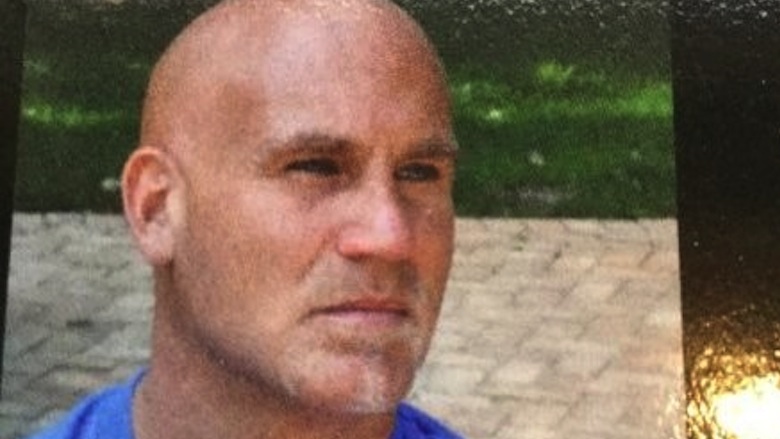

Linkedin Dennis Shields

Dennis Shields has died. The on/off boyfriend of Real Housewives star Bethenny Frankel was found dead at his Trump Tower home on Friday. The Medical Examiner’s office is currently investigating Shields’ cause of death, which the New York Post said may have been a medicinal overdose. He was 51.

This shocking news has prompted many to wonder just how much Shields made while he was alive, and how much he was worth at the time of his death. According to Earn The Necklace, he had an estimated net worth of $11 million. Read on to learn how Shields made his fortune and what he liked to spend his money on.

1. He Co-Founded the Finance Company YieldStreet In 2015

Shields was born to an affluent family. According to E! Online, his mother Gail was a lawyer and his father Lawrence was a neurologist. He ultimately decided to go into finance, however, and earned an M.A. in public relations from New York University. After graduating, Shields went on to start several different financial and crowd-funding companies.

He helped create the American Legal Finance Association (ALFA), and from June 1996 to May 2002, he was the president and CEO of HealthShield Capital Corporation. YieldStreet.com states that HealthShield “provides financing, billing, collection and collateral-management services to the healthcare marketplace on a nationwide basis.”

In 2015, Shields co-founded the financial service company YieldStreet. The company provides access to asset based investments and allows average consumers to “participate in opportunities with low market correlation and target yields.”

On his Linkedin profile, Shields referred to himself as a “serial entrepreneur in the specialty finance space” and a “philanthropist.” He also said that he “created the concept of and founded the only bank in the United States to understand and meet the needs of the trial bar.” Shields added that he and his fellow business partners have invested over $25 billion in non-traditional assets over their career.

2. He Was the Chairman & Founder of Esquire Bank

Shields founded the Esquire Bank in 2007. On the company’s LinkedIn profile, the mission statement read: “Esquire Bank is a full service bank founded by attorneys for attorneys. We are deeply aligned with the trial bar and cognizant of the unique needs and cash flow issues of the contingency fee practice. Esquire Bank provides customized banking and business solutions to service those [in need].”

In addition to being the founder of the company, Shields served as the executive chairman. This standing netted him an annual salary of $475K, along with bonuses and stock option points. According to Salary.com, the 2017 fiscal year brought him $225K as a bonus, $288,750 in stock, and $9,949 in “other types of compensation.” In total, he earned $998,699 for the year.

The ‘About Us’ section of the Esquire Bank website states that “Mr. Shields’ extensive experience in both the financial services and legal industry provides the Board with an important perspective on Esquire Bank’s business and strategic direction.”

In 2017, Shields and the company offered $500 million or more to those who presented new and exciting business ideas. “We have huge expertise in funding many different asset classes,” he wrote in the proposal. “As long as we can wrap our arms around the type of business, the structure, and the risk, we are willing and know how to fund alternative assets.”

