative payment methods. We apologize for any inconvenience.”

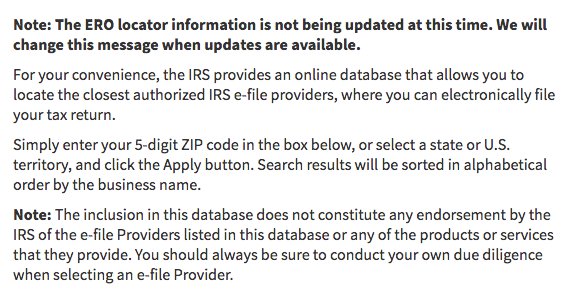

Here’s another message some people are getting:

And another example:

You might also see this:

In fact, software providers were asked to stop sending in returns until the problem was fixed.

If you do need to mail your tax return because you can’t e-file, you’ll speed up the process if you can pay your postage online first. The USPS offers many options for paying your postage online and printing your shipping labels online too. This means you don’t have to stand in a long line at the post office. But if you do this, you may still need to drop off your taxes in person at the post office. Some collection boxes have very specific pick-up times that may end earlier than the 5 p.m. time that most post offices closes. Check the pick-up times on collection boxes before opting not to go to the post office in person. In fact, you might be safest still dropping off your returns at the post office personally, just to be sure they’re received.

This is a developing story.