3. He Donated $25K to the Survivors of Hurricane Harvey In 2017

https://www.instagram.com/p/BmTxcZPHbfV/?tagged=dennisshields

Shields donated to a number of charities during his lifetime. After the events of Hurricane Harvey, he and then-girlfriend Bethenny Frankel traveled to Houston to help the survivors. Shields reportedly donated $25K to help provide clothing and shelter. Joi Gordon, the CEO of Frankel’s Dress for Success campaign, spoke on the importance of his donation. “That money helped them get back on their feet so they can help women in the community,” she told People Magazine. “Now in Houston, the first phase is to help women who’ve been displaced and take care of their immediate needs.”

During a Dress for Success event, Frankel revealed that Shields made another sizable donation. “People do kind things for me all the time,” she told Bravo. “I think it’s kind that my friends are here. I think that Dennis donated $10,000 to the two charities today. Everyday [people are kind]. My staff is kind to work with me and be crying that they’re so happy.”

In 2016, the New York Post claimed that Shields and Frankel were seen looking at New York apartments in the $10 million to $30 million range. “One of the units they scoped was a $29.99 million penthouse at 11 North Moore St,” they wrote, “which comes with its own private pool.” Shields resided at Trump Tower at the end of his life, where apartment range between $625K for a studio to over $28 million, according to Reuters.

The status of Shields and Frankel’s relationship was unclear leading up to his death. Appearing on the Listen Up Show podcast, Shields explained where he and Frankel stood, saying: “About four weeks ago we were still together.” He also praised Frankel for being a “great mom.”

4. He Published 2 Novels & Produced the Broadway Play ‘Indecent’

In addition to his professional services, Shields contributed heavily to the arts throughout his career. He wrote two novels, 2010’s God Went Fishing and 2012’s Urgency of Now, both of which received positive reviews from critics. He also acted in the 2009 experimental drama The Girlfriend Experience. The film, directed by Oscar winner Steven Soderbergh, grossed an estimated $1 million at the box office and earned ecstatic reviews from critics. It later spawned the Starz television series of the same name.

Shields was also a producer and financier on the Broadway play Indecent. Written by Paula Vogel and directed by Rebecca Taichman, Indecent ran for 128 performances between April and August 2017. “I have always loved the theater,” he wrote on Linkedin. “My next foray into the theater is a play I’ve written called Consequences, which is about the veracity of our legal system and the elusive nature of observed truth.”

5. His Company LawCash Was Accused of Costing NY Taxpayers Millions of Dollars

Earlier this year, Shields’ company was accused of encouraging questionable lawsuits against the state of New York, therein costing the taxpayers millions of dollars. “Fraudulent claims and lawsuits cheat taxpayers and takes precious resources away from critical services,” said City Comptroller Scott Stringer. “It’s unacceptable for any company to game the system for an easy buck at the expense of everyday New Yorkers.”

LawCash, which Shields founded in 2000 and ran until his death, reportedly has thousands of clients with pending lawsuits, each of which are charged with interest rates as high as 124 percent. According to the New York Post, that’s nearly five times the 25 percent limit set by the state. Any higher, and companies are breaching “criminal usury” territory.

The Post reported that LawCash, along with a handful of similar firms, cost taxpayers an estimated $722 million in payouts during 2017. Shields denied these claims outright. “I could send you what the actual charges were,” he told the publication. “And they’re nowhere near what the lawyer says they were.” He continued, saying that he’s proud of the work he’s done at LawCash:

Almost two decades later, LawCash has funded over 100,000 cases, and advanced over $440M to deserving plaintiffs. We are proud of the work we have done; all the Thanksgiving turkeys we’ve helped put on family tables, and the families we’ve helped keep their homes. Done the right way, litigation funding really helps. I like to think we’re on the side of the angels.

In addition to LawCash’s legal controversies, Shields and his ex-wife Jill Schwartzberg were involved in a lawsuit in 1995. According to Radar Online, they sued another couple and an attorney for refusing to refund a $75K deposit on their Long Island property.

The defendants claimed that Shields and his wife did not follow the contract’s demands to make a “prompt and diligent” mortgage application, and were therefore not to blame. The case was settled when the defendants’ lawyer made a motion to return the $75K with interest to the Shields’